Cryptocurrency bear markets can be brutal for new investors without sufficient experience. The swings are typically a lot more violent compared to traditional stock markets, and it’s not unheard of for some coins to lose 90% (or more) from their all-time high values.

Not having enough knowledge or experiencing a cryptocurrency bear market for the first time can lead investors to make many mistakes. With that in mind, learning from people who have been there in previous rounds, as well as identifying those mistakes in advance, could save both money and emotional hurdles.

Below are some of the most common mistakes that traders and investors make during a cryptocurrency bear market and how to avoid them.

panic sale

Panic is universally bad. Indeed, when we panic, we experience an intense feeling of fear and anxiety, and this usually comes in response to an existing danger. When this happens, we tend to be more prone to losing control and making reactionary decisions that lack common sense and logic.

In the realm of trading and investing, panic selling refers to the action of a widespread selloff of a cryptocurrency because of fear, rumor, or – in general – an overreaction instead of a reasoned and carefully planned analysis.

Investing in a cryptocurrency is an act that should be based on objective and solid merits rather than emotions. For example, Bitcoin is widely considered digital gold – a store of value – something that has historically appreciated over time. Many people invest in them with the intention of preserving the purchasing power of their funds, especially in times of high inflation when fiat currencies tend to devalue at a faster rate. If it is the seed – the main reason for investing – one is likely to have a preference for a long time, and the only reason to sell would be if something fundamentally changes in the narrative and Bitcoin ceases to fulfill its role.

However, what we see in practicality is many people start market selling their BTC when the price begins dropping. They forget (or fail to acknowledge in the first place) that BTC is also primarily considered a risk-on asset by many, and that’s the general consensus, at least at the time of this writing. Therefore, during times of economic turmoil, it’s entirely possible for investors to liquidate BTC before they liquidate other assets that they consider safer. This causes the price to go down, sometimes more aggressively.

During these sell-offs, many investors panic. This is completely normal, but it’s also probably the most common error.

Remember – no asset goes up in a straight line. There will be bumps along the journey.

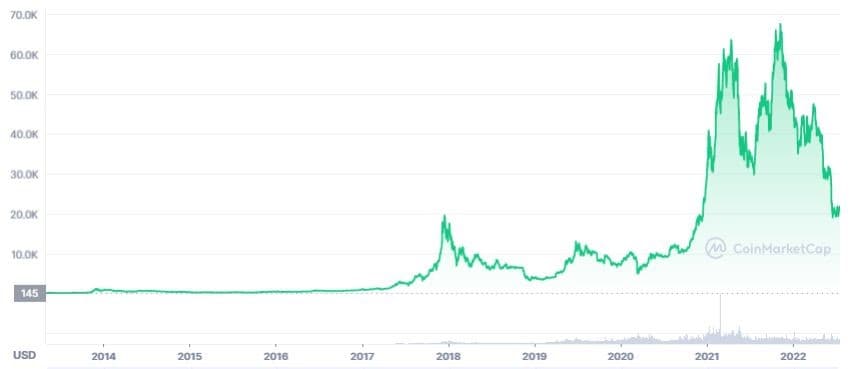

This is what the Bitcoin chart has looked like over the past ten years:

Yes, Bitcoin’s a lot more volatile compared to, let’s say, the S&P 500, but it has also historically gone up in price. The corrections are vicious, though, and it’s critical not to lose sight of the primary reason for which the investment was made in the first place.

Match your bags

While you should avoid panic selling, that doesn’t mean you should never sell either. Equally important is realizing you made a bad investment and putting your ego aside. Many people “marry to their bags,” which means they form an emotional attachment to investing and give up on reason and logic when the underlying narrative fails.

This is something that happened to many people back in 2017 and 2018 – when the ICO boom was peaking. Many investors got in early, made serious returns, but failed to realize them in chase of even higher ROI. Later on, when their cryptocurrencies started crashing, they didn’t sell because they were convinced of their recovery.

The thing is, many altcoins that have lost more than 90% of their value since ATH are unlikely to return to these levels. Don’t be afraid to cut your losses and move on.

Overtrading

This has a lot to do with mishandling emotions too. Overtrading is frequently the consequence of a few things – regret of misreading an investment thesis, missing out on an opportunity, the strong desire to recoup previous losses, and so forth.

The one thing that all of the above have in common is that they encourage emotion-based decision-making. Remember – the market doesn’t care about your emotions – charts are nothing more than a visual representation of information, and it’s up to you how you will interpret that information. Either way, however, it is a process based on nothing but objectivity – a process where emotions have no room to thrive.

There’s also the fact that you pay additional trading fees when jumping in and out of trades, and if you’re not managing this properly, they can add up pretty quickly.

Trying to time the bottom

Trying to time the bottom is another common mistake that newcomers tend to make. It’s a tale as old as time – “BTC still has room to go down, I’ll buy then.” And then one of two things happens:

1. Bitcoin does go down, but they never buy, thinking (once again) that it has more room to drop.

- Bitcoin never goes down, and they don’t buy thinking that “one last leg down” will eventually come.

But consider this. Imagine Bitcoin trading at $10,000, and you think it will go down to $8,000 in another 20% crash. You don’t buy, and then Bitcoin goes on a parabolic bull run, hitting $100,000. Now ask yourself – were those 20% worth it?

During the COVID crash in March 2020, when BTC fell below $4,000, many believed the worst was yet to come as the world was on the brink of economic disaster in the face of global lockdowns and an impending pandemic. But that never happened – instead, BTC embarked on a frantic bull run where it topped $69,000 a year later.

The point is – nobody knows where the market will go next – it’s all just educated and informed guesses. Therefore, if you’re not a professional trader, one of the best strategies you can use is the Dollar Cost Average (DCA). If you DCA on the way down – that’s even better.

The idea is that you take the amount of money you want to invest and break it down into small lots that you invest on a regular basis – for example, once every two weeks or once a month. This will get an average price between all entries and minimize risk.

For more information on the DCA strategy – please read our detailed article on it.

Not paying attention to mental health

From all of the above, one thing should become crystal clear: your mental health is paramount. No amount of money is worth sacrificing your well-being. Now that cryptocurrencies have somewhat entered mainstream investment mediums, it is important to talk about them as more and more people are getting into trading and investing in crypto.

Pay attention to your mental health – do not neglect it. One of the more stress-free things you can do is invest for the long run if you have the conviction that cryptocurrency is here to stay. If you think that Bitcoin is digital gold and, as such, will replace traditional gold – why sweat over a 10% increase or decrease in its price now?

If you think Ethereum is going to be a global platform used by hundreds of thousands of developers and users around the world, does it matter if you buy it for $1,000 or $1,100?

During bear markets, prices tend to go down to the extremes, and it’s commonplace for people to see their paper gains diminish. If that’s the case, don’t forget that there’s life outside of crypto – it surely stings to lose life-changing money but remember there’s no amount that’s worth your health.

These are some of the most common mistakes people tend to make during a bear market. None of the above is financial advice. The purpose of this content is solely to entertain and educate. Investing in cryptocurrencies carries a high risk of capital loss. You can lose everything you have invested. Therefore, never invest more money than you want and can afford to lose.