Ethereum, the world’s largest altcoin, has suffered an immense setback in terms of price. This bearish scenario saw the altcoin falling to extremely low levels. Even so, at press time, ETH did note some recovery as it crossed $2k on the charts. Ethereum recovered by about 14% from its lowest level at $1,800.

What happens afterwards?

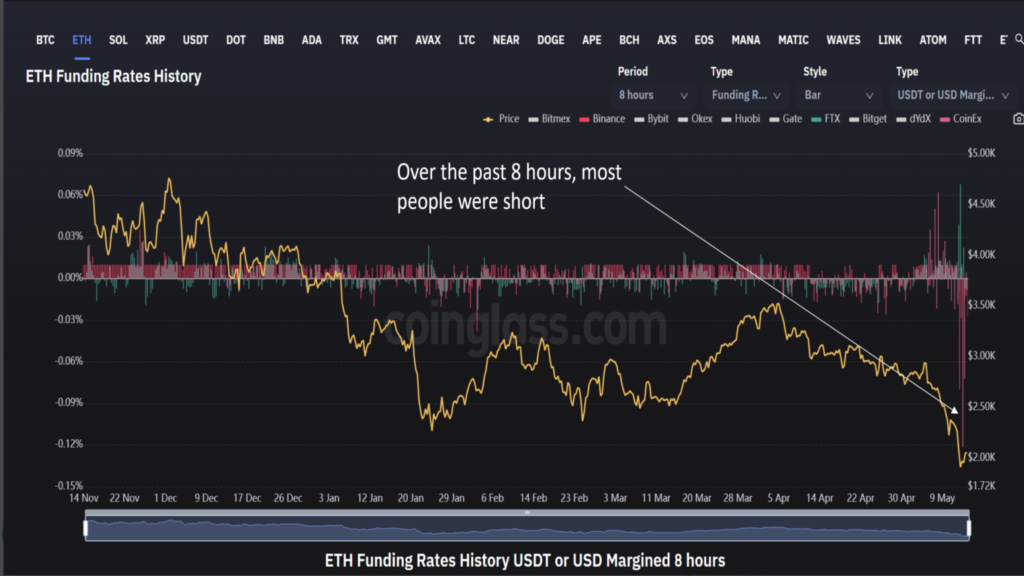

On-chain analytics-based company Santiment has shared some thoughts on what could be the next price action for Ethereum. The data provider noted that this 8-hour chart, added below, showed heavy shorts “building” for Ethereum at $2,000.

The blog stated, ‘this usually don’t end well for late shorters and a squeeze is likely to push prices up.’

Ergo, Ethereum could see a potential rise in price given this narrative. But it’s not that. Ethereum’s supply on exchanges had also decreased at the time of publication. This seemed to support the aforementioned bullish picture.

But, one needs to consider what the May 1 episode precipitated –

“While we saw a nice drop in supply on exchanges for the past year or so, May 1st 2022 saw a huge increase in supply on exchanges as folks rushed to exit their positions, which is clearly reflected on the price itself.”

Now, any further increase in the FX supply would fuel further decline. However, a possible scenario could arise from this move where investors sold or dumped their ETH holdings.

Consider this – According to the blog, ETH’s MVRV 90D (measures the mid-term profit/loss of holders) “showed that we are almost into the opportunity zone, which historically saw a local bottom being developed with a decent R/R.”

Even at press time, said metric hovered around the (-)20 zone, still signaling an “opportunity zone.”

Generally, a negative value indicates that these holders are underwater. Hence, the probability of a sell-off is low. This could indicate that short-term holders are at a loss and long-term holders tend to accumulate under these conditions. Therefore, the aforementioned range is termed an “opportunity zone,” since the risk of a sell-off is low.

Other factors?

Besides on-chain analysis, development within the ecosystem and global macros would play an important role.

Cloudflare, for instance, ventured deeper into Web3 and Ethereum staking with the launch of validator nodes.

Such support could help ETH in the coming days.