Bitcoin on-chain data reveals the exchange reserve sign looks different for the present selloff when compared to the May crash.

Bitcoin Spot Exchange Reserve Continues To Decline Despite The Huge Dip

As pointed out by a CryptoQuant post, the BTC reserve on spot exchanges has actually declined amidst the current price dip.

The Bitcoin all exchanges reserve is a sign that reveals the quantity of coins present in wallets of all the central area exchanges.

When the reserve’s value moves up, it means more investors are sending their BTC to exchanges for withdrawing to fiat or altcoin purchasing.

Similarly, a sag in the metric suggests financiers are withdrawing a net quantity of Bitcoin from exchange wallets to individual ones for hodling them, or offering through OTC offers.

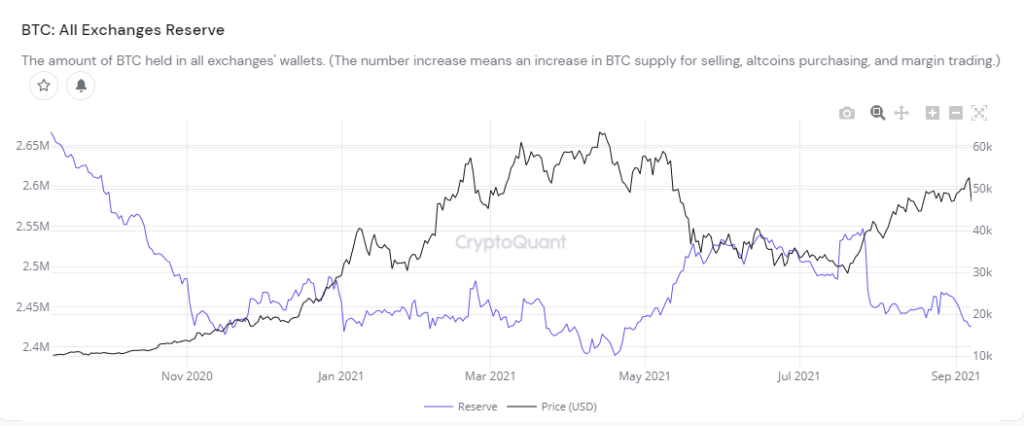

Here is a chart showing how the value of the indicator has changed in the past year:

Now, on analyzing the above chart, some intriguing functions can be seen. In the lead-up to the 2021 bull run, the exchange reserve was coming down from a very high value. This makes good sense as a sag like that a person indicates financiers were building up more coins, which can assist drive the cost up.

Then, around when Bitcoin hit its all-time-high (ATH), the metric started climbing back up quick, indicating a selloff, and thus the price crashed in response.

The present sharp dip, nevertheless, looks different. The BTC reserve has actually been on a decline, implying investors haven’t been quick to selloff on these spot exchanges.

This would indicate that this selloff might have been totally driven by derivatives, unlike the May crash where area exchanges likewise played a huge function.

BTC Price

At the time of writing, Bitcoin’s price is around $47k, down 5% in the last 7 days. Over the previous month, the cryptocurrency has actually collected 3% in gains.

The below chart shows the trend in the value of the coin over the past five days.

Two days earlier, Bitcoin saw outright mayhem in cost action as the coin’s worth went from $50k all the method to $43k within the matter of fifteen minutes. And then just minutes later, BTC had already recovered above $47k.

The coin dipped pull back to $44.4k the other day, however it is currently back to $47k now. It’s hard to say at the moment where the price might head next, but one thing can be expected for sure: more volatility ahead.