More than $1 billion worth of digital assets were liquidated on 16 June in the face of the crypto crash. Moreover, around $480 million was wiped out on centralized exchanges over the past 24 hours. The major VC firm, Three Arrows Capital, closed $400 million worth of positions and hundreds of millions in additional loans remain at risk.

CeFi platform, Celsius’ stop on withdrawals triggered the selloff again.

Non-stop bleeding

Ethereum, the largest altcoin remains in a dangerous position. Lenders could face a massive cascade of liquidations worth around $500 million, according to on-chain tracker Parsec Finance. The massive sell-off fueled the market’s further decline and a massive outflow of funds from decentralized apps.

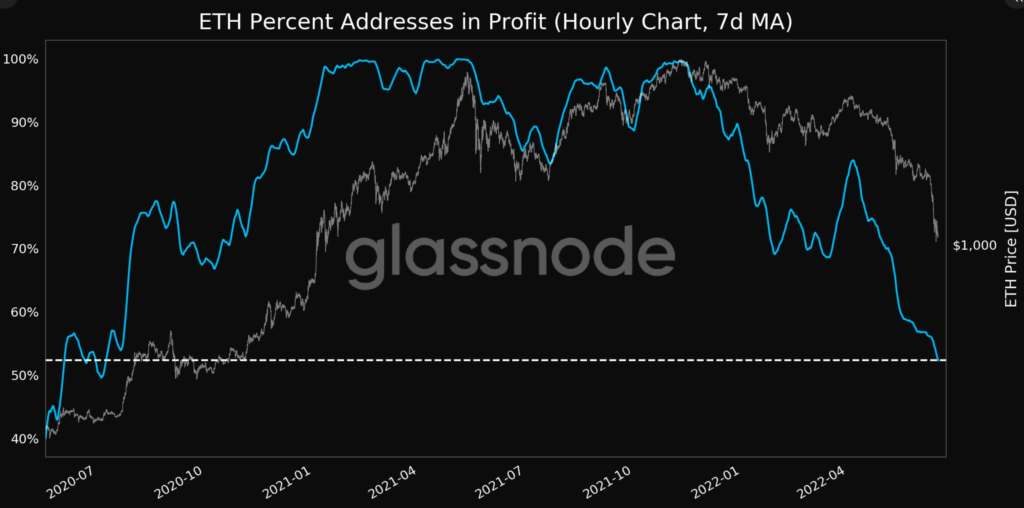

At the time of writing, ETH was struggling to keep up the $1100 mark after suffering a fresh 4% correction. The cryptocurrency could decline further but bulls were someway able to prevent any further drops. Although, this has also put the number of ETH addresses in a loss at an all-time high.

Data from analytics provider Glassnode claimed that the number of Ethereum addresses in loss based on a seven-day moving average hit an all-time high – the percentage of ETH addresses in profit hit a low of 23 month of 52.328%.

Indeed, showcasing a grim scenario for the largest altcoin within the crypto market.

The only saving grace is…

While it may seem dead and boring to the coin, the upcoming merge continues to support. In fact, the total value locked in the ETH 2.0 deposit contract has just reached new highs. Glassnode reported that the locked amount just marked the new ATH of 12,896,853 ETH, worth over $25 billion at the current exchange rate.

This means that nearly 11% of the total ETH supply of 119,318,828 is currently staked in the ETH 2.0 contract.

Merging in transit has done the larger altcoin network a huge service. As the Ethereum network accelerates the transition to ETH 2.0, investors have prepared for the staking feature by continuing to deposit Ether.

As past bore the witness, the aspect did continue to reach new heights despite the massive price correction. Although, the question is- Can investors/stakers remain patient until the Merge actually comes true?