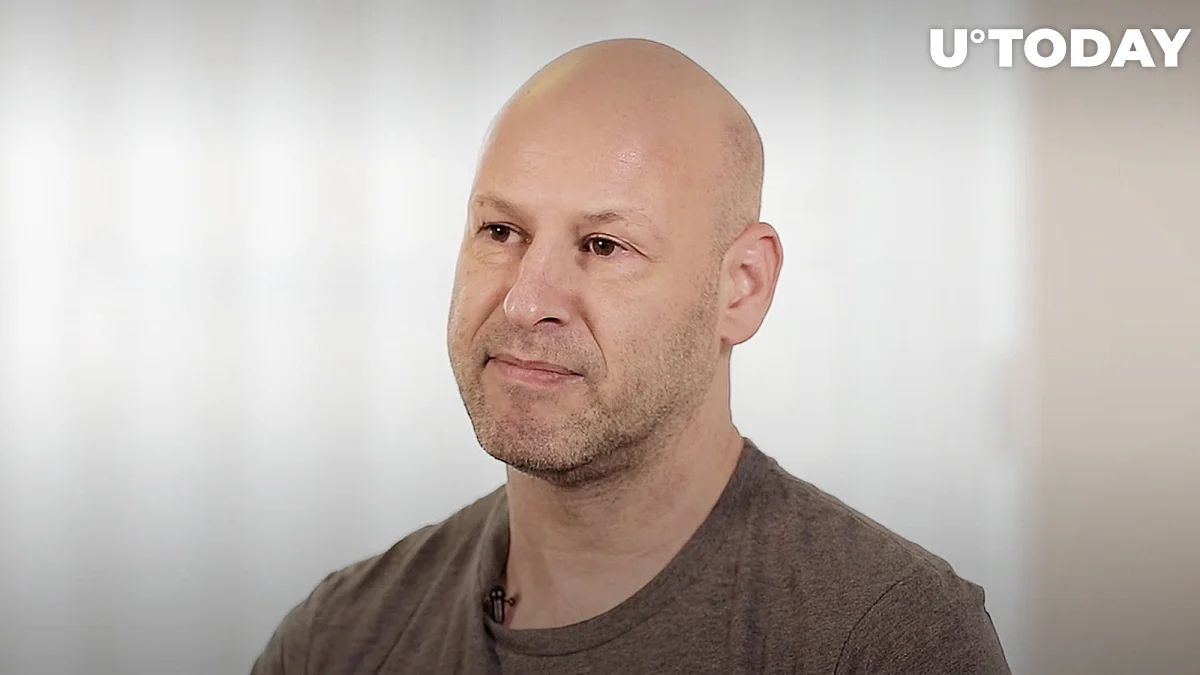

Consensys creator Joseph Lubin asserted in a recent interview with CNBC that Ethereum (ETH), the cryptocurrency that runs the Ethereum network, should be categorised as a commodity.

In order to corroborate his claims, Lubin used prior remarks made by regulatory agencies such as the Commodity Futures Trading Commission (CFTC) and the U.S. Securities and Exchange Commission (SEC). Despite this, Gary Gensler, the head of the SEC, has not yet declared Ether to be a commodity, despite having done so for Bitcoin.

In the interview, Lubin referred to Bill Hinman’s 2018 lecture, which he said essentially proclaimed Ether to not be a security.

The co-founder of Ethereum emphasised that 18 of Hinman’s coworkers contributed to the speech, demonstrating agreement inside the SEC at the time. He did not consider it to be a major problem, although he acknowledged that some authorities would still be reluctant to accept that Ether is not a security.

Lubin also discussed the development of the bitcoin market during the last 12 months. He emphasised the importance of the endeavour to “clean up the CeFi rot” and cited successful advancements and launches in 2022 as evidence. For not adhering to the decentralised concept of cryptocurrencies, CeFi, or centralised finance, has received a lot of flak in the past.

Despite how strong Lubin’s claims are, they have no bearing on the official classifications of ether. Ether has yet to get official certification from Gensler and the SEC defining it as a commodity.