Investors might receive serious profits if Ethereum makes this unexpected move

The industry’s second largest network hasn’t faced any problems that occurred in the last week before the merge update, despite the increase in liquidation volumes in the cryptocurrency market. But things could change if the price drops to $1,348.

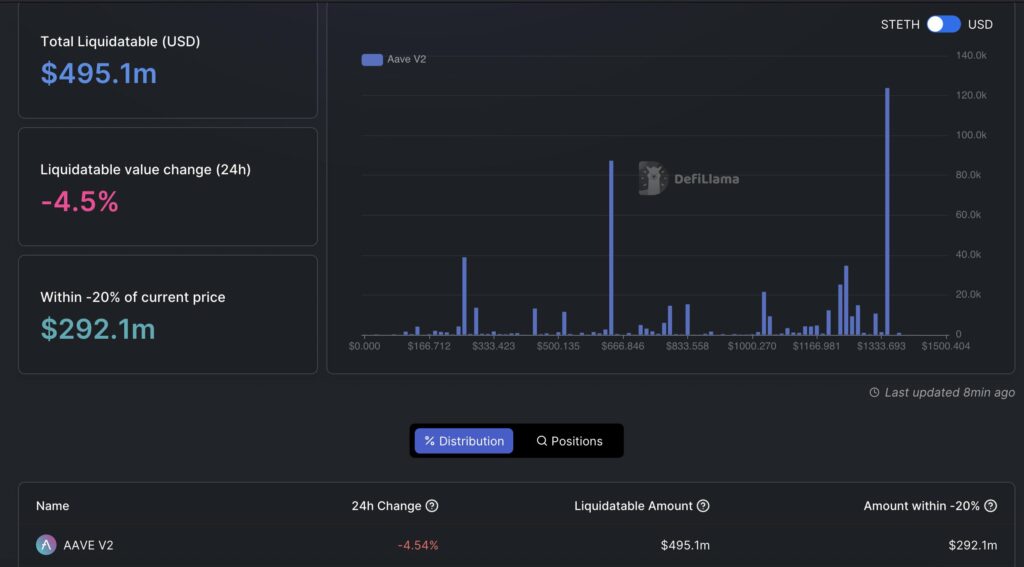

According to DeFiLIama, there are $167 million worth of stETH at risk of liquidation at $1,348. Compared to spot-based Ethereum futures, the liquidation level is almost two times higher.

In the event of the liquidation, $167 million worth of tokens will be injected into the market, which will put huge pressure on stETH, which will certainly detract from the price of the spot ETH asset. Such terms can be used for arbitrage trading.

With an immediate spike in selling pressure, the price of the token might plunge far lower than Ethereum’s price on the market. In order to take advantage of it, traders might start buying stETH at a lower price and then sell their regular ETH holdings, making an immediate profit, considering the high possibility of stETH returning to the same level as the spot asset.

One way or another, the liquidation may not happen at all if the price of the second largest cryptocurrency market suddenly drops to the above price. Investors and traders can always fund their positions in addition, reducing the liquidation price even further and avoiding a crash.

In addition to financial reasons that may help the market avoid the cascade of stETH liquidations, the price of the spot assets might also avoid such a rapid and unexpected spike in selling pressure, considering its previous performance on the market.

At press time, Ethereum is trading at $1,512 and is showing a slight correction of 3% over the past 24 hours.