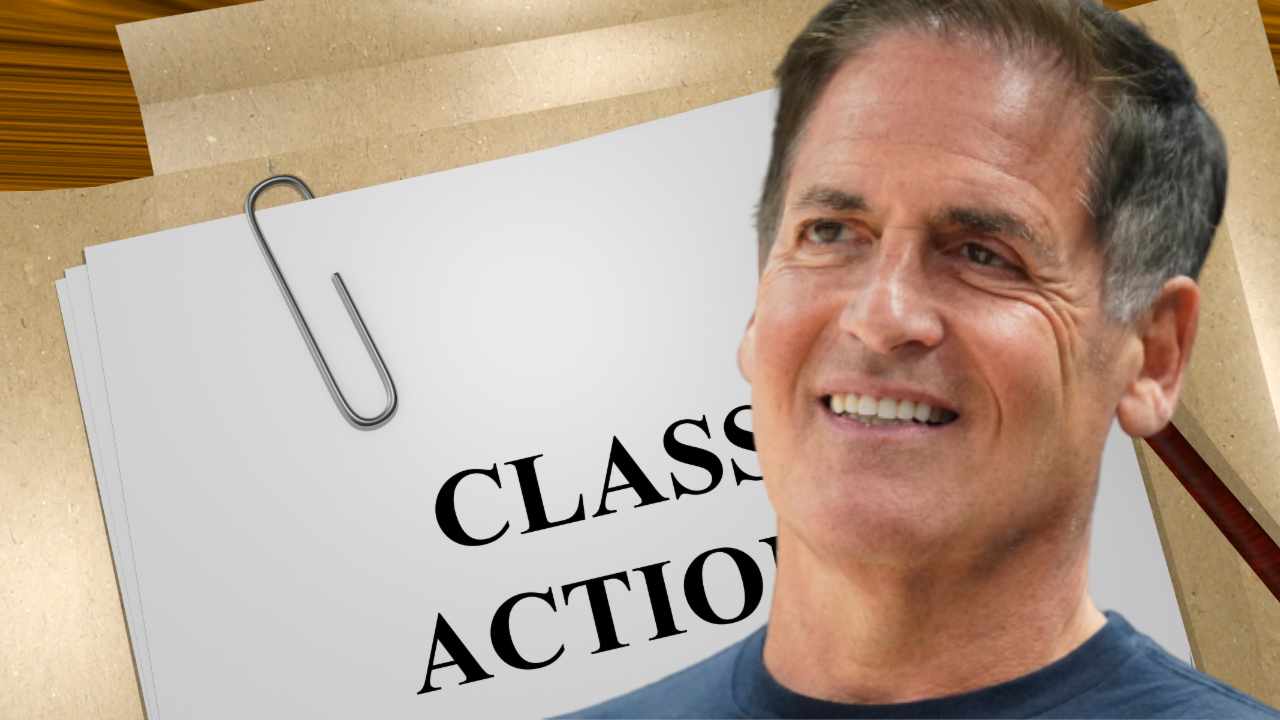

Shark Tank star and the owner of the NBA team Dallas Mavericks, Mark Cuban, is facing a class action lawsuit for promoting Voyager Digital’s crypto products. The plaintiffs claim that Voyager was “a massive Ponzi scheme” and Cuban “duped millions of Americans into investing.”

Mark Cuban sued by Voyager Investors

A class action lawsuit has been filed in the US District Court for the Southern District of Florida against Shark Tank star Mark Cuban, Dallas Basketball Ltd (DBA Dallas Mavericks) and Voyager Digital CEO Steven Ehrlich.

There are 12 lead plaintiffs. Referencing the case of “Mark Cassidy v. Voyager Digital Ltd., et al.,” filed in December last year, they alleged that Cuban and Ehrlich “went to great lengths to use their experience as investors to dupe millions of Americans into investing — in many cases, their life savings — into the Deceptive Voyager Platform and purchasing Voyager Earn Program Accounts (‘EPAs’), which are unregistered securities,” the lawsuit describes, adding:

As a result, more than 3.5 million Americans have now lost over $5 billion in crypto assets. This action attempts to hold Ehrlich, Cuban, and his Dallas Mavericks accountable for paying them back.

The lawsuit notes that Cuban spoke at a Dallas Mavericks press conference, “where he strongly supported and touted the partnership between his company and the Voyager defendants.” The plaintiffs stressed that the Shark Tank star “proudly described how he would personally help significantly increase scope and presence of the Deceptive Voyager Platform for those with limited funds and experience.”

He emphasized:

Ehrlich and Cuban’s misrepresentations and omissions, committed and disseminated nationwide via the Internet, made them liable to plaintiffs and class members for soliciting the purchase of unregistered EPAs.

The lawsuit also details that Cuban “went on record calling the Deceptive Voyager Platform ‘as close to risk-free as you’re gonna get in the crypto universe.’” The Dallas Mavericks owner “even hyped up the fact that he was investing his own money into the Deceptive Voyager Platform to further induce retail investors to follow in his footsteps.”

The plaintiffs claim that the “misleading Voyager Platform is based on false pretense, false representations, and is specifically designed to take advantage of investors who use mobile apps to make their investments in an unfair, tasteless and deceptive manner.” use.” He further alleged:

Put differently, the Deceptive Voyager Platform was a massive Ponzi scheme, and it relied on Cuban’s and the Dallas Maverick’s vocal support and Cuban’s monetary investment in order to continue to sustain itself until its implosion and Voyager’s subsequent bankruptcy.

Voyager Digital filed for bankruptcy last month, citing “prolonged volatility and transitions in the crypto markets over the past few months, and the default of Three Arrows Capital (‘3AC’) on a loan from a subsidiary of the company.” The Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Board recently ordered Voyager to cease and desist from making false and misleading statements about the company’s FDIC deposit insurance status.