Number of ”long” traders and market trend are inversely correlated

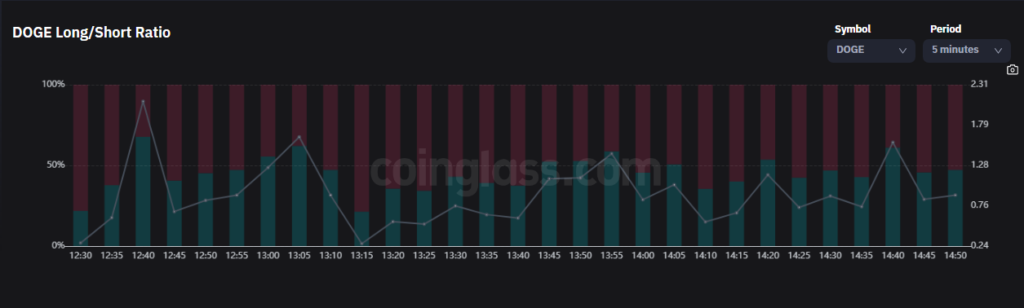

According to data from Coinglass, around 57% of Dogecoin traders on Binance futures are net long. The long-short indicator reflects the sentiment of most retail traders. “Going long” refers to the buying side of a particular asset.

Market volatility is likely to be extreme when the number of ”long” traders approaches the two extremes (too high or too low). The number of ”long” traders and the market trend are inversely correlated. In other words, the previous market trend is likely to continue if the number of ”long” traders increases during a downward market trend or decreases during an upward market trend.

It is conceivable that the market trend will change if there is a surge in “long” traders while the asset price remains high. However, the market trend is likely to persist if the long-short ratio is close to 1:1.

Overall, the Dogecoin long/short percentage in the last 24 hours remains at 49.53%/50.47% with a ratio at 0.94. This might suggest slight equality between bears and bulls, indicating consolidation, although the near-term picture remains slightly bearish. Given that the total value of long orders to short orders is always 1:1, but when the long-short ratio is higher than 1, there are more long traders than short traders and vice versa.

DOGE courses

Dogecoin (DOGE) is now down 2.35% in the last 24 hours, trading at $0.065. A small advantage for the sellers is indicated by the fact that the RSI is barely below the midpoint and the MA 50 has flattened out.

If the price drops below $0.06, it might be a sign that the bears are trying to take control once again. The decline might be resumed by sellers to drive Dogecoin below the crucial support level of $0.05. At $0.04, there is another support.

On the other hand, if the price rises from its current level, the buyers may again try to breach the $0.08 (MA 50) barrier. Dogecoin could then try to hit the $0.10 mark.