Many brokers try to claim that their platforms are designed to be easy to use. Easymarkets even has it in their name. This large and regulated broker has been around since 2001 and has expanded greatly over the past 19-odd years. They have not only grown in numbers but also expanded their product offering greatly. However, given all the competition, is it still really worth it?

In this EasyMarkets review, we will give you what you need to know about the broker. I will also give you some top trading tips you need to consider.

Easy Markets Overview

As mentioned, easyMarkets was established in 2001. They have offices in Cyprus (Easy Forex Trading Ltd), Sydney (Easy Markets Pty Ltd) and the Marshall Islands (EF Worldwide Limited). The latter services international clients.

It is regulated by two agencies (CySec and ASIC) and is a CFD, FX and option broker. Traders at easyMarkets can trade hundreds of assets on three different platforms with leverage up to 400:1.

Since launching in 2001, the broker has racked up some pretty impressive stats. For example, they have completed over $2.92 trillion in USD volume, have executed over 56.3 million order and have served over 145,000 traders.

Given how long this broker has been operating, they have been through some pretty tough market conditions such as the Swiss Franc in 2015 and the Brexit referendum. The former even sank other brokers such as Alpari.

They have translated their website into 6 different languages in order to target the numerous different regions for potential traders. Although they do have large client coverage, there are a number of regions where they cannot accept clients from. You can see the full list on their site but perhaps the most prominent is the United States.

Is EasyMarkets Safe?

This is perhaps one of the most important questions that anyone can ask about a broker. There are a number of things that we look for in order to determine this. Saftey of funds and risk management procedures are essential.

Much of this is covered by a solid regulation of the broker. So, let’s take a look into that shall we?

Regulation

Thankfully easyMarkets holds two regulatory licences. One of these is a CySec licence (Number 079/07) and the other is an ASIC licence (license No. 246566). There are a number of benefits that come with this not least of which is that they can operate in these regions.

Having a licence is also a great signalling metric as it shows that the broker has had to pass some pretty strict minimum requirements. These include some of the following:

- Minimum Capital Requirement: In order to have an ASIC licence you need to hold at least A$1m and in order to get the CySec type you needed a minimum of a €750k in order to open a brokerage there.

- Segregated Accounts: The brokers are required to keep their client funds in a segregated bank account. This ensures that if there is anything that were to happen to the broker, it’s business funds are separate from the client accounts.

- Segregated Accounts: Before a broker is granted any sort of licence they will first have to complete rigorous background checks. Both at the company level and at the director level.

- Renewal Requirements: Its not just about getting the licence and operating into perpetuity. These have to renewed every year and the same checks are done on the broker’s operation.

Apart from knowing that the broker has had to pass these requirements, you also have the comfort of someone to turn to should you have complaints. Both ASIC and CySEC have dispute processes that you can make use of.

Banking & Capital Adequacy

When it comes to those segregated client funds, you want to be sure that they are kept in the hands of some pretty strong banks. Easymarkets makes use of top tier banks that have high credit scores and easy access to their accounts.

Communication Security

Easy Markets has full 256 bit SSL encryption which means that your connection with them is completely secure. This includes sensitive information such as passwords, credit card info as well as personal identification documents.

This is also a great defense against Man-in-the-Middle and other phishing attacks. And while we are on this point, you also need to make sure that whenever you are accessing the easyMarkets website that you see the SSL lock.

Risk Management Tools

There are several important risk management tools that easyMarkets provides for their clients. For example, they have their Guaranteed stop losses and their negative balance protection.

We will cover these in more detail in the leverage section but the main idea behind these are:

- Negative Balance: This means that the broker has processes in place to prevent client accounts going into negative equity.

- Stop Loss: Which is a free and standard feature on easyMarkets Proprietary Platform & App

- Guaranteed Stop Loss: If the market moves below your stop – it will be executed 100%

Apart from these client side protection tools, easyMarkets regularly conducts thorough audits on their own risk management procedures.

EasyMarkets Fees

Another really important consideration for any trader has to be the fees and spreads. These are, after all, the factors which can directly impact on your trading returns over the long term. Easy Markets has fixed spreads.

When it comes to easyMarket’s spreads, they differ quite a bit and will depend on a few factors. This includes things such as your account, the platform used and the asset / instrument traded.

However, to give you a relatively good idea of some of the spreads, here is a select group of FX, Metals, Commodities and indices.

Most of these spreads seems to be quite tight when compared to the competition. However, it is important to note that these spreads are for the VIP account and you may have wider for the standard etc. We will cover the account types in due course.

As mentioned, easyMarkets also has options on forex. I won’t go into all of them here but to give you an indication, here are some of them:

- EUR / USD: 0.0005

- GBP / USD: 0.0006

- USD / CAD: 0.0006

- AUD / NZD: 0.001

There are also cryptocurrency assets at easyMarkets. Here are the spreads on the three cryptos that you can trade on the Web App / MT4 respectively:

Now, we did notice that these crypto spreads were a bit higher than on crypto derivative exchanges such as ByBit and PrimeXBT. However, the instruments on these crypto exchange are futures instruments that charge a commission (where easyMarkets charges none).

Trading Instruments & Assets

As you may have already noticed above, there is quite a large array of assets and instruments that you can trade at easyMarkets (over 200 of them). When it comes to the asset coverage, here is a quick run-down:

- Most Forex pairs including Majors & Minors

- Metals like Gold, Silver, Copper & Palladium

- Commodities such as Oil, Gas, Soy etc.

- Indices from most of the global stock markets

- Three cryptocurrencies – Bitcoin, XRP, Ethereum

- Shares on over 20 large cap stocks

This is indeed quite a comprehensive selection which covers most of the assets that you would like to trade. The only thing that appears to be quite limited is the crypto coverage. If you wanted to trade a larger array of physical crytpocurrency you could use the likes of Binance.

Account Types

EasyMarkets has also got quite a few options when it comes to the types of accounts that traders can use. This is unlike many other brokers these days that offer a standard account irrespective of amount traded.

The minimum that you can deposit for any of the accounts is $100. This is for the standard or “entry level” account. Then you also have a premium account that requires a deposit of $2,000 and a VIP account which requires $10,000.

One of the most noticeable differences between these accounts is the spreads that you will get when trading. When you are on the VIP tier then you will also get some other perks that reflect your client value.

Apart from the above, the accounts don’t seem to differ that much at all. All have no account fees, no commissions as well as free deposits and withdrawals. This is unlike other brokers with regular ongoing maintenance fees. For example, Plus500 has a “no activity” fee that they sneakily activate on some user accounts.

All these accounts also have a live telephone support option as well as an account manager. We cover the customer support more in-depth below.

You may also be wondering what perks came with the VIP package? So, let’s take a look at that shall we?

VIP Account

The first thing to note about the VIP status is that it can attained with a relatively low initial deposit. Compared to many other brokers which require $20,000 plus, easyMarkets has a pretty strong selling point at $2,500.

When you have this account level, you will get your own personal account manager. You can reach out to them at anytime on account related queries. This is really quite refreshing as it gives you that delicate “human touch”.

Also, when you have the VIP account you have the lowest spreads on offer at easyMarkets. These start at only 1 pip on some of the forex majors. You will also have access to real time market updates sent through SMS.

Leverage

At easyMarkets, you only need to place a certain initial margin that is only a fraction of the trade size that you will be taking on. This means that you will be trading with leverage and can magnify your gains / losses.

At easyMarkets, the leverage you will get will depend on the asset, platform and region. For example, the maximum leverage that you can get on the web platform is 200:1 whereas if you trade on the MT4 you can get up to 400:1 (on major forex pairs).

It is also important to note that the new ESMA regulations in Europe limit the maximum leverage that retail traders can get at 30:1. Therefore, if you reside in Europe and are trading through Easy Forex Trading Ltd then you can only trade with 30:1 leverage.

Easy Markets does not have a leverage table but if you want to know exactly how much leverage a particular asset provides, you can calculate it on the trading platform. For example, with a Bitcoin trade, we noticed that the for 1 Bitcoin exposure at a price of $8,300 we would need to put down $166.

You can run the same calculations on the other assets that are available to trade on the web platform. Of course, those assets that are more volatile will have a lower leverage limit.

Of course, leverage is a double-edged sword and you want to make sure that you have implemented the correct risk management procedures to limit potential downside potential.

Mobile Apps

For those traders who are on the go, you will be happy to know that easyMarkets has got a pretty functional mobile app. This is available on iOS and Android devices and has a lot of the same functionality as their main web platform.

For example, you can do one touch easyTrades on the mobile app as well as Freezing the rate and Deal Cancellation. You also have some charting functionality although this is not nearly as effective as the web-based tradingview charts.

The App is available in both the iTunes store and the Google Play store. If we were to take a look into the ratings, they are both highly positive with 4.7 stars in the former and 4 stars in the latter.

Apart from the fact that the Apps are well rated by the community, the easyMarkets team seems to be quick to respond to those who have concerns. This is always a good sign as it shows that they are receptive to feedback from traders.

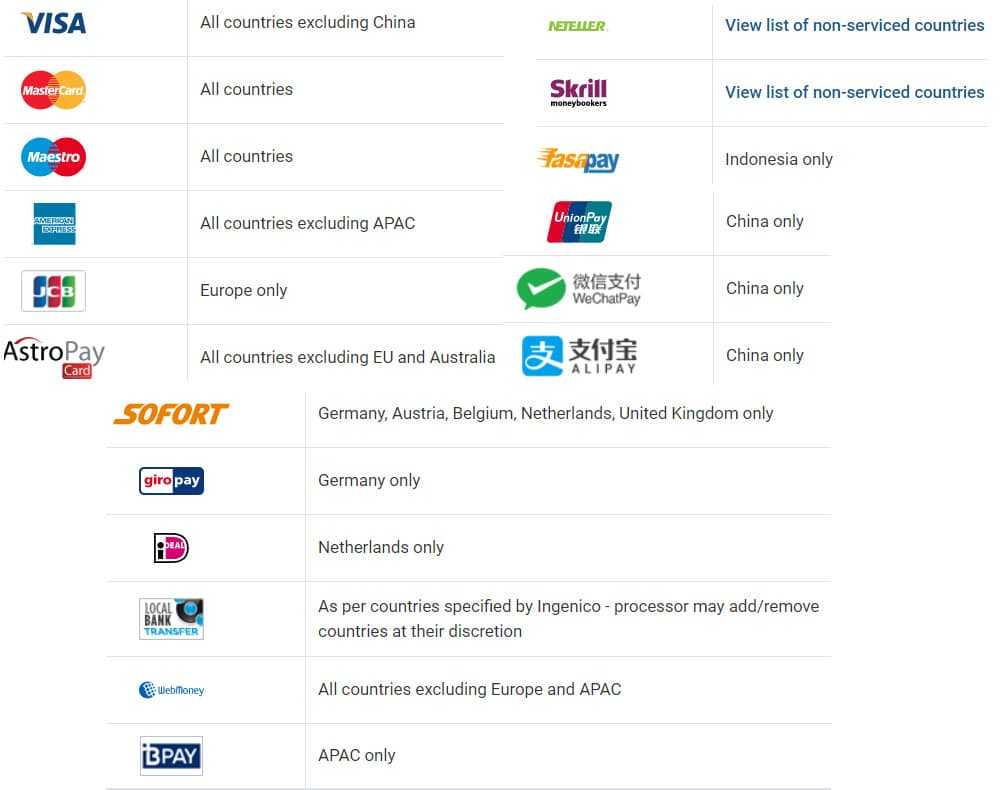

Deposits & Withdrawals

There is a wide array of payment methods that are supported for both deposits and withdrawals. There are well known global options such as cards and bank wire as well as more local solutions for specific countries.

Perhaps the quickest and most effective way to fund your account is through a credit card or an eWallet solution such as Neteller or Skrill. The full range of funding options are presented below:

Bottom Line

Overall, we were greatly impressed by easyMarkets. It seems that they have spent their 19 years in operation honing a comprehensive yet simplistic trading experience for traders of all stripes.

Not only does it have time on its side but it is also well regulated by two well known agencies and have strong risk management processes in place (both trader side and internally). There are also a plethora of assets that you can trade on their platform with low spreads.

Not only can you trade standard FX instruments but you can also trade Forwards and options. These are traded on some pretty advanced trading platforms with unique trading tools and conditions.

Finally, that customer support was quite comprehensive and attentive. All of our questions were answered promptly and it really smoothed our review process.