During the past 30 days, $285 billion has left the crypto economy and bitcoin’s USD value hit a 2022 low at $17,593 per unit on June 18. Moreover, last month’s statistics show bitcoin’s market dominance was 2.9% higher and ethereum’s market dominance was 2.1% higher than it is today.

Bitcoin and Ethereum Dominance have fallen over the past month

The crypto bear market has wreaked havoc on the digital currency economy and many continue to wonder if the market carnage will continue. The market experienced a brief period of consolidation after the most recent selloff, which brought BTC down to $17,593 per unit and ETH to $877 per coin.

Both coins have seen a significant amount of fiat value removed since last month and BTC’s and ETH’s market dominance has decreased since then as well. At the time, BTC was trading for $28,946 per unit on May 27, 2022, and ETH was exchanging hands for $1,745 per unit.

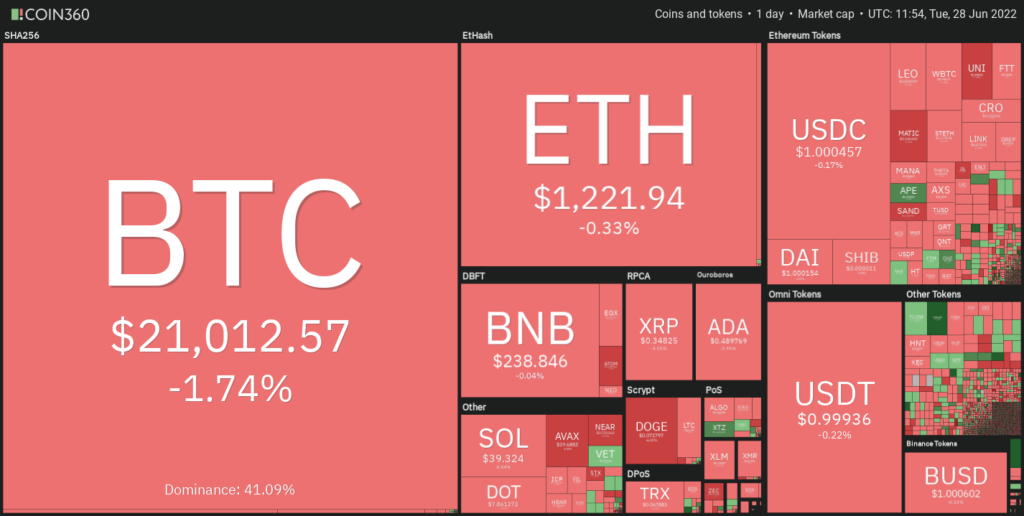

At the time of writing, BTC is trading hands for just over $21,000 per unit, while ETH is trading for $1,221 per unit. BTC dominated the $1.25 trillion crypto economy by 43.9% that day and ETH had a dominance rating of 17.1%. 30 days later, data shows that BTC’s current dominance is 41%, while ETH controls 15% of the entire crypto economy.

Tether, USD Coin, and BUSD Dominance Swells

The stablecoin tether (USDT) captures 6.94% of the digital currency economy’s net value and usd coin (USDC) commands 5.77%. Tether’s market cap has grown since last month as it was hovering around 5.72% at that time.

As of mid-May, USDC’s market capitalization was 3.77% of the crypto economy. The BUSD stablecoin issued by Binance was equivalent to 1.43% of the crypto economy in terms of dominance, and today it is 1.8%. In fact, between USDT, USDC, and BUSD, the combined market caps equal 14.51%, which is just below ETH’s 14.7% dominance rating.

While BTC saw $18.7 billion in global trade volume during the past 24 hours and ETH saw $13.5 billion, the combined $32.2 billion in trade volume is still eclipsed by USDT’s $48.58 billion during the last day. Out of all the 24-hour BTC trades, 60.62% of those bitcoin trades are paired with tether (USDT).

With lower dominance ratings for BTC and ETH, it looks like sellers are turning to stablecoins. This trend suggests that it is possible but not guaranteed that a large portion of stablecoin funds are people waiting on the sidelines for official ETH and BTC funds.