Most of the best altcoins in the crypto space were relentlessly hitting new highs, one after another, less than four months ago. However, the market became merciless one fine day in mid-May, with most crypto-assets ending up shedding close to half their value.

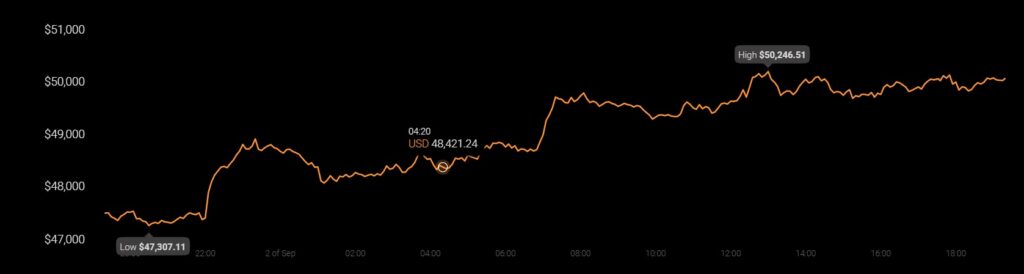

Well, a hundred days have passed since the May 19 crash and the market, at the moment, may be on the cusp of completing a full circle.

Make sense of contradictory numbers

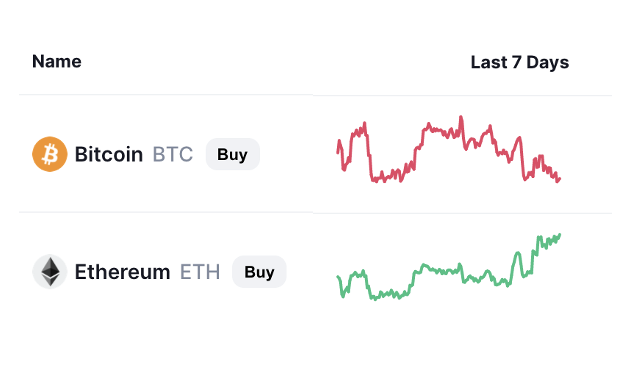

Bitcoin’s price, at the time of publication, was at 28% of its ATH of $ 64,000, while Ethereum’s price was only 14% of its benchmark of $ 4,350. Interestingly, over the past week, Ethereum’s price has seen a 14.25% pump while Bitcoin’s price deflated by 0.5% over the same timeframe.

Over the past couple of years, the market has scrupulously pumped and emptied together. One coin has always managed to take the lead and other coins have historically followed suit. Earlier this year, for example, BTC was the first to reach new highs.

Other altcoins including Ethereum eventually ended up reciprocating congruent trends.

So who would lead the rally this time around?

At the time of this writing, BTC and ETH appeared to be heavily dependent on each other’s price movements. That being said, that market’s largest coins shared a positive correlation of 0.81. Ethereum trading at its three-month high ($ 3.5,000) at the time of publication, to a large extent implied that it had already taken control of this rally.

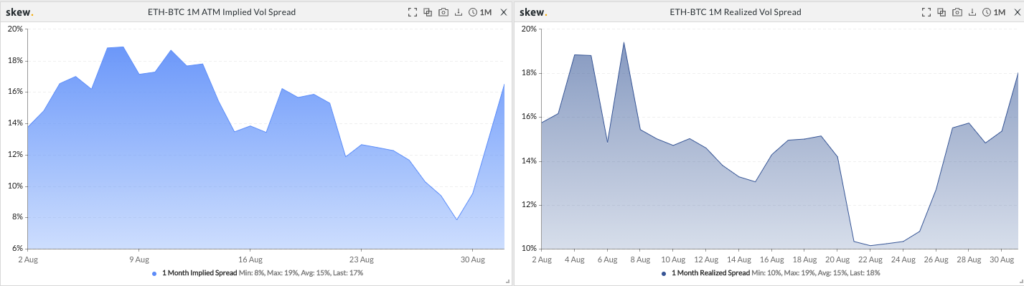

Furthermore, the ETH-BTC 1-month realized volatility spread and 1-month implied volatility spread supported the aforementioned narrative. Whenever these two indices have risen in the past, Ethereum has largely been able to outperform BTC in the volatility aspect by making higher highs and lower lows for that matter.

Right now, both the IV and RV have seen notable upticks, thereby giving ETH a positional advantage.

Bitcoin has obviously not been able to assert its dominance in space as before. However, Ethereum has been able to make up for the same. In mid-April, for example, Bitcoin and Ethereum’s market cap dominance percentage was hovering around 50% and 15%.However, the same were down to 42% and 19.2%, respectively, at the time of writing.

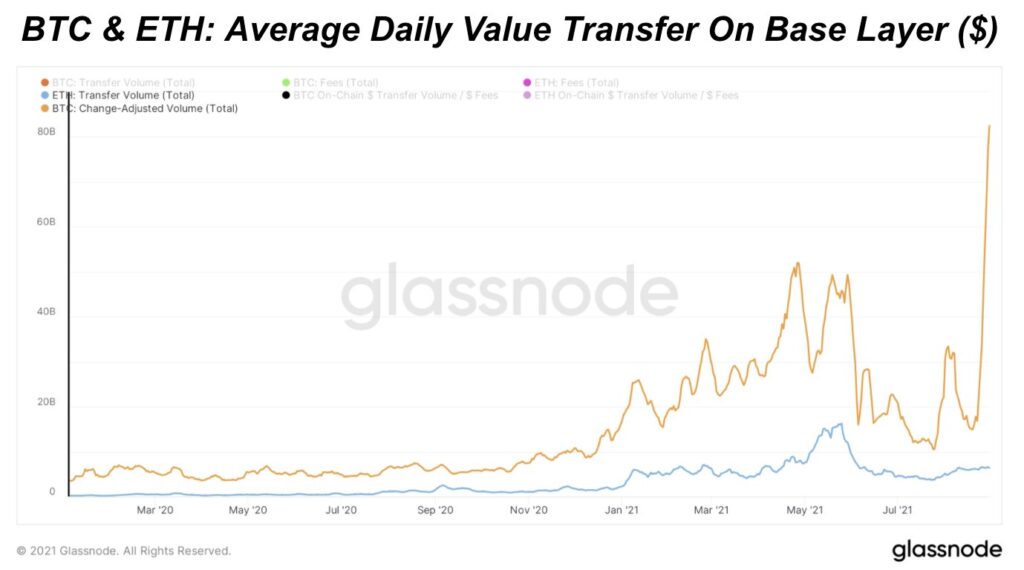

It should be noted, however, that Bitcoin has not been lagging behind on all fronts. Take the daily transfer value, for instance. As shown in the attached graph, the transfer value on the base layer of the BTC blockchain stood at $ 82.48 billion / day over the past week. Ethereum, on the contrary, saw figures of $6.37 billion/day.

Even though Bitcoin may already have broken its April levels, it should be noted that Ethereum is just at par with its levels seen 4 months back.

The ultimate essence of the 100-day waiting period

Well, the farther back an arrow is pulled before it releases it from the elastic bow of the bow, the farther it goes. Thus, it can be argued that these hundred days were quite critical for the market to step back and prepare itself for the upcoming bullish phase.

It can therefore be concluded that almost all cryptos are in a better position than they were in May.