Institutional investors were also in panic mode

The 2022 “crypto crash” was one of the largest and steepest falls in digital asset industry history, as a variety of assets lost up to 50% of their value in A few days. The most notable case was Ethereum, which plunged to $880 within days, reaching values below the 2017 ATH.

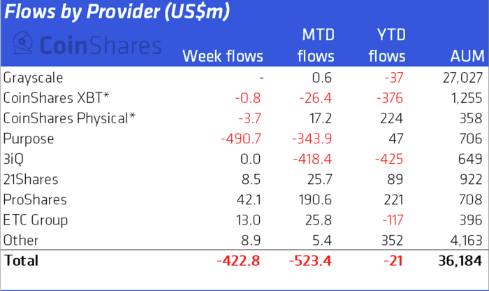

Such a strong drop in the capitalization of the market, plus a series of liquidations and margin calls received by companies holding digital assets or having long positions open, could have caused fear among institutional investors, which led to almost $500 million outflows from the industry.

According to Coinshares, the outflows appeared on June 17 but only reflected now due to the reporting lag that exists among institutional and corporate investors. The main reason, as already mentioned, is the Bitcoin and crypto market crash. As the data suggests, the outflows were mostly focused on Bitcoin.

The biggest outflow provider is the Purpose Bitcoin ETF, which provided $490 million outflows WTD, with month-to-date flow at negative $343 million. The only asset that saw inflows is the Short Bitcoin asset that exposes investors to “Bitcoin short orders,” allowing making a profit from a descending asset.

In terms of territorial source of outflows, Canadian exchanges are the largest providers of negative volume, as we saw significant withdrawal activity on them on June 17th.

Luckily, we should not see such large outflows in the next report as the market was already in the recovery process, and we should expect neutral or positive dynamics on institutional addresses.

At press time, Bitcoin is changing hands at $21,178 and Ethereum is trading at $1,212.