Almost $400 million in liquidations hit market as Bitcoin loses battle against bears

As we have noted several times in U.Today cryptocurrency market reviews, most experienced market participants are anticipating another downside break from bitcoin and other cryptocurrencies, despite signs of positivity.

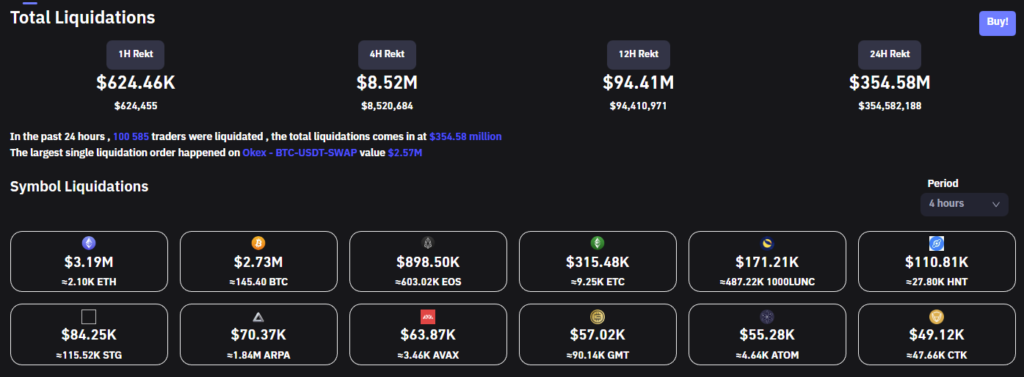

As CoinGlass suggests, the market saw a massive $358 million loss following the liquidation of the remnants of long orders that some bulls thought are appropriate to have open considering the massive imbalance between longs and shorts.

Previously, bitcoin’s open interest on derivatives platforms affected extremely low prices, creating situations in which short openers had to pay the bulls to maintain their long positions in the market.

Historically, a large imbalance between orders has been a perfect condition for a short squeeze to happen on the market and fuel the rally of BTC. Unfortunately, this was not the case yesterday, as bears have finally become successful in pushing the price of the first cryptocurrency down, triggering a small cascade of liquidations.

What’s next for bitcoin?

Yesterday’s pump confirmed the fears of most crypto industry experts, who bet on another dip ahead of the reversal. Unfortunately, bitcoin still has some room for correction, and we could see a drop to the same level we saw in June when the price of the first cryptocurrency fell to the $17,000 price range.

The strict monetary policy, upcoming rate hike and other factors will not let the first cryptocurrency return to the top of the market quickly, especially with the absence of growth factors.

The Ethereum merge could have been a catalyst for a rally in the market, but for now, it only provides an influx to Ethereum, keeping other cryptocurrencies in a bear market.