Ethereum reports increased network usage as market remains in panic

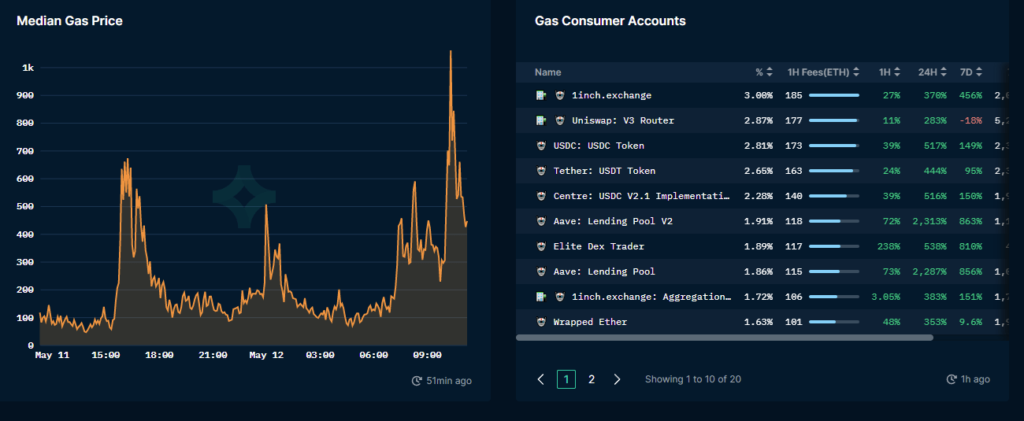

According to gas tracker Nansen, Ethereum’s gas cost soared to 1,000 Gwei as the network faces a massive surge in usage after lending and borrowing platforms reported a 300% increase consumption.

Among the biggest gas users on Ethereum chains are platforms like 1inch, Uniswap and Tether token contracts. The spike in consumption reflects the current sentiment on the market as traders are actively moving their funds away from crypto and looking for a way to exit into fiat.

Lending and borrowing platforms are also under heavy “attack” as investors quickly lose faith in any of the leading stablecoins or DeFi solutions and pull money away from various liquidity contracts. .

Following the drop in UST, the market saw massive outflows of funds from the whole DeFi industry. According to DefiLIama, the industry of decentralized solutions saw a crucial drop in TVL by losing 24% of the total value of funds locked in the contracts in the last 24 hours.

In the space of a week, total TVL on various channels went from $204 billion to $115 billion. Such a drastic drop takes the DeFi industry back to July levels when Bitcoin and other cryptocurrencies bottomed just before a new rally began.

DeFi-related tokens like AAVE, ADA and ATOM are also tanking as they lose over 60% of their value in a matter of days. But DeFi is not the only industry that reported a massive drop in netflow, as cryptocurrencies like Bitcoin are also at double-digit losses over the last few days.