CoinShares’ most recent data reveals a startling 338% spike in weekly fund inflows for XRP-focused investment products during what has been an intense week for the cryptocurrency market.

According to the data, inflows have increased dramatically—in just one week, they went from $800,000 to an astounding $2.7 million.

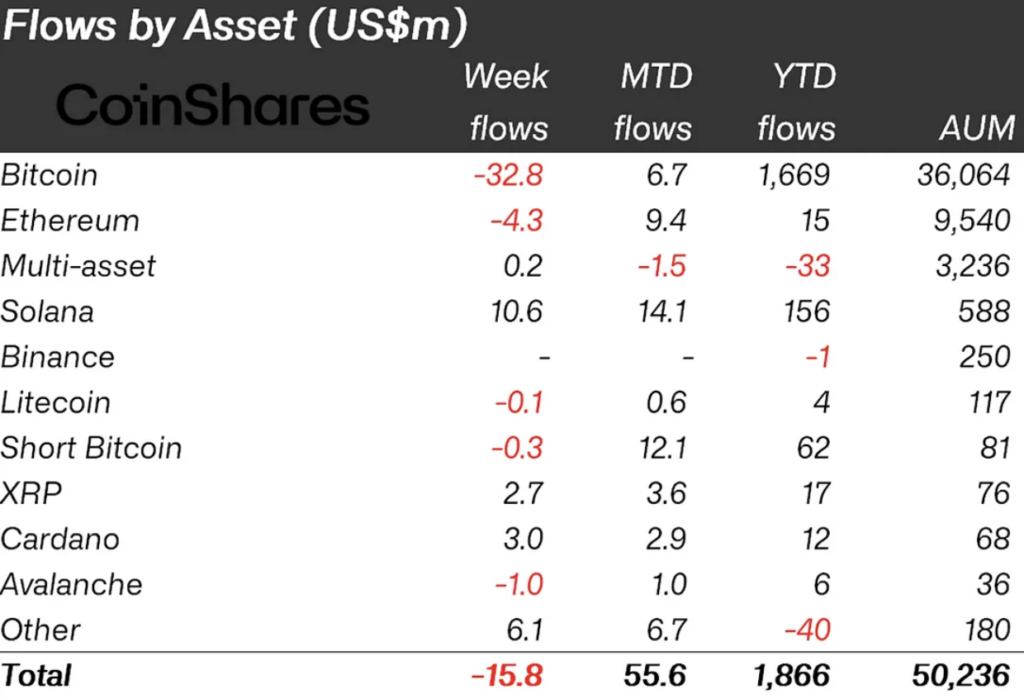

The net flows in XRP ETPs have increased to $3.6 million since the beginning of December thanks to this rise, surpassing even Ethereum (ETH) by $2 million. Nevertheless, Solana (SOL), the cryptocurrency that leads in this number with $156 million, still surpasses XRP in value.

Rotation

With its remarkable 338% rise, last week’s performance was historic for XRP. The world of digital asset investment products, however, presents a different picture. An 11-week run of inflows was ended by slight withdrawals totaling $16 million.

The largest victim of this trend was Bitcoin, which had withdrawals of $32.8 million. Short Bitcoin ETPs also saw some outflows, totaling $300,000.

Reiterating a pattern seen in recent weeks, altcoins—led by XRP, Solana (SOL), and Cardano (ADA)—rose to prominence as the foundation of the cryptocurrency market in an unexpected turn of events. According to the statistics, investors may not be completely giving up on these assets but rather making a deliberate switch in their money from Bitcoin to altcoins.

It’s amusing, though, because ETH—the leading altcoin—saw withdrawals of $4.3 million over the previous week, indicating that it did not escape the dynamics of the market untouched.

This change in investing behaviour begs the concerns of how cryptocurrency investors’ tastes are changing and how it could affect the larger market.