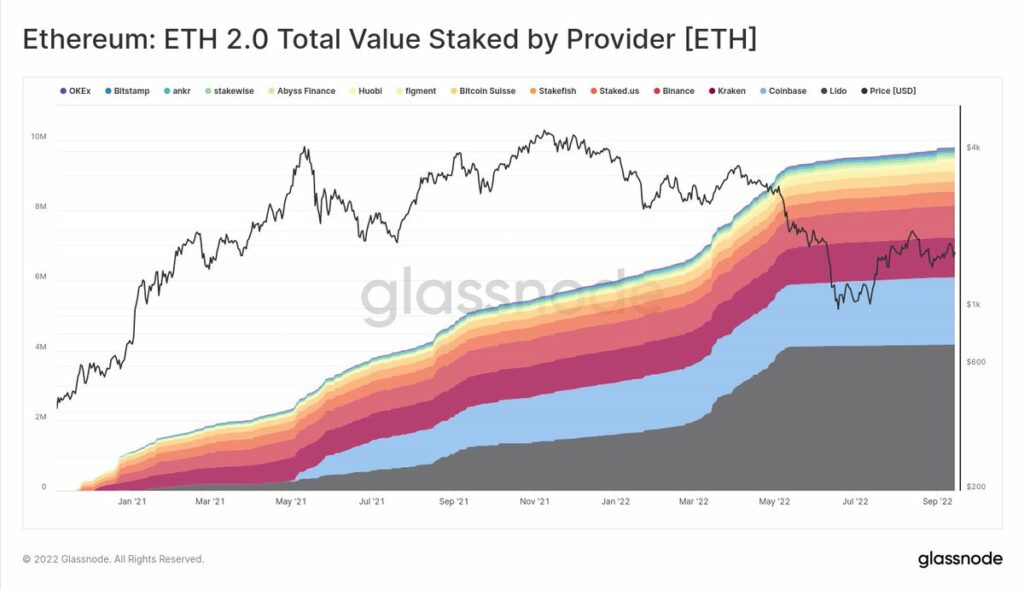

Prior to The Merge, Ethereum used to have dozens upon dozens of mining pools dedicating hashrate toward the blockchain network. That has all changed and most of the miners transitioned or plan on transitioning to other Ethash compatible coins like ethereum classic, ERGO, and the new fork ETHW. Now Ethereum blocks are verified by validators and at the time of writing, there are 429,278 validators. However, a great deal of the 13.7 million staked ethereum is held by four known providers.

4 Known Providers Hold 59% of Staking Ethereum Today

Bitcoin.com news reported four days ago about Ether holding a 30% stake in Lido. Twitter account on 15 September checkmateThe lead on-chain analyst at Glassnode wrote about the entities that currently hold the lion’s share of ETH staked today. “We profiled a few more entities,” Checkmate wrote For anyone discussing Lido’s holdings. Checkmate said that data shows 13.7 million ETH are at stake and 10 million Ether is with known providers. This equates to 73% of the ETH held, and the top four providers hold 8.13 million ETH, or 59.3% of the total.

“4.17M in Lido, 1.92M in Coinbase, 1.14M in Kraken, [and] 0.9M in Binance,” Checkmate said. The tweet shared by the onchain analyst at Glassnode was further discussed by the popular bitcoiner Tuur Demeester, the editor at satoshipapers.org. “44% of ETH is staked by just 2 entities, Lido [and] Coinbase. Add Kraken, and it jumps to 52% of total ETH staked by 3 entities,” Demeester wrote. The editor also mocked a tweet written by Vitalik Buterin which talks about the idea of having average users validate the system.

SEC Chairman Gensler Hints He Takes Another Look at Coins At Stake, Jack Dorsey Shares Anti-PoS Editorial, Ethereum Supporters Believe People Are Getting Beyond Themselves

In addition to bitcoiners like Demeester and Checkmate, the chairman of the US Securities and Exchange Commission, Gary Gensler, recently spoke about the Howe test and the coins to bet. The Wall Street Journal (WSJ) reported that Gensler said: “From a coin’s perspective … while the WSJ noted that Gensler commented that he was not referring to any cryptocurrency in particular, many crypto enthusiasts believed That the SEC chairman was discussing Ethereum (ETH) and PoS coins.

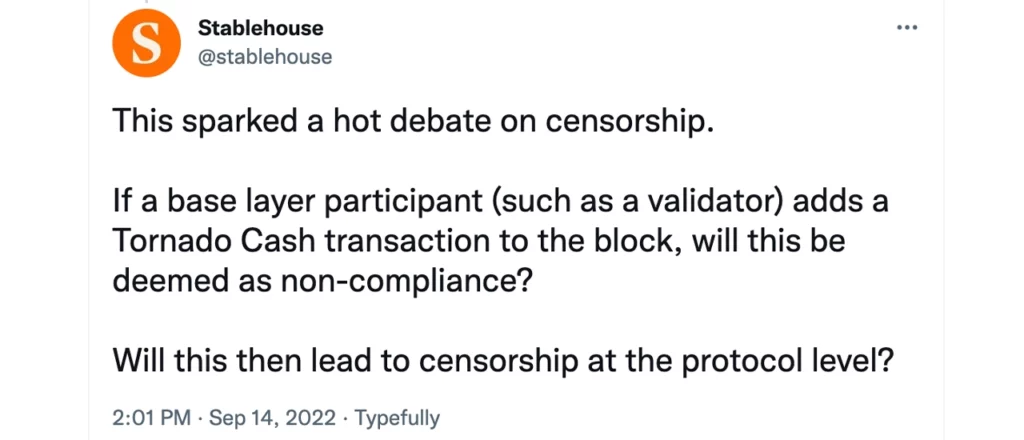

In mid-August, Coinbase co-founder and CEO Brian Armstrong was asked if the exchange would censor at the ethereum protocol level with validators. “If regulators ask you to censor at the ethereum protocol level with your validators will you: (A) Comply and censor at [the] protocol level (B) Shut down the staking service and preserve network integrity,” the user asked.

armstrong reacted Three days later and said: “It’s a hypothetical we won’t really face. But if we did we’d go with (B), I guess. The big picture has to be looked at. Some better option (C) or There may also be a legal challenge which can help in reaching a better outcome.

A number of people believe that it’s quite possible that known validators could be forced to comply with regulatory policy and censorship. With four centralized entities staking the most ethereum (ETH) today, people have concerns about whether or not validators will be centralized and censor transactions. On September 14, Twitter co-founder Jack Dorsey shared an editorial published on substack.com that criticizes PoS. The substack.com article is written by Scott Sullivan and it claims that “to be a validator is to live every day walking on [eggshells]” and “PoS is a permissioned system.”

Meanwhile, most of the criticism comes from bitcoiners, some of whom are labeled as bitcoin maximalists. Ethereum proponents think the idea is absurd, with one proponent saying he will simply jump to an ETH chain that does not censor transactions. “Guys,” tweeted Ryan Adams, “[the U.S. government] not trying to censor [ethereum] Verifier now. Let’s not get ahead of ourselves. But… if they ever do… I’ll be on a fork of Ethereum which doesn’t censor transactions. simple as that. Layer 0 is our security layer,” Adams said.

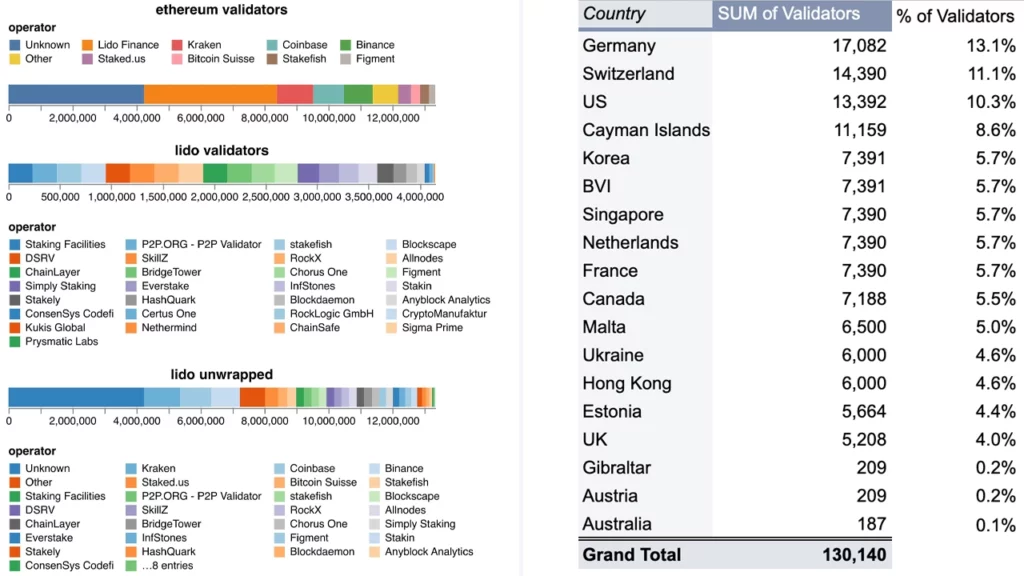

Bitcoin supporter and blogger, Eric Wall, published a Twitter thread on September 16 that details in the case of Lido staking, “Lido isn’t even a pool.” Wall further remarks in his thread that “Lido can’t decide what blocks anyone of their underlying node operators mine.” Wall does disclose that he’s an LDO investor, as lido dao (LDO) is the native governance token for the Lido Finance project.

“Lido also cannot fire or delist any of its node operators as it currently stands. More than 13.1% of Lido validators are not based in any one country. The geographic distribution here is actually quite impressive. ,” adds Wall’s Twitter thread.