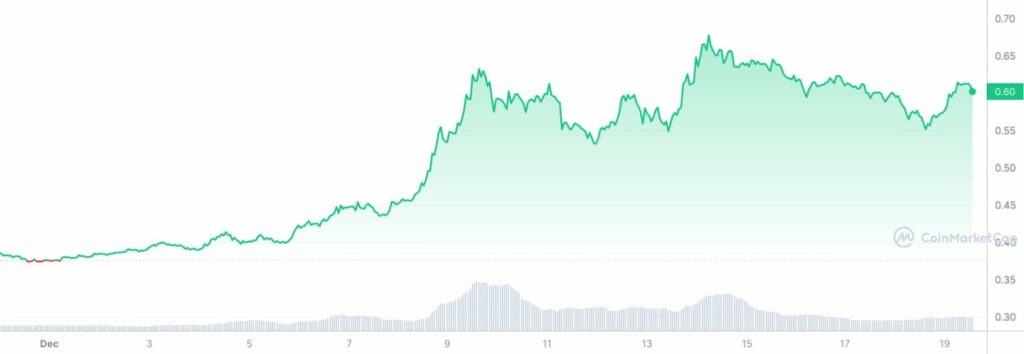

In a positive development, Cardano’s ADA has sparked a bullish trend at the start of this week, overcoming the short reprieve from last week with a strong 50.62% increase. Fans of ADA have cause for celebration once more as the token, presently worth $0.6, shows off a 3.8% rise.

The durability of Cardano’s comeback is being questioned by critics who have attacked the company throughout the last two years, despite the recent positive momentum. But analysing on-chain data shows a fascinating story that may take ADA to new heights.

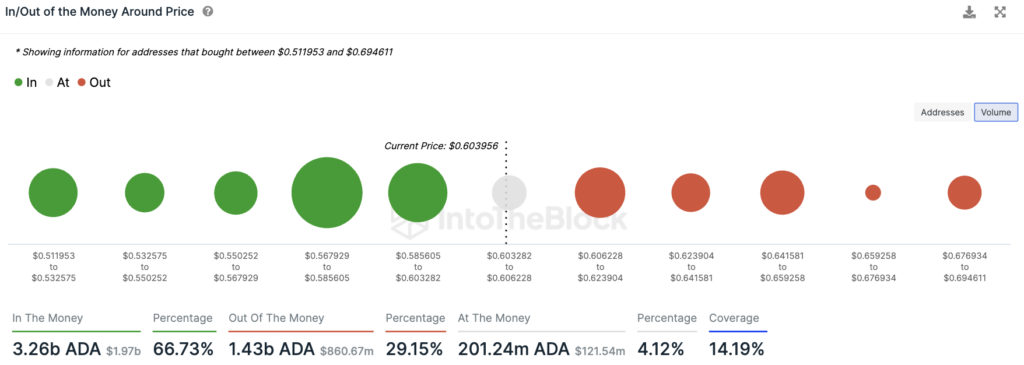

Data from IntoTheBlock, which is a critical tool for analysing liquidity accumulations and price movements, highlights that the primary liquidity accumulations for ADA are still situated below the current market levels.

If Cardano wanted to surpass its short-term goal of $0.7 per ADA, it would just have to take in 1.42 billion ADA, or tokens that were bought between $0.6 and $0.7 and are now losing value for holders.

Understanding the mechanics of token growth and the possible effects of loss-making tokens at particular price points are crucial. With $855 million worth of ADA on the road to $0.7—a massive 4% of the token’s market capitalization—Cardano is at a crossroads.

However, because this amount is spread out between $0.6 and $0.7, there is less chance of concentration at one crucial moment.

A tempting 15% rise beyond present values becomes conceivable if Cardano is able to effectively absorb this volume in an environment where the market is supportive of growth. On the negative side, though, there’s a warning sign: profit-driven investors may choose to take advantage of gains, which would put pressure on the ADA price to decline.