BaseFEX is a new cryptocurrency futures exchange that gives traders the opportunity to trade crypto with leverage. BaseFEX is based in Hong Kong and have been developing their trading platform for over 2 years. Offering leverage of up to 100x on a user friendly yet advanced product, they hope to be able to challenge the status quo. However, can you really trust such a new exchange?

In this BaseFEX review, we will give you everything we found out about this exchange. We will also give you some top tips that you need to consider when trading here.

Overview

BaseFEX officially opened their books in December of 2018. Although the team is based in Hong Kong, they are registered in the Republic of the Seychelles as Base Investing Corporation with a company number of 205276. The company is run by Jesse Wu (CEO) and Isaac Zeng (CTO). They claim that it is the mission of BaseFEX to be the “most reliable, transparent and advanced cryptocurrency derivative exchange, and make trading smooth, secure and accessible for traders worldwide.”

Given that they are developing a cryptocurrency derivatives exchange, they are looking to challenge the likes of BitMEX, Deribit and Prime XBT among others. They offer leverage on four different cryptocurrency pairs that goes all the way up to 100x. This is on some of the more exotic cryptocurrency pairs which we will cover in the asset support section.

BaseFEX is able to take clients from around the world and they have translated their site into 5 different languages. These include English, Japanese, Korean, Chinese and Russian. Despite their global presence though, there are some regions where they cannot accept traders. These include countries such as the United States of America, Québec (Canada), Cuba, Crimea and Sevastopol, Iran, Syria, North Korea and Sudan.

BaseFEX Leverage and Margins

BaseFEX allows their clients to trade crypto on Margin. This means that they can enter positions on trades that are many multiples bigger than they hold for said positions. The minimum margin that you can obtain here is 1%.

Trading on margin implies trading with borrowed money which implies leverage. This means that your gains / losses can be maximized by the leverage factor. At BaseFEX, this max leverage factor is 100x which is the same as their competitors.

The exact instruments that you are trading at BaseFEX are futures products. These are derivatives that are bets on the price of the asset at some predetermined price in the future (expiry price).

BaseFEX also has typical “perpetual” futures. These are instruments that do not have an expiry time and are rolled daily into a new contract. They remain open until they are closed by the trader. These will track the spot price of the asset most closely.

Margin Requirements

When you are trading a futures contract, you have two different types of margin requirements. These are the initial margin and the maintenance margin.

These start at 1% for the initial margin and 0.5% on the Base Maintenance Margin. These of course differ according to the contract in question as well as the size of the overall position. The below table has the exact requirements.

Is BaseFEX Safe?

This is perhaps one of the most important questions and is particularly relevant when using a new exchange.

There are a number of things that one should look for when determining whether they should trust a margin crypto exchange. These include the way they handle their market risk, coin risk and as well as the tools that they provide users to protect their accounts.

Coin Management

Given that BaseFEX is dealing with cryptocurrency, they are constantly facing the risk of hackers trying to exfiltrate these coins. Hence, they have implemented prudent coin management protocols.

In fact, BaseFEX is one of the few exchanges that we have seen that makes use of 100% cold storage for all of their coins. This means that the coins are kept securely in an offline state away from the threat of these hackers.

Usually, we see exchanges have a limited percentage of coins in “hot” storage for paying out clients.

When it comes to the wallets that they use to manage these coins, these are multisignature wallets with 5 of 7 configuration. This means that in order to send funds, 5 of the 7 directors at BaseFEX need to sign the transaction.

Risk Management

Given that this is a futures exchange with up to 100x leverage, there is a great deal of market risk that traders are exposed to especially when it comes to liquidity.

Like other futures exchanges, BaseFEX operates a liquidation engine. This will take out those positions that have exhausted their maintenance margin (mentioned above).

They also operate what is called an “insurance fund”. This is a pool to protect those traders who are exposed to late liquidation that is beyond the bankruptcy price of the trader’s position. This insurance fund is replenished by the liquidations that are executed above the bankruptcy price on losing positions.

User Security

Apart from security procedures in place on the exchange, BaseFEX has also provided users with some tools in order to protect their accounts individually.

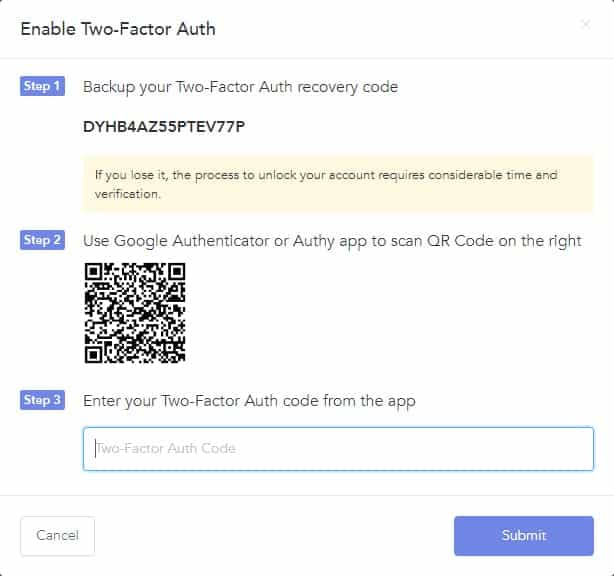

Firstly, they have standard two factor authentication security options. This means that before you can log into your account or authorize withdrawals, you will need to confirm it on your phone.

This is not enabled by default so you will perhaps want to do it the moment you have created your account. To do this, in your account management section you can head on over to the two-factor authentication section. Here you will generate the QR code that we have presented below.

BaseFEX Fees

The fees that you are charged at the broker are particularly relevant when dealing with large volumes on leveraged trades.

So, how does BaseFEX stack up?

Well, they operate a standard “Maker-Taker” fee model. This is where those who make markets (create liquidity) will be charged a lower fee than those who take liquidity from the order books. Below you can see the exact fees at BaseFEX:

| Contract | Maker Fee | Taker Fee | Long Funding | Short Funding |

| BTCUSD | 0% | 0.05% | 0.0000% | 0.0000% |

| BNBXBT | 0% | 0.05% | 0.2063% | -0.2063% |

| HTXBT | 0% | 0.05% | 0.0100% | -0.0100% |

| OKBXBT | 0% | 0.05% | 0.0100% | -0.0100% |

As you can see, they will not charge you any fees when you are making liquidity on their books. However, for the takers, they will charge you 0.05% for the trades. This is about standard at other exchanges.

You will also see that they charge a “funding fee”. This is a financing fee that is applied because you are trading on the margin with borrowed money. This is charged every 8 hours which is the funding interval.

Asset Coverage

In terms of asset coverage, BaseFEX currently offers 4 different types of contracts. These are all perpetual futures contracts but they are on some pretty interesting assets. Below are these assets:

- BTCUSD: The Bitcoin price in USD

- BNBXBT: Binance Coin Price in BTC

- HTXBT: Huobi Token Price in BTC

- OKXBT: Okex token in BTC

As you can see, they have the standard contract on Bitcoin but they also have the proprietary tokens from the other exchanges including Huobi, Binance and Okex.

These are all settled in Bitcoin and there are reasonable levels of volume for them on their books. There are some specific limits and contract specifics that you can read more about in their docs.

Unfortunately, they do not offer any other crypto derivative assets.

They have Ethereum on their homepage but they do not appear to offer a market in these yet. They also claim to offer standard futures but all of the contracts above are perpetual. Perhaps these are still to be added as the exchange is still brand new?

BaseFEX Testnet

Something that we found was quite a nice touch was the fact that BaseFEX offers a testnet platform at testnet.basefex.com. You can think of this as a demo account that are offered at other brokers.

This is great as it allows you to trade on the BaseFEX platform in a non-threatening way without risking any real funds. They will give you demo funds of 10BTC that you can practice your trading with.

Although the testnet is run through a separate sub-domain, it still has all the same features and functions as the live account platform. Hence, you are getting the exact feel of how it would look when you are trading with the live account.

Funding / Withdrawal

Assuming that you were happy with the platform from the demo run, you will need to fund an account to start trading. As we have mentioned, this is a Bitcoin only exchange which means that they do not take fiat currency.

This means that if you want to fund your account you will need to use a fiat gateway crypto exchange in order to get your Bitcoin. These include the likes of Kraken or Bitstamp.

Once you have got your Bitcoin then you will need to head over to your wallet section on the exchange and hit “deposit”. This will bring op your unique wallet at BaseFEX in both QR code and string form.

Withdrawing is just as simple. You will head on over to the withdraw section where you can insert the address of your offline wallet. They will present you with the fee that will be applied to the withdrawal which is the network fee.

Once you have submitted your withdrawal request, you will have to first approve it in a confirmation email that will be sent to you.

Given that they store 100% of their coins in cold storage, your withdrawal request will have to be completed manually. Therefore, you should factor in some time for them to complete this.

BaseFEX API

For those developers among you, you will be happy to know that BaseFEX offers full API functionality. This will allow you to develop scripts and bots that will trade crypto algorithmically.

They offer a full REST API as well as a WebSocket streaming connection. You can view all the developer docs to these on the official BaseFEX GitHub.

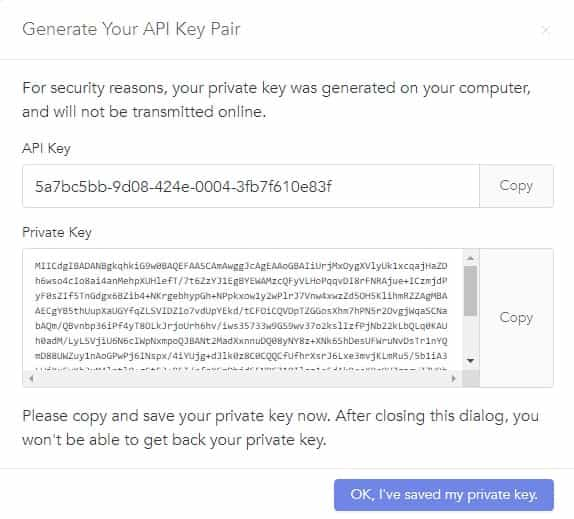

In order for you to start using the API, you will have to get your API key. This can be accessed within your account management section. You will head on over to the “API Keys” tab. You will be presented with the below:

Generating the API Key and Secret Phrase

Here you can choose the name of the API key as well as whether you would like to bind this key to only one IP address. This will prevent hackers or other users from trading on your account should they have access to your key.

Once you have approved the creation, you will be presented with your API key as well as your private key. Both of these will be required to create an authorization token for API access.

Bottom Line

In the end, our BaseFEX review found them to be quite an attractive exchange that would be able to challenge the status quo in the crypto derivatives markets. They have reasonable fees and a user-friendly platform. They have also augmented this with a prudent coin management protocol as well as strong trading risk management systems that avoid socialized losses.

Of course, there are areas for improvement but the exchange is still new and it is likely that they can easily implement these changes.