Prominent Bitcoin critic has admitted scarcity of Bitcoin after saying recently that crypto has future, but there’s catch

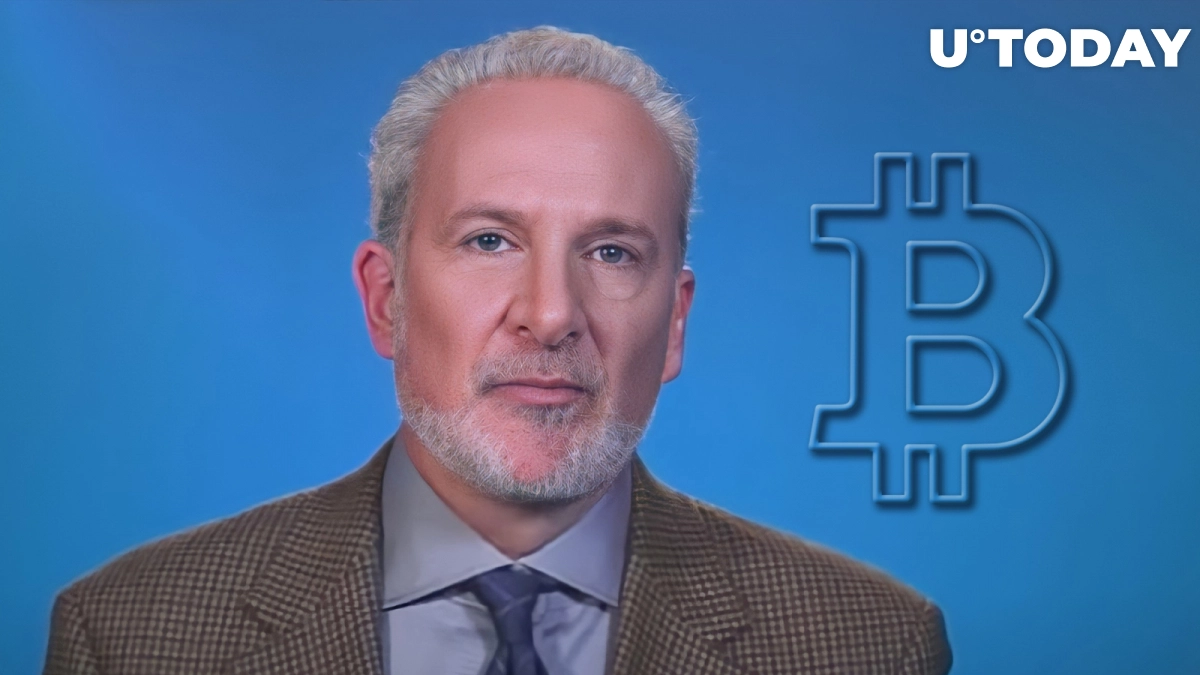

Economist Peter Schiff, founder and chairman of the SchiffGold Fund, a vocal bitcoin rival, took to Twitter to comment on bitcoin’s extended drop that occurred on Tuesday.

He admitted that Bitcoin is indeed scarce, but it does not matter now, he said.

Bitcoin’s Dominance Gets Tough, Its Lack Doesn’t Help

On Tuesday, it fell 5.61% to a low of $18,630 – the biggest drop in two months. In his tweet, Peter Schiff said that not only is there an extended Bitcoin crash, but BTC dominance is also barely falling.

By now, this metric has fallen to 38.1%, the lowest level since the previous crypto winter in June 2018.

Schiff believes that the loss of dominance over the crypto market is due to the fact that bitcoin has to compete with around 21,000 other crypto, NFT and crypto-based equities. As far as altcoins losing BTC dominance is concerned, Schiff refers to them as “intrinsically low value” as well as bitcoin.

The economist also admitted that Bitcoin is a scarce asset; however, in the current situation this does not matter, he said, since altcoins have a much bigger supply than BTC. Bitcoiners, including Schiff’s son Spencer, rushed to persuade Schiff that he is not right.

Earlier, Schiff acknowledged that crypto “probably has a future”, but that bitcoin will not be part of it. Influencer David Gokhshtein admitted that Peter Schiff got his predictions about BTC at this point.

“$20,000 is false bottom”

On Tuesday, fund manager and gold bug Schiff took to Twitter to share his opinion that $20,000 is likely to prove a false bottom for the benchmark cryptocurrency.

He mentioned that BTC had been trading near that level for almost two weeks as the market was giving gullible investors a chance to jump on that bandwagon. He recommended leaving the “sinking ship” before it was too late.

Curiously, the flagship crypto went deeper down the next day after that tweet.

Bitcoin remains in a bull market, claims Mike McGlone

Mike McGlone, senior commodity strategist at Bloomberg, shared a screenshot on Tuesday with a quote from a recent Bloomberg report. It said that, this year, BTC joined the global store of value alongside gold and the US Treasury.

The report also pointed out that, previously, in 2015 and 2018-19, the flagship crypto went through a similar deep crashes as now and, after that, the price soared to new historic peaks.

At the time of writing, bitcoin is changing hands at $18,785 per coin on the Bitstamp exchange.