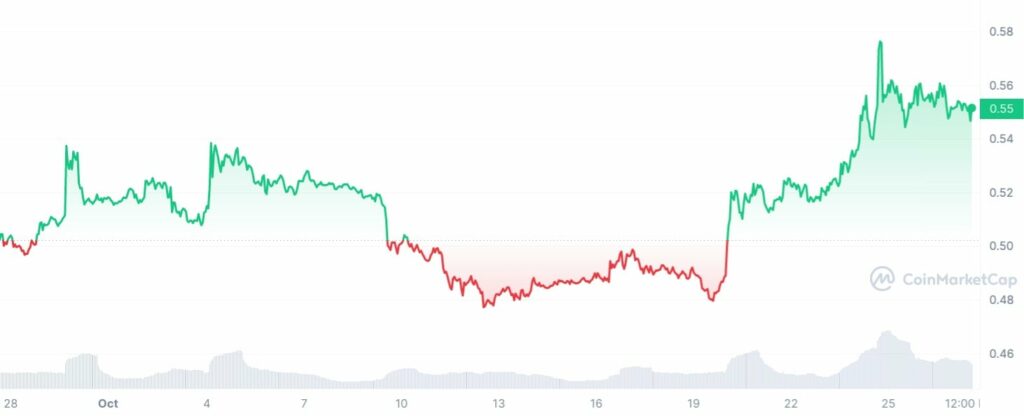

The cryptocurrency community is buzzing with excitement as October comes to an end, wondering what November could hold. All eyes are on XRP, one of the most well-liked digital assets on the market, which had an incredible October performance.

With an incredible rise of 6.97%, XRP has bucked the norm for October falls, which typically average -4.36% and have a median of -0.62%. It’s interesting to note that since XRP’s founding in 2013, October of this year was the third most lucrative month.

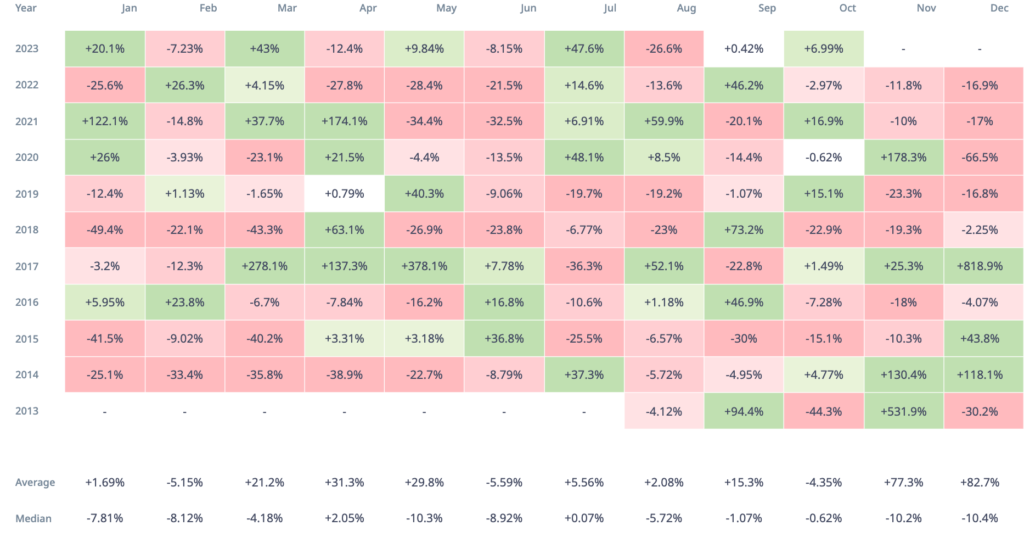

Data from the CryptoRank portal indicates that XRP has had an upward trend in recent years, which bodes well for November. In November, XRP’s average return on investments over the last ten years is a remarkable 77.3%.

Unpredictable month

It is crucial to remember that the more trustworthy median statistic indicates a less optimistic number of -10.2%. The notable differences in returns between the average and median may be mostly ascribed to a few exceptional price surges for XRP in 2013, 2014, and 2020.

Even while things are looking well generally, XRP’s November performance has been inconsistent. Only in 2013, 2014, 2017 and 2020 did XRP end the month in the black during the previous ten years, giving it a score of 4-6 in favour of Novembers that resulted in losses.

It is crucial to remember that the more trustworthy median statistic indicates a less optimistic number of -10.2%. The notable differences in returns between the average and median may be mostly ascribed to a few exceptional price surges for XRP in 2013, 2014, and 2020.

Even while things are looking well generally, XRP’s November performance has been inconsistent. Only in 2013, 2014, 2017 and 2020 did XRP end the month in the black during the previous ten years, giving it a score of 4-6 in favour of Novembers that resulted in losses.