Bitcoin fell 14 percent on Monday when Celsius Network, a major US cryptocurrency lending provider, halted withdrawals and transfers due to “extreme” conditions.

Celsius’ action prompted a selloff in cryptocurrencies, with their value falling below $1 trillion for the first time since January 2021 on Monday.

Furthermore, institutional investors are being forced to sell their crypto holdings as a result of the crypto market crisis. Since November, the crypto market cap has plunged to $961.83 billion, a loss of about $1.5 trillion.

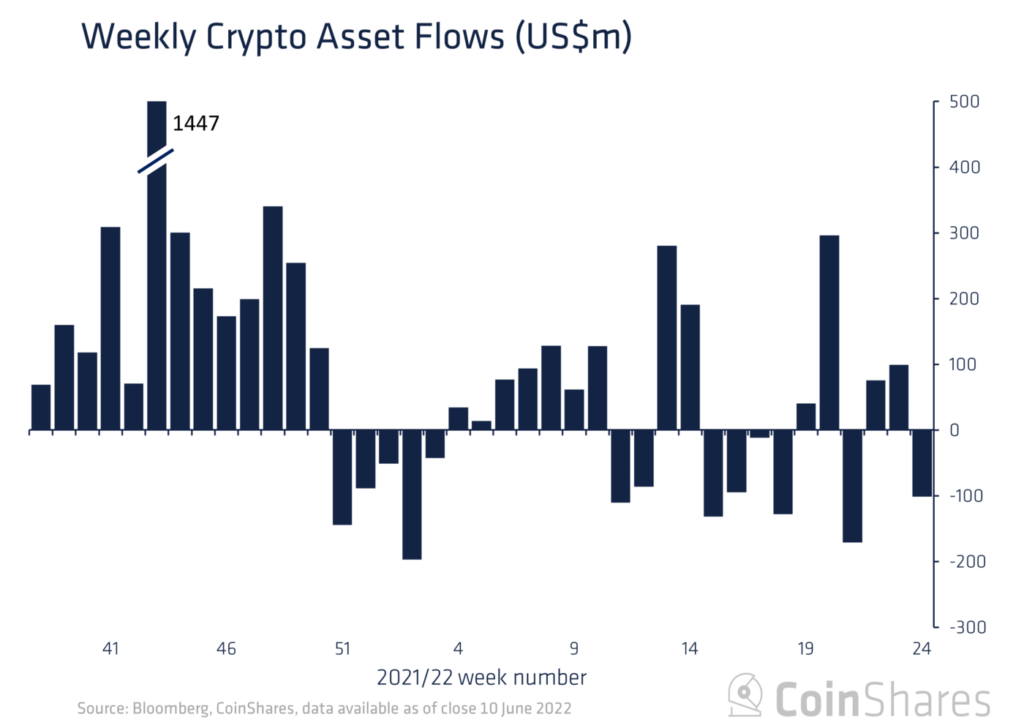

The outflow of digital asset investment products stood at $102 million last week, according to the latest report from CoinShares. Last week, amid Fed monetary tightening and market-wide selling, Bitcoin outflows of $57 million and Ethereum outflows of $41 million were seen.

Due to monetary tightening, digital asset investment product flows have been weak, with outflows continuing last week due to rising inflation and the stETH depeg from ETH.

Surprisingly, releases were dominated by Americans, who accounted for $98 million in total. In Europe, however, releases were only $2 million.

Millions of withdrawals

In the recent week, 3iQ, Purpose Investments, CoinShares XBT, and ETC Group saw withdrawals of 72.1, 43.4, 11.3, and 6.2 million, respectively. Inflows of 24.2, 19.1, and 4.5 million were seen in ProShares, CoinShares Physical, and 21Shares, respectively. In addition, Grayscale, the institutional leader, has only recorded 0.3 million in the last week.

Last week, institutional investor interest in Bitcoin and Ethereum dropped dramatically. Last week, bitcoin outflows totaled $57 million, with a total of $91 million for the month.

Short-bitcoin investment products have a far lower total assets under management, at $55 million, compared to $27 billion for long-term bitcoin investment products. Huge selling was also triggered by the delay of the Ethereum Merge and the stETH-ETH depeg.