Gas prices on the Ethereum network have been a bane to anyone using it over the past year or so. Prices surged to astronomical highs on several occasions during the 2021 bull market. In 2021, transaction fees on the ETH network spiked as much as 470% due to congestion on the network.

But 2022 could turn out to be different. Now, is this good or bad news for ETH proponents?

From an ATH to an ATL

Every time an operation occurs on Ethereum’s network, a transaction fee or gas fee is incurred. Every interaction on the Ethereum blockchain demands a certain amount of computational resources from the network. Based on the complexity of the transaction and how quickly the user wants the transaction settled, the gas fee changes.

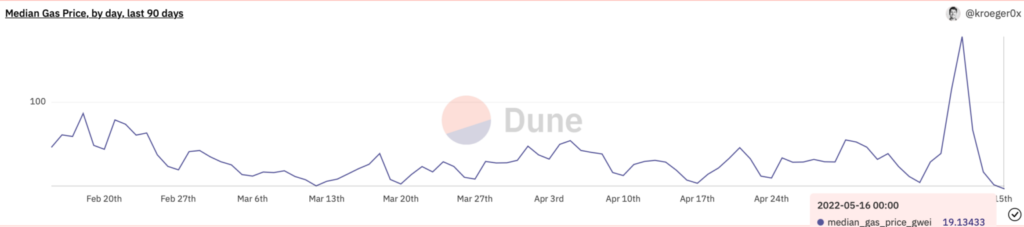

However, it seems that users are no longer in a rush to make such transactions. According to Dune Analytics, the average gas fee on the Ethereum network has fallen to a new low over the past 90 days. At press time, the median gas price was hovering around the 19 Gwei mark, as seen in the chart below.

Given the change in demand and supply, gas prices varied as well. Given the uncertainty and lack of demand, the gas fee once fell to 14 Gwei as network activity fell to a periodic low.

Now, such a drop in the fee structure injects two possible scenarios. The most obvious – This would bring some relief to ETH investors/traders/holders who had to face or rather incur huge fees. But here is another grief scenario.

One reason for this could be the sustained decline in DeFi usage. The total value locked in DeFi smart contracts went down to $56 billion from $98.4 billion in February 2022. According to DeFi Llama, the DeFi dominance of the ETH blockchain is waning.

Users moved transactions to other blockchains with cheaper fees. At the time of writing, the dominance stats for ETH stand at 54%. (Terra – 13%, BSC – 6.0%, Avalanche – 5.5%, all other DeFi platforms – 22%)

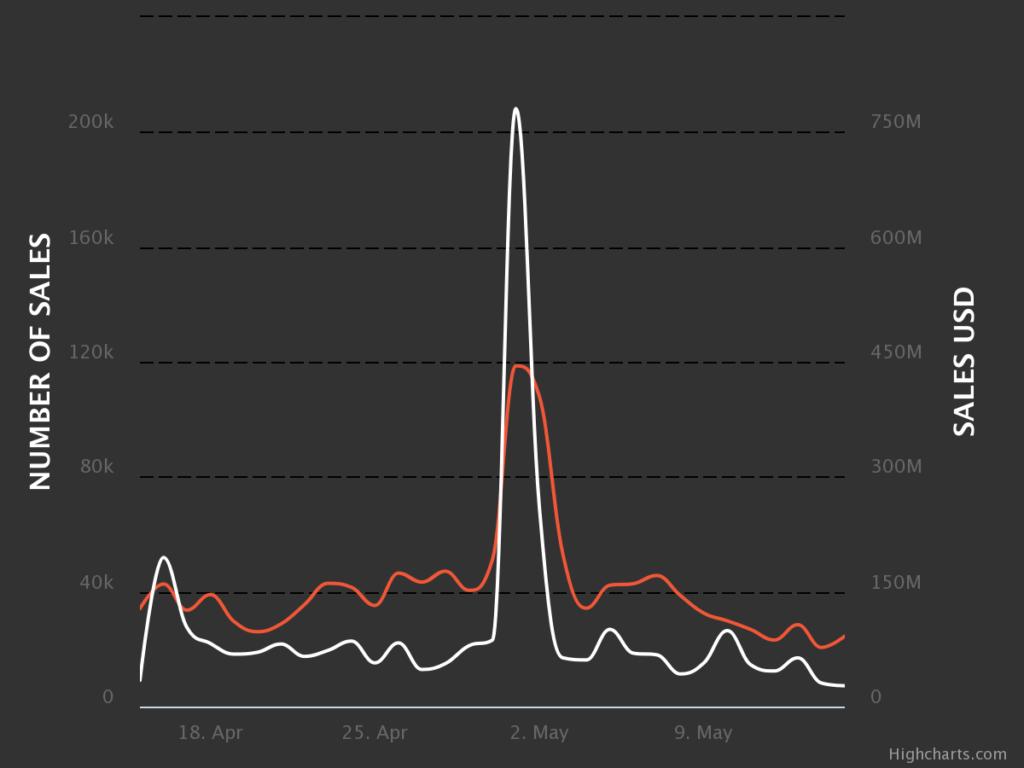

Another reason could be the decline in NFT sales. In fact, the number of sales, at press time, declined by 28% – A massive fall, especially when compared to the 1 May hike.

Now, with the upcoming “merger”, the ETH blockchain would soon be able to handle TPS (>100,000). This will further reduce network backups, transaction costs, and settlement times.

On the other hand, Ethereum’s hashrate continues to climb higher ie. miners worked harder than ever before to mine Ethereum before the upcoming Merge. The network hit 127 petahash per second (PH/s) that day and the processing power operated at 1.18 PH/s, at the time of writing.

Satisfied customers?

Surely that seems to be the case. Despite the aforementioned setbacks, ETH holders continue to show their strengths. For example, consider this –

While gas fees are low, they won’t necessarily stay that way for long. It often jumps back up due to the price of Ethereum increasing. Whether a similar event will play out soon remains to be seen.