The approaching Ethereum Merge is the focus of the cryptocurrency market, but Bitcoin miners seem to be anticipating a bleak future. The Ethereum Merge is expected to spark a bullish trend in the cryptocurrency market. Some traders, however, do not anticipate that the price of Ethereum (ETH) would increase roughly six months after the Merge.

Data indicates that the reserves held by bitcoin miners have continued to decline recently, indicating that miners may be selling their coins. As one analyst noted in a post on Cryptoquant, BTC miner reserves have been turning negative recently, which could lead to a fall in the price of the cryptocurrency. The total amount of bitcoins currently held in the wallets of all miners is indicated by a metric called “miner reserves”.

When this metric’s value increases, it indicates that miners are currently adding more money to their wallets. When such a pattern persists, it may indicate that these network validators are accumulating their holdings, which is bullish for the value of BTC.

On the other hand, a drop in the indicator suggests that miners are now moving coins from their reserves. This type of pattern could be counterproductive for the cryptocurrency as miners often sell their BTC.

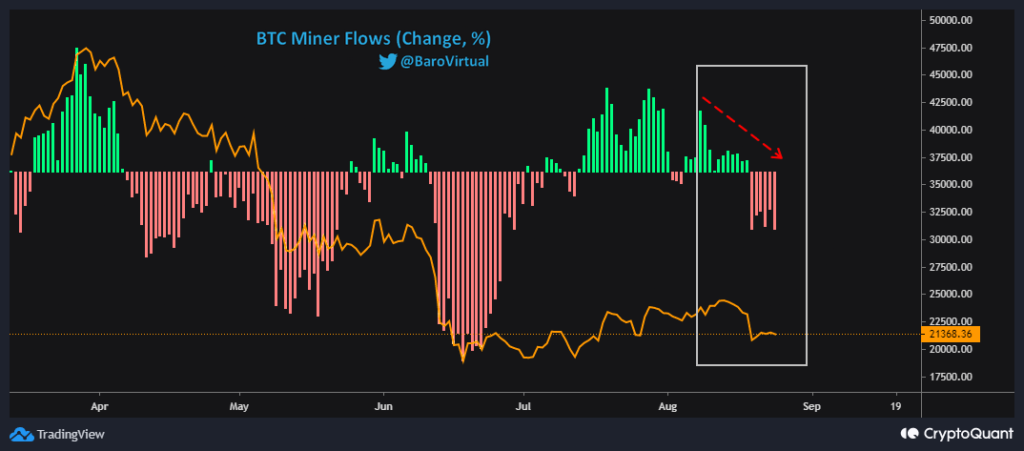

Here is a graph showing the trend in bitcoin miner net flow over the past few months, a statistic that tracks the percentage change in total miner reserves:

Positive figures indicate that the reserves are increasing, while negative values indicate that they are decreasing. The value of this BTC indicator had been above zero earlier in the month, as you can see in the graph above, but recently it has fallen below zero.

This could be a sign that these miners have been dumping lately. This figure shows that at any point in the past few months where reserves have experienced an unfavorable adjustment, the price of BTC has fallen.