On October 6, Grayscale Investments announced a new venture that gives accredited investors the opportunity to invest in the mining infrastructure that powers the digital asset ecosystem. According to the announcement, the co-investment vehicle is called Grayscale Digital Infrastructure Opportunities (GDIO), and the crypto mining firm Foundry will handle the new product’s operations. GDIO is meant to “capture the upside of crypto winter,” Grayscale’s announcement on Thursday details.

Grayscale’s new co-investment vehicle GDIO seeks opportunities within market cycles of the crypto economy – Day-to-day operations to be managed by Foundry Digital

The world’s largest digital currency asset manager, Grayscale Investments, on Thursday announced the launch of a new co-investment opportunity, a financial vehicle that aims to take advantage of the market cycles of the crypto economy. The new co-investment product is the first of its kind for Grayscale and bitcoin mining, and staking infrastructure firm Foundry Digital will “manage the day-to-day operations” of the Grayscale Digital Infrastructure Opportunities (GDIO) co-investment vehicle.

During the last 12 months, Foundry has been the largest bitcoin mining pool in terms of total hashrate. The firm’s mining pool captured 19.38% of the global hashrate this year, or discovered roughly 10,375 out of the 53,532 BTC blocks found during the past 12 months. The bear market has been troublesome for miners this year and Grayscale believes that the crypto winter can provide unique opportunities for investment.

Grayscale’s investment thesis states:

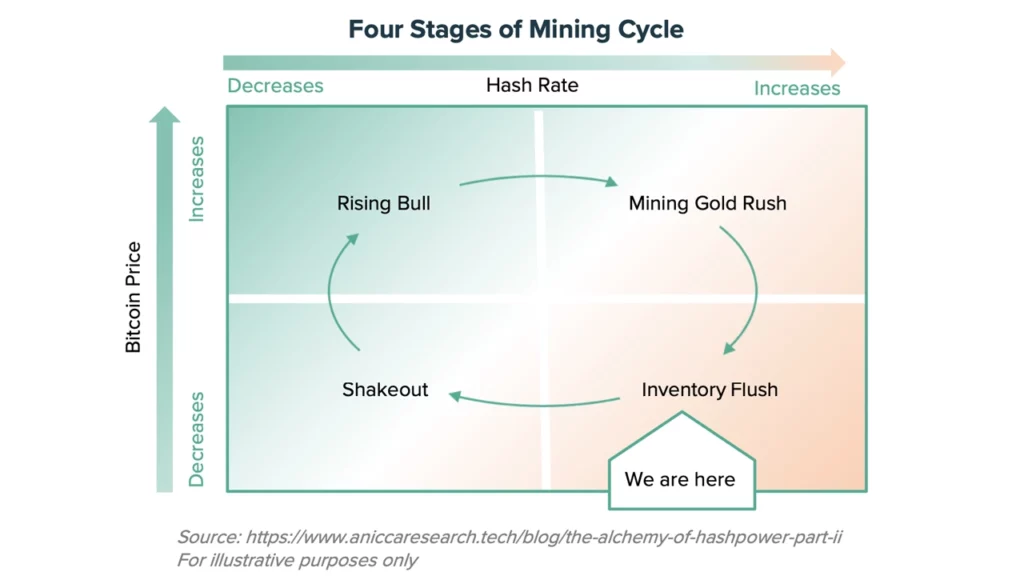

As the bitcoin price has fallen dramatically, leveraged miners have experienced meaningful pressure on their operating margins. In the coming months, we anticipate that some miners will be forced to phase out their mining equipment. We believe that GDIO will have the opportunity to purchase mining equipment at distressed levels and mine bitcoin profitably in the future.

For instance, the crypto miner Cleanspark explained this past summer that the crypto economy’s downturn has produced “unprecedented opportunities.” At the end of June, a report noted that $4 billion in bitcoin mining loans were in distress. Moreover, In September, Jihan Wu’s Bitdeer launched a $250 million fund to help distressed miners. Grayscale CEO Michael Sonnenshein says his firm has an edge above the rest that allows Grayscale to find opportunities within the crypto winter cycle.

“Grayscale’s unique position at the heart of the cryptocurrency ecosystem enables us to create products that allow investors to invest capital as they work through various market cycles,” Sonnenshin commented during the announcement. “Our team has long been committed to lowering the barrier to investment in the crypto ecosystem – from direct digital asset exposure, to diverse thematic products, and now infrastructure through GDIO.”