Popular index draws grim picture that may be hinting at yet another BTC plunge

The leading social indicator developed by Alternative.me called the “Fear and Greed Index” is one of the best ways to determine the current social sentiment on the cryptocurrency market. Apart from evaluating the current state of the market, it can give us some hints on upcoming events.

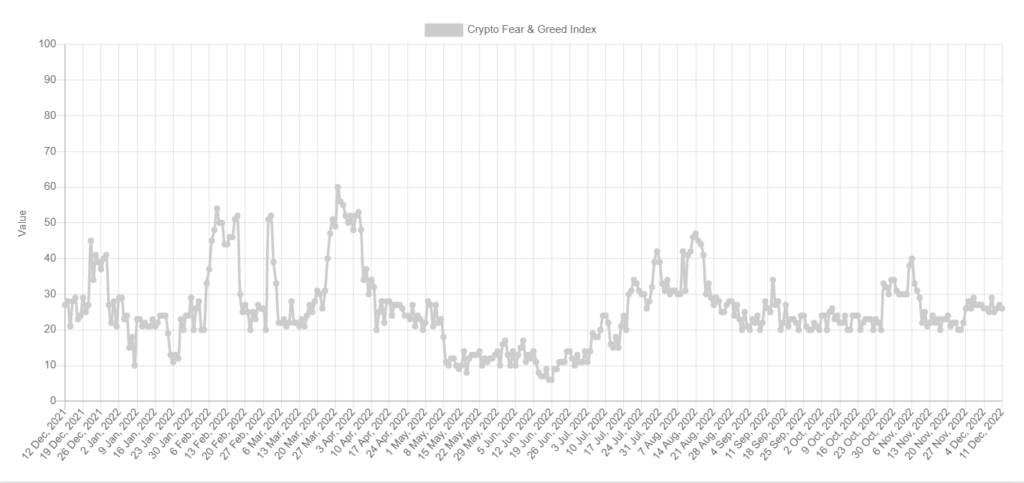

According to the official website, the Fear and Greed Index currently stays at the value of 26, which marks the market as fearful. In the end, the market persisted in “extreme fear,” a more aggravated version of the current level.

In “fear” mode, investors move their funds away from exchanges, abstain from trading large portions of their portfolios and prefer to keep their funds in investment instruments with stable assets that are as volatile as some cryptocurrencies. are not.

In the last two weeks, the market sentiment index has been relatively stable as the volatility of the cryptocurrency market stabilized after the FTX implosion. Despite the continuing migration of funds from cryptocurrency exchanges to private wallets, the panic on the market disappeared, with the majority of investors staying calm in comparison to the same period around a month ago.

Unfortunately, historical analysis of the charts shows that such periods do not last long. A significant drop in market volatility is a good position to calm investors who are panic selling most of their assets during the storm, creating a situation of “extreme fear”. But the low volatility is temporary, and, according to relevant indicators and factors, the market is likely to slide further down rather than bounce back with the next volatility spike.

At press time, Bitcoin is trading at $17,159 and showing the lowest intraday volatility we have seen in the last two months.