Sentiment shift is clear among cryptocurrency investors, and there’s real reason behind it

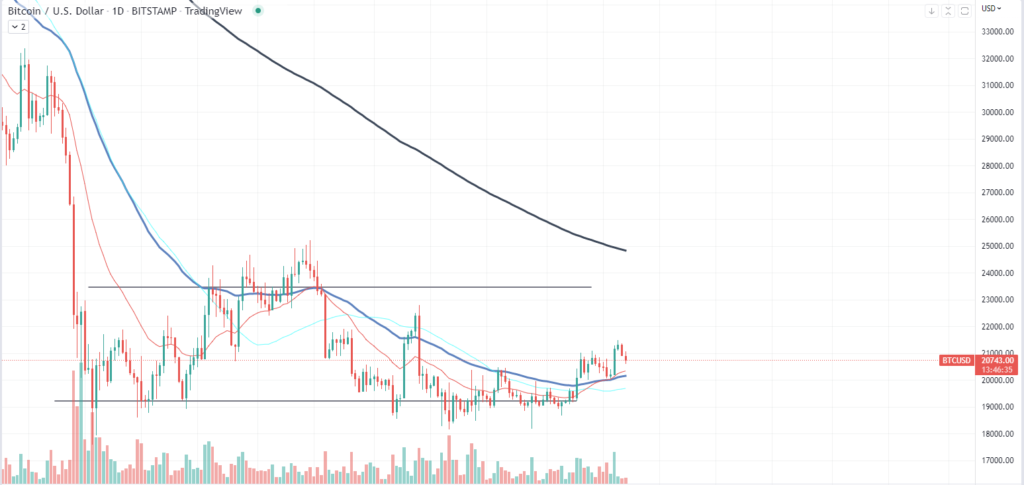

Bitcoin’s recovery in the cryptocurrency market has potentially led to an increase in positivity among investors as funding rates on various derivatives trading platforms hit several-month highs.

According to market data, investors are opening a high number of longs on the market, pushing funding rates on BTC higher, meaning that bulls have no other choice but to pay a high percentage to bears.

Despite the fact that the bulls tend to pay more interest in the opening long, the number of positions in the market is increasing, indicating that most investors believe in increased volatility on bitcoin.

Such a rapid sentiment change does look unusual, but at the same time, it could be justified. The main reason that might push the price of the first cryptocurrency higher than previously is a potential shift in the monetary policy of the United States.

The rate hike cycle that has been going on for more than six months has already pushed financial markets down enough to create a situation in which the Fed should start moving if the regulator is prepared to avoid further declines.

However, the desire of institutional investors contradict the current state of the economy since the risk of an inflation surge still exists. According to the most recent CPI report, the Fed could not take full control of inflation, which means that yet another 50 or a 75 bps hike is necessary.

With monetary policy tightening for the first time at the start of the year, the Fed conducted a massive outflow of funds from the cryptocurrency industry following a reduction in risk appetite.