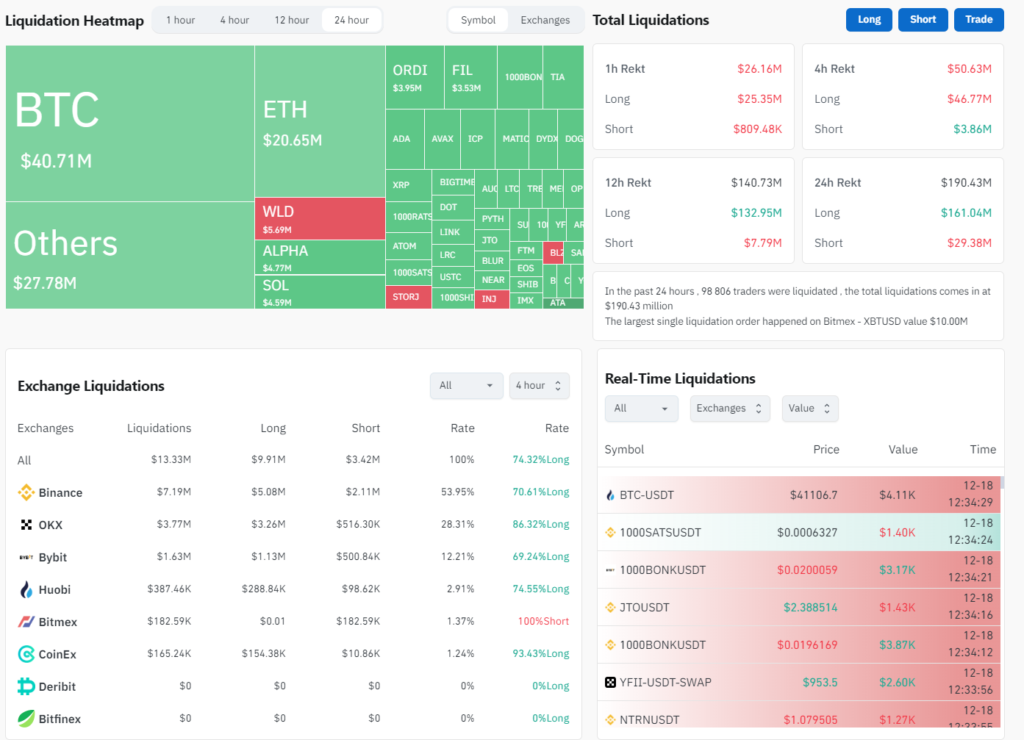

The recent surge in volatility in the cryptocurrency markets caused a large wipeout of long holdings worth $130 million. When traders who have placed bets on rising prices see their positions covered by an automatic sell-off, this is known as a liquidation. The impact’s magnitude is seen by the liquidation heatmap, with Bitcoin and Ethereum suffering the worst losses.

The price of Bitcoin has seen a significant correction, according to the chart. As usual, changes in the price of Bitcoin set the tone for the whole market, and this time was no different. The cascade of liquidations, in which several leveraged long positions were quickly erased, has been intimately linked to the price decline. This implies that traders were taken aback by the abrupt shift in the market’s direction because they were maybe unduly confident about the continuation of the positive momentum.

But the story of liquidated holdings is not entirely accurate; the market’s response provides further context. The reality has been more muted, despite the word “bloodbath” conjuring pictures of sharp declines and market panic. The BTC chart shows that there isn’t much high volatility and that there are no indications of a sharp decline in the market. Rather, what we are seeing may be characterised as a constructive corrective.

As a normal component of market cycles, corrections aid in keeping the market from getting overly overbought. There was no very high RSI reading before to the liquidation event, indicating that the market was not overextended. This implies that the market was in a stage of rebalancing rather than in a bubble about to pop.

One way to think of the $130 million long position liquidation as a market release valve is as a decrease in speculative bets and an increase in stability. The market could discover a new base after the dust settles, on which to construct the subsequent leg of the voyage.