Even after the recovery, the cryptocurrency market saw recently, the sentiment of traders and investors is still built around extreme fear as the correction in the market does not seem to be ending. However, some cryptocurrencies like Cardano, are still managing to show a positive dynamic despite the chaos around them.

By the middle of this month, Cardano (ADA) will launch its new Vasil hard fork. Notably, the blockchain has also registered a commendable performance during the past week with a gain of over 5% in the last seven days.

With this gain, it clearly outperformed several other cryptos with higher market capitalization, including Ethereum (ETH) which is set for its Merge in mid-September. At the time of writing, ADA was trading at $0.4937.

Is a Bull Rally Possible for ADA?

The Vasil Hard Fork, which has been delayed for some time, is finally set to go live in mid-September. This has caused a lot of excitement in the Cardano community. While the development and testing of the hard fork is still ongoing, the Input Output Global tweeted Recently some updates regarding the same.

Charles Hoskinson also came forward to comment on the story and tweeted about how Cardano was at its best despite a plunge in its price last month.

Hoskinson said, “A universal truth about cryptocurrencies is that markets have diverged from reality.”

More interestingly, a crypto influencer Dan Gambardella recently indicated a possible bull rally for multiple coins, including ADA.

According to Dan, the current market conditions are somewhat similar to the 2018 bear market, which is creating an opportunity for a price rally soon.

Do the Metrics Justify ADA’s Growth?

Although the developments in the community and statements from officials and influencers seem quite promising, metrics paint this picture. ADA’s Market Value Realized Value (MVRV) ratio surged slightly compared to last week. This may be hinting at a possible uptick.

Also, daily active addresses have increased since early August, indicating the presence of users on the network.

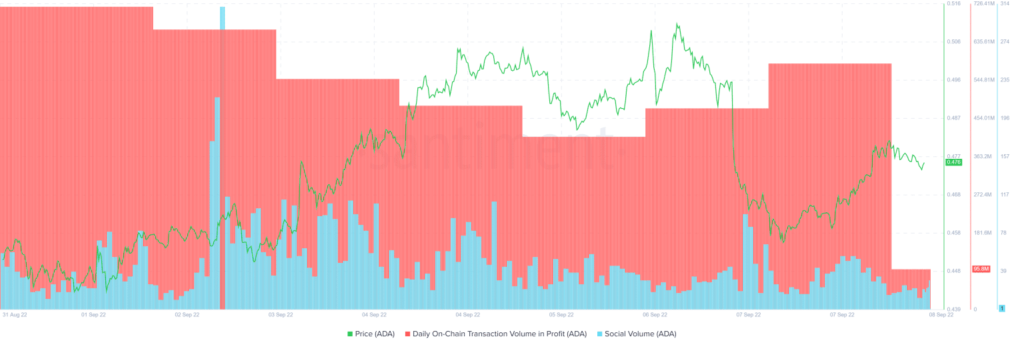

Despite ADA’s recent gains, which seem bearish, the on-chain transactions in profit declined. Development activity, and social volume, also followed a similar downward trend. This might prevent ADA from moving up further in the short term.

cardano breaks down

As of September 8, the ADA’s four-hour chart also told a debatable story. Some indicators pointed to an increase while others indicated the opposite.

For example, the EMA Ribbon displayed a reduced gap between the 20-day and 55-day EMAs, which is clearly a bullish signal. Moreover, the Moving Average Convergence Divergence (MACD)’s data also hinted the same as the blue line above the red.

However, the latter was rapidly approaching the former, raising the possibility of a bearish crossover. The Relative Strength Index (RSI) was in a neutral position, indicating that the market could move higher.

On September 4, ADA finally broke the local resistance level on the ADA/BTC pair. The breakthrough of the ascending triangle was a necessary condition for the continuation of ADA’s growth in the market.

In addition to breaking the patterned resistance level, Cardano has also managed to break above the 200- and 50-day moving averages which usually act as a strong barrier for any asset in a downtrend.

If ADA manages to keep up the same growth pace for a few days more, the market will most likely see the emergence of a much-needed bullish signal.