By market capitalization, Dogecoin ranks ninth among cryptocurrencies and has recently been range trading.

The price of Dogecoin advanced to the higher range last week after breaking past the $0.067 resistance level at the MA 50.

Bulls failed to maintain the gain, which left Dogecoin trapped between its 50 and 200 day moving averages, which are now at $0.067 and $0.076, respectively.

DOGE was trading at $0.069 at the time of writing, down 2.10% over the previous 24 hours. The crucial hurdle for Dogecoin to cross on the upside is the $0.075 level around the MA 200.

The $0.085 level up ahead, which would indicate a 10% rise from there, may be the goal of a move over this mark. Additionally, persistent bullish action may drive Dogecoin to all-time highs of $0.094 or possibly $0.104.

On-chain data provides this glimpse

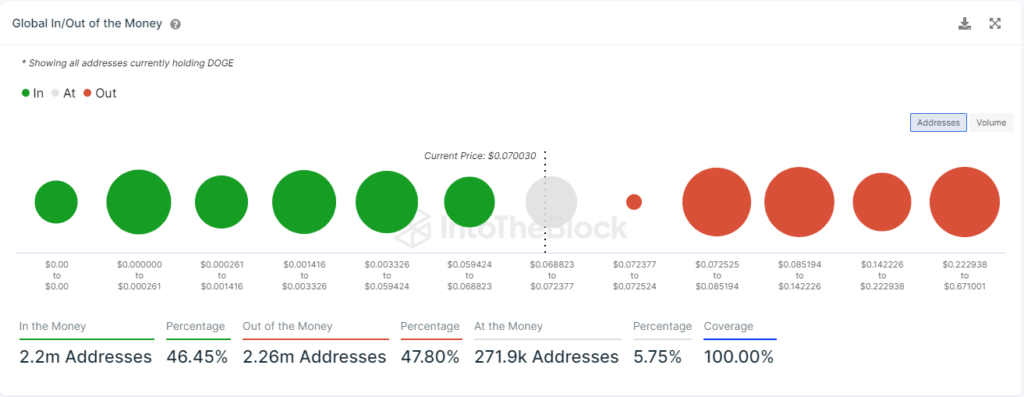

The Global In/Out of the Money feature of IntoTheBlock groups all addresses’ positions depending on the proportion of people who have previously purchased within a specific price range. More support or resistance is anticipated around these price levels as these clusters grow in size.

This signal suggests that there may be a very slight resistance close to the present price level, which is approximately $0.072. 8,180 Dogecoin addresses purchased 382.79 million DOGE at this time.

Between $0.072 and $0.085, which is the next significant resistance zone for Dogecoin, 40.22 billion DOGE were purchased by 599,390 addresses. This could act as a stopgap measure against additional price increases at those levels.

Meanwhile, the fact that 17% of Dogecoin’s supply hasn’t been traded in the previous five years is encouraging for the cryptocurrency. Unmoved coins, in the opinion of IntoTheBlock, say volumes about the long-term perspective of cryptocurrency investors.