The cryptocurrency market has witnessed a massive sell-off this week. Over $3.15 billion in the value passed in or out of exchanges, with a net bias towards inflows, which accounted for $1.60 billion (50.8%). In fact, this recorded the largest aggregate exchange-related volume peak since October last year.

Do you like surprises?

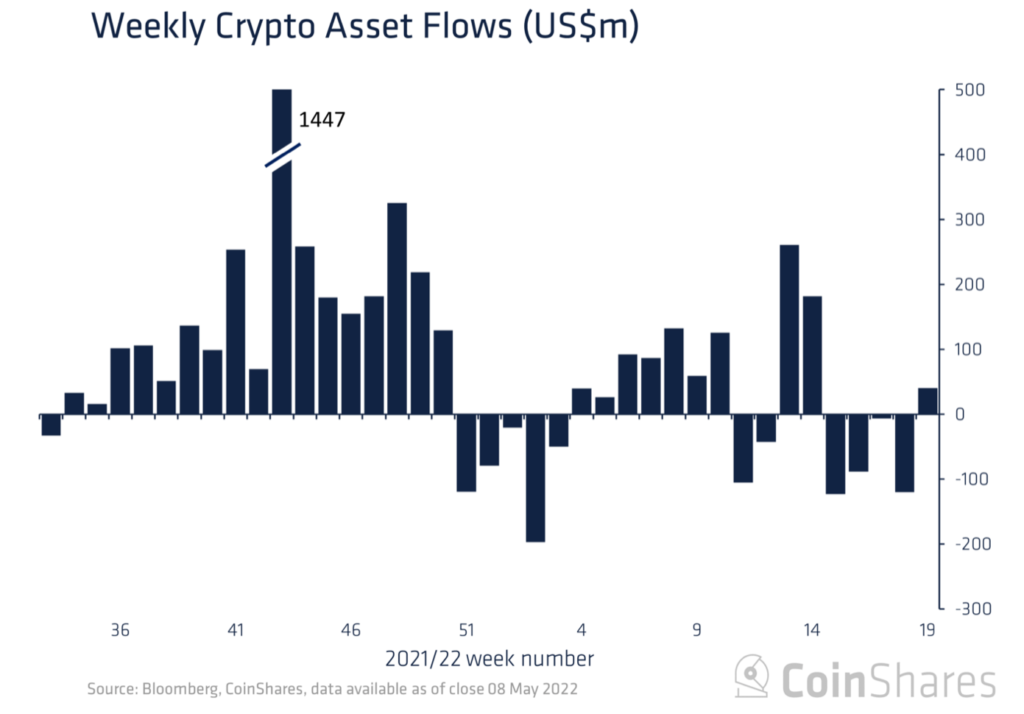

As cryptocurrencies continue to lose ground, blockchain analysts at CoinShares have spotted an interesting mix of investor activity. James Butterfill on May 9 released the weekly Volume 79: Digital Asset Fund Flows report which covered these attributes. Digital asset investment products surprisingly saw inflows totaling $40 million last week.

Investors took advantage of the substantive price weakness to add to positions. Or rather ‘buying the dip’. This was a sign that investors were taking advantage of the market to get into exchange-traded Bitcoin products at reduced rates. Exchange-traded crypto products, such as Grayscale Bitcoin Trust (GBTC), shares fell by 19% over the past five days compared to BTC’s 25% drop.

James Butterfill, Head of Research at CoinShares asserted,

“Interestingly, we haven’t seen the same spike in investment product trading activity that we typically see in the past during periods of extreme price weakness. It’s too early to tell. if this marks the end of four weeks of negative sentiment.”

One needs rather wait and watch as the crypto drama unfolds. Investors are panic-stricken, but, the question remains- What is the way forward?

A little light at the end

BTC, the largest coin suffered a massive 1.47% correction in 24 hours as it traded around the $31,000 mark. But the holders still trusted the king’s coin.

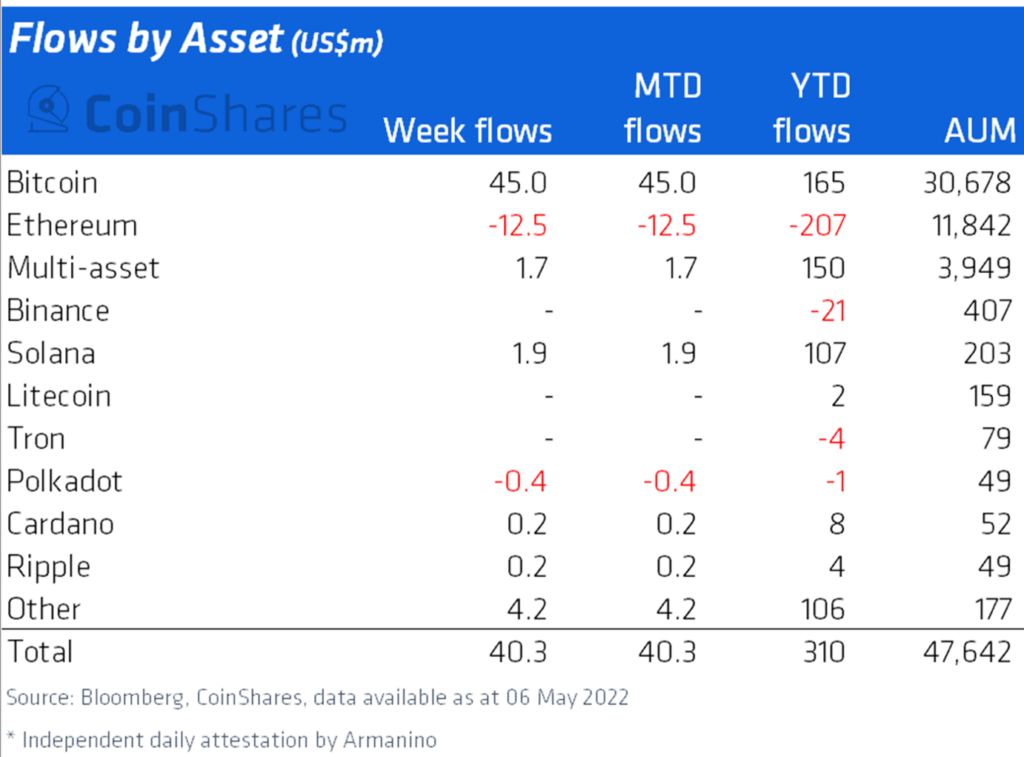

Bitcoin saw inflows totaling US$45m. Although, some investors toom profits as well. Bitcoin short funds recorded their second-strongest inflows of the year, $4 million, thus, reaching $45 million in assets under management.

Interestingly, despite the record, assets favoring long Bitcoin still far outweigh short Bitcoin products. The $45 million in short products represents 0.15% of the $30 billion in assets under management in long Bitcoin products.

What about the altcoins?

Well, alternative tokens’ reports mostly contained red marks with an exception. Ethereum, the largest altcoin saw outflows totaling US$12.5m last week, Thus, bringing total outflows year-to-date to US$207m. Apart from this, Polkadot suffered the same fate as it underwent an outflow recording $0.4m.

Here is the exception: Solana. The only altcoin that saw measurable inflows totaled $1.9 million last week.

On the brighter side, it is important to note how BTC had a significant improvement from recording $132m outflows to the current figure.