Just recently, the product comparison platform finder․com polled 36 fintech specialists about the cryptocurrency terra (LUNA) before terrausd (UST) lost its parity with the U.S. dollar. According to the poll, Finder’s experts predicted LUNA would be $143 before the end of the year. Currently, LUNA is worth far less than a U.S. penny and while it has gained over 23,000% in the last three days from the all-time low, LUNA would need to jump 58,331,533% to reach $143 per unit.

Finder Poll Recorded Before Collapse Shows Fintech Experts Believe Terra’s LUNA Has Potential, While Others Remain Skeptical

Before LUNA and UST collapsed, a large number of people were very optimistic about the Terra blockchain project. The recent terra (LUNA) price prediction report from product comparison platform finder․com highlights this fact. Finder researchers conducted numerous surveys with dozens of fintech and crypto specialists regarding crypto assets such as XRP, ETH, APE, etc. Finder’s latest Touch to Terra (LUNA) survey and survey data comes from late March to early April 2022, weeks before the Terra ecosystem implosion.

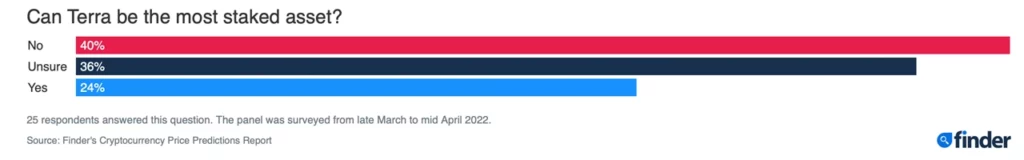

Matthew Harry, the head of funds at Digitalx Asset Management, thought LUNA would end up being around $160 per coin by the year’s end. After the fallout, Harry said: “There is a lot of uncertainty around LUNA right now – the project is really ambitious and the objective an admirable one but just what the effect on the LUNA token itself will be is unclear.” 40% of Finder’s panelists did not think LUNA would be the most staked asset.

Desmond Marshall, Managing Director of Rouge International, expected Terra native token LUNA to “fall flat very soon.” Marshall insisted this was due to the “lack of overall functional support”. Although 40% thought LUNA would not be the most-staked asset, 24% of Finder panelists said it would become the most-staked coin, while the rest of the fintechs weren’t. sure.

Swinburne University of Technology Lecturer Says Algorithmic Stablecoins Are Considered ‘Inherently Fragile and Are Not Stable at All’

According to Dimitrios Salampasis, director and lecturer at the Swinburne University of Technology, algorithmic, fiat-pegged tokens are easily broken. “Algorithmic stablecoins are considered as being inherently fragile and are not stable at all. In my opinion, LUNA will be existing in a state of perpetual vulnerability,” Salampasis said. Ben Ritchie, the managing director at Digital Capital Management, thought LUNA would gain traction as long as regulatory scrutiny on the stablecoins economy was lax.

“We believe LUNA and UST will have an edge and be embraced as a major stablecoin in the crypto space,” Ritchie said in the poll conducted before the Terra fiasco. “LUNA is burned to hit a UST, so if UST adoption grows, LUNA will benefit greatly. Having bitcoin as a reserve asset is a great decision by the governance of Terra,” added the spec specialist. fintech.

In addition to the bullish commentary, the panel average indicates people predicted lofty prices for LUNA before the UST tumble and LUNA’s value plummeting to zero. Prior to the Terra fallout, the panel thought LUNA would be $390 by the end of 2025, and $997 per unit by the end of 2030. With the way things look today, in mid-May 2022, LUNA will have an extremely hard time reaching $143 per unit.