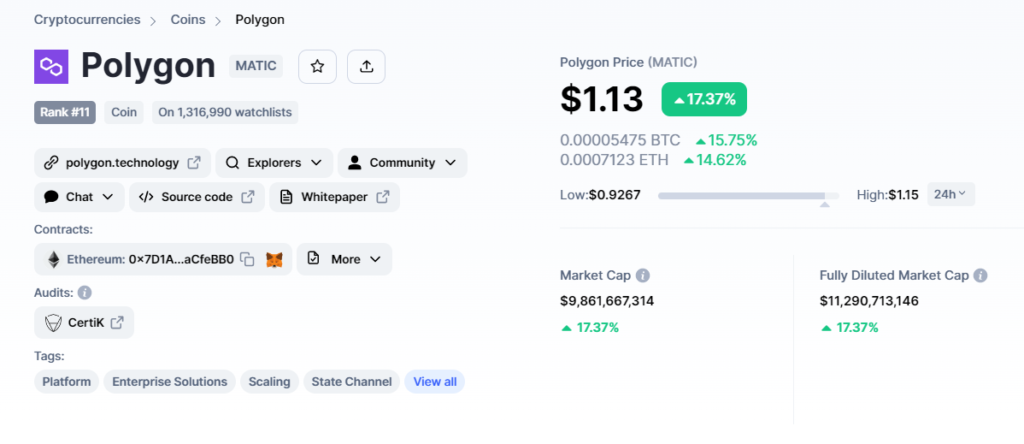

MATIC price has demonstrated rise of over 17% overnight, here’s why this may be happening

Popular analytics platform Sentient recently shared in a Twitter post that whales have become very active lately, shoveling over $100,000 worth of transactions into MATIC.

Besides, recently, Polygon blockchain was engaged by a major banking giant in the U.S. for its first DeFi transaction. The price of the coin has jumped by more than 17% in the past 24 hours.

Whale relocation peaks since February

Santiment reported that it has recorded a peak of $100,000+ worth of MATIC transactions since February. Furthermore, in mid-October, the balance of MATIC held by Whale in his wallet increased to over 10 million; This fact may have foreshadowed a peak in transactions, the company’s analytics team believes.

Overall, as for the 100 largest whales on Ethereum chain, they now hold $37,377,294 in Polygon’s native token, according to data shared by WhaleStats.

JP Morgan chooses Polygon for its first DeFi transfer

Two days ago, US banking giant JPMorgan Chase performed its first DeFi transfer using a modified version of the Av token, using an infrastructure based on the Polygon chain.

The transfer made by the bank was not about trading crypto; the bank was making its first attempt to explore decentralized finance. It tokenized $71,000 and traded it as an experiment for tokenized yen provided by Japan’s SBI Digital Asset Holdings. This pilot was also joined by DBS Bank Ltd., Standard Chartered Plc and HSBC Holdings Plc.

Instagram is also pushing into NFTs using polygons. Sandeep Nelwal, co-founder of the platform said, in a recent tweetThat he will not rest until MATIC becomes one of the top three cryptos sitting next to Bitcoin and Ethereum.

I will not rest till @0xPolygon gets its well deserved “Top 3” spot alongside BTC & ETH. No other project comes even close. In one day, @jpmorgan & @instagram launched with @0xPolygon