After a blistering start to 2021 saw token valuations and trading volumes surge to ignite the current bull market, the DeFi sector as an entire took a break whereas the NFT sector stepped into the limelight.

While investors’ attention was elsewhere, DeFi prices have had time to consolidate and project developers were able to focus on protocol upgrades and in the past month, DeFi-related tokens have been gaining traction and look poised for a breakout in September.

Data from Cointelegraph Markets and TradingView shows that multiple DeFi tokens, including Aave (AAVE), Synthetix (SNX), YFI and SushiSwap (SUSHI) have rallied nearly 40% since May 10, whereas the worth of BTC continues to be 27% away from its all-time excessive.

The recent bullishness in DeFi tokens prompted some analysts to point out that the ‘DeFi summer 2.0’ did in fact take place, and at a a lot bigger scale than anybody anticipated.

On-chain metrics show DeFi is heating up

Proof that the DeFi area is heating up will be present in varied on-chain metrics that point out a wholesome quantity of buying and selling exercise and an growing variety of new customers interacting with DeFi and DEX protocols.

According to data from Dune Analytics, the number of new participants coming into the DeFi ecosystem has risen non-stop over the past year reaching a record 3,285,643 total users as of Aug. 3

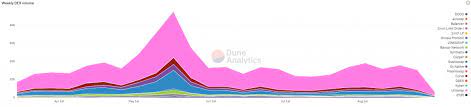

The regular addition of recent customers has helped to maintain exercise on DeFi lending protocols and decentralized exchanges (DEX) elevated, with data from Dune Analytics showing that the weekly DEX volume in August reached levels not seen since late May.

For many who are involved that top transaction charges on the Ethereum (ETH) community could restrict the flexibility for smaller traders to have interaction with the sector, the growing field of layer-two (L2) solutions like Loopring (LRC) and cross-chain bridges to competing networks like the Solana, be certain that portfolios of all sizes will be capable to partake in DeFi investin.

One of the best examples of this has been the rapid rise of the Polygon (MATIC), a layer-2 network that has emerged as a top-ranking blockchain in regards to total value locked (TVL). Knowledge from Defi Llama reveals that Polygon is now the fourth-ranked chain by way of TVL with greater than $4.93 billion locked within the community.

With Bitcoin still struggling to gain momentum below $50,000, it’s possible that the market is headed toward an altcoin season and if that occurs, the highest DeFi protocols with robust long-term fundamentals are prone to profit from the bullish momentum.