Decentralized finance (defi) has been hit hard by the recent crypto market rout as the total value locked (TVL) across 118 different blockchains has slipped below the $100 billion mark to today’s $74.27 billion. The TVL in defi today is down more than 70% from its December 2, 2021, all-time high (ATH) at $253.91 billion. Moreover, since December 2021, the top smart contract platform tokens have lost 70% in value against the U.S. dollar as well, sliding from $823 billion to today’s $245 billion.

Defi continues to be slammed by market carnage, leading smart contract platform tokens see steep losses

While a large number of cryptocurrencies, including the main crypto asset in terms of market valuation, bitcoin (BTC), have fallen significantly in value, smart contract platform tokens and decentralized finance (defi), in general, have suffered greatly.

While Terra’s LUNA and UST fallout primed the flames, issues with Celsius, Three Arrows Capital (3AC), and the lack of trust in algorithmic stablecoins have continued to keep defi fires roaring. Six days ago, Bitcoin.com reported on how defi and smart contract coins got slammed by significant blows and at the time, there was still $104 billion in value locked into a myriad of defi protocols.

Today the total value locked (TVL) in defi is $74.27 billiondown 70.74% since the all-time high 197 days ago on December 2, 2021. Makerdao defi protocol tops the pack with 10.43% in TVL of the $7.75 billion app out of the $74.27 billion.

During the past 24 hours, the entire TVL across 118 different blockchain networks dropped by 6.03%. Makerdao’s TVL shed 15.19% during the past seven days and the second-largest protocol in terms of TVL size Aave lost over 40% last week.

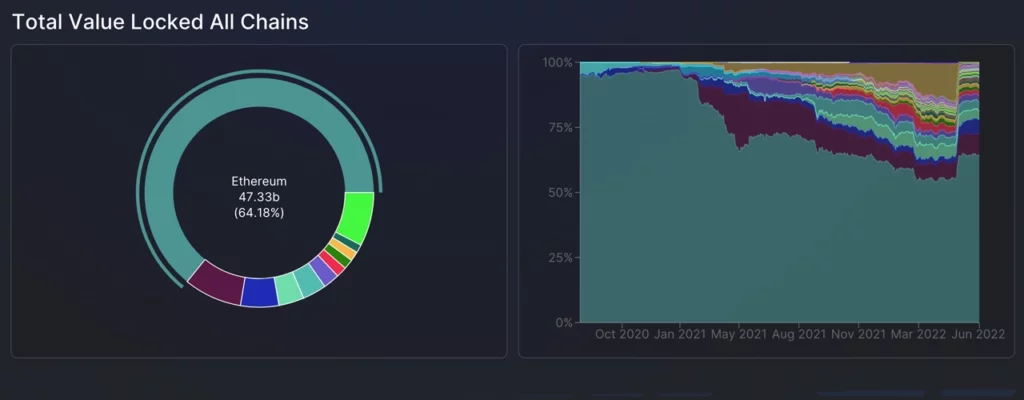

Today, Ethereum commands the greater TVL size of all blockchains with $47.33 billion or 64.18% of the locked aggregate. The second largest defi blockchain in terms of TVL size is Binance Smart Chain (BSC) with $6.06 billion or 8.22% of the $74.27 billion locked in defi today.

Tron is the third-largest blockchain network in terms of TVL size with 3.99 billion or 5.42% of the aggregate locked across the 118 chains. Furthermore, the total value locked in cross-chain bridges from Ethereum has dropped more than 60% during the past month, according to Dune Analytics metrics.

Often mined tokens in defi, the smart contract platform coins have also lost more than 70% since December. At that time, the market capitalization of all tokens in the smart contract platform was $823 billion and today it sits just above $245 billion.

Ethereum (ETH) is the leading smart contract platform token as it commands $131.50 billion of the $245 billion. ETH is down 39.3% over the last seven days and most smart contract tokens have seen considerable losses during the past week.

Avalanche (AVAX) lost 34%, binance coin (BNB) lost 25%, cardano (ADA) fell 22.5%, polkadot (DOT) slipped 20.7% and solana (SOL) lost 22 .3% in seven days. One of the only smart contract coins that didn’t fall last week is chia (XCH), as it is up 1.2% against the US dollar.