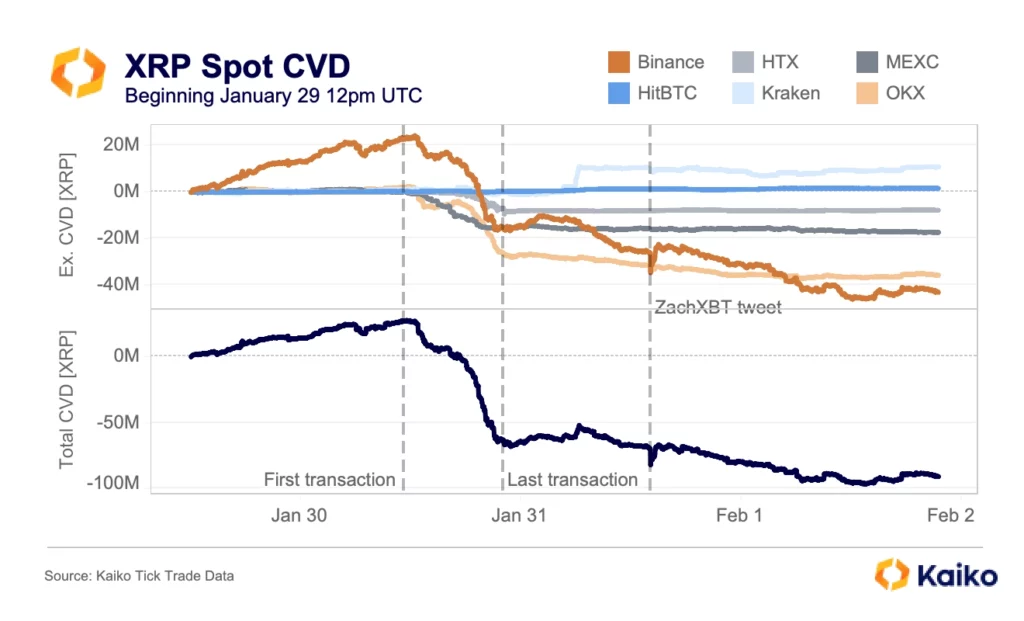

A security breech that affected Ripple’s founders resulted in the unlawful selling of more than 200 million XRP. Between 11:00 a.m. and 10:00 p.m. UTC, there was a net sell-off of around 100 million XRP as a result of the transactions, which mostly happened on the exchanges OKX and Binance. The result of these large-scale disposals was a notable net outflow in the XRP Spot Cumulative Volume Delta, which measures the net pressure to purchase and sell.

The amount of XRP lost to this illegal sell-off is significant. Judging from the average market price of XRP at the time of the transactions and the CVD’s net sell-off statistic, it is anticipated that the hacker was able to liquidate tens of millions of dollars’ worth of XRP before the accounts were rendered inoperable.

A sizeable amount had already been embezzled before the hacker’s accounts were frozen as a reactive action to stop more unauthorised liquidations.

The XRP market is clouded by this occurrence, which also raises questions about security and the quick response needed to stop these kinds of abuses. The market’s response, meanwhile, has been very muted, suggesting that the environment is growing and becoming more resilient to these kinds of storms.

Regarding XRP’s price analysis, these developments have put negative pressure on the asset. With a negative bias, XRP has been trading recently, circling the $0.5 support level.

If this support is broken, there may be further losses ahead; the next important support level is at $0.5. Resistance is beginning to emerge on the upside around $0.5692, which XRP would need to cross in order to indicate a possible rebound.