Just a week can completely change the entire outcome in the cryptocurrency market. A report posted on 7 June, revealed that digital assets witnessed inflows last week despite the bearish run. This inflow amounted to $100 million bringing the total assets under management (AuM) to $39.8 billion.

But, said influx did not stay long…

Bleeds profusely…

The cryptocurrency market is going through a heavy correction phase which has seen the market exit the “Trillion” zone. At press time, the overall market stood at $959.7 billion after suffering a 14% correction in 24 hours.

As expected, digital assets saw outflows of $102 million last week as per CoinShares’ latest Digital Asset Fund Flows Weekly report. Given the negative sentiment across crypto, the blog noted:

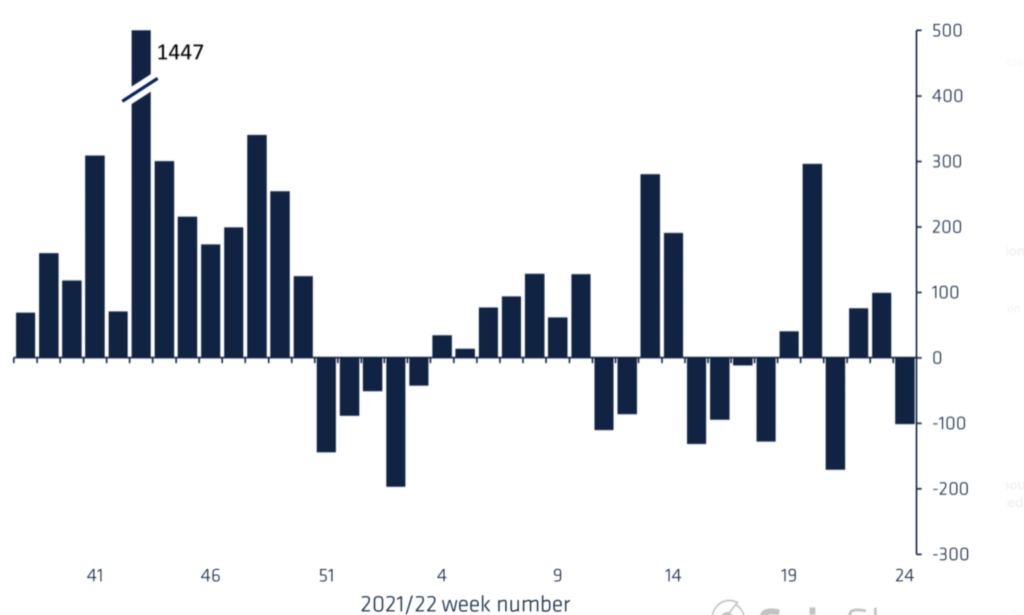

“Inflows of digital asset investment products remain choppy in anticipation of hawkish monetary policy, with steady daily outflows over the past week totaling $102 million.”

Here’s a graphical representation:

Geographically speaking, the majority of outflows focused on the Americas, totaling $98 million with Europe seeing just $2 million outflows.

Stairway to hell?

Surely it looks like it.

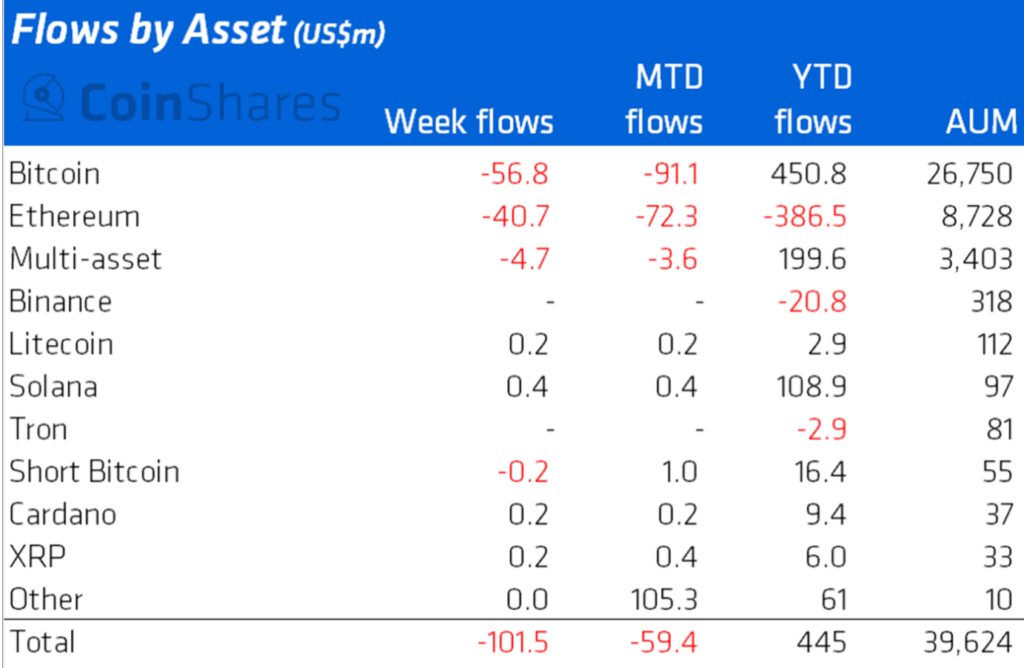

Bitcoin recorded outflows totaling $57 million last week, bringing monthly outflows to $91 million. Interestingly, despite these outflows, short bitcoin investment products also saw minor outflows totaling $0.2 million. Nevertheless, the total AuM was well below $55 million, compared to $27 billion for long-long bitcoin investment products.

According to the blog, an important factor led to BTC’s demise:

“What has pushed Bitcoin into a “crypto winter” over the last 6 months can by and large be explained as a direct result of an increasingly hawkish rhetoric from the US Federal Reserve.”

Even the Terra fiasco contributed to worsening this grim scenario. Anyway, now on to altcoins…

Ethereum, the largest altcoin saw another week of outflows totaling $41 million bringing total year-to-date outflows to $387 million (4.4% of AuM). Well, ETH saw a constant departure in the past as well. One of the reasons why the total AuM fell from its peak of $23 billion in November 2021 to $8.7 billion today.

That said, Solana (SOL) recorded a small rise to around $400,000. While Litecoin (LTC), Cardano (ADA) and XRP each saw an influx of $200,000. But that didn’t really help the fate of altcoins as the blog claims:

“Aside from Multi-asset investments products, which saw US$4.7m of outflows last week, investors steered clear of adding to altcoin positions.”

All in all, it will take a long time for cryptos to overcome these huge hurdles and recover.