Bitcoin’s price plummeted over 10% on early Tuesday, as El Salvador announced that it would officially accept the major cryptocurrency as the nation’s legal tender.

According to CoinMarketCap, Bitcoin’s depression from Monday sped up as the crypto stopped working to hold its $50,000 rate level — moving from $51,000 to $44,700 within a single hour. The sudden sell-off resulted in $1.44 billion in futures liquidations of Bitcoin trades in the past 24 hours, according to data from ByBt.

The single biggest reported liquidation took place on Huobi-BTC — worth $43.7 million at the time. As expected, the vast majority of the liquidations were longs, representing about 88% of the total liquidations.

Since dropping to weekly lows, the rate of Bitcoin rebounded as much as as high as $47,500. At press time, BTC is hovering at $46,500 across major exchanges Binance, Coinbase, and Huobi.

Following the force of the pullback, El Salvador president Nayib Bukele tweeted that he is “[b]uying the dip,” buying another 150 BTC worth about $6.9 million, including on top of the 400 BTC position. The average cost of the purchase appears to be around the $46,000 price range.

Is This the “Reset” Bitcoin Needed to Trend Higher?

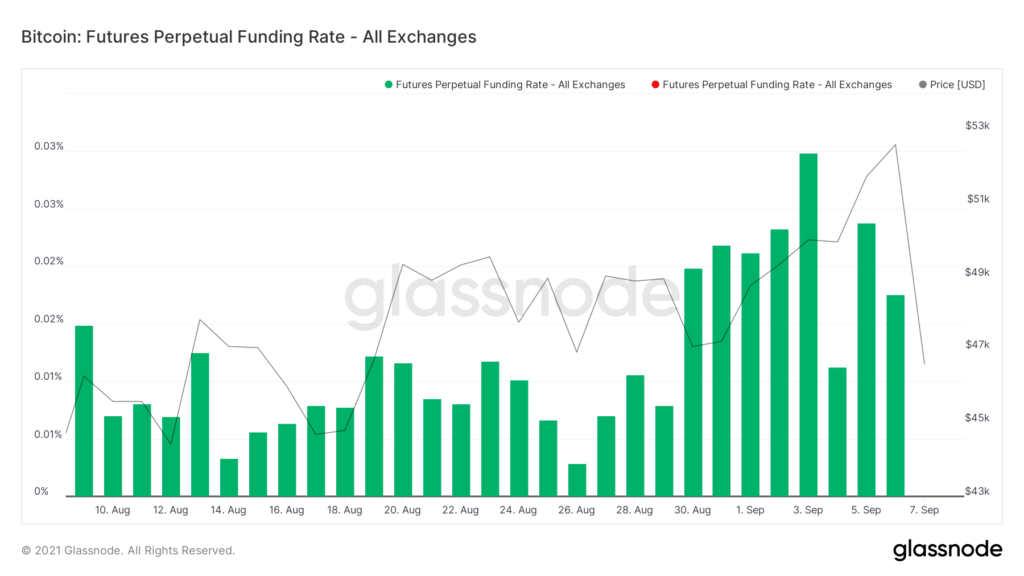

Data from Glassnode reveals that the mean Bitcoin funding rate (typical throughout all exchanges) had actually progressively increased throughout August.

Funding rates rose from 0.015% in early August to as high as 0.03% at the start of September.

Derivatives exchange ByBit saw its funding rate increase to as high as 0.085% in late August.

Relatively high funding rates can indicate that the market is overheating, with too many traders being overleveraged. More typically than not, high funding rates will cause a pullback — which held true previously this May.

More specifically, funding rates on major exchanges Binance and Huobi dropped to 0.023% and 0.021% at the peak of the sell-off. OKEx, on the other hand, went back to an unfavorable funding rate of -0.009%, per Bybt.

As Bitcoin and the broader crypto market slightly recovered from the sell-off, funding rates have stabilized at 0.01% for Binance, Huobi, and ByBit. Funding rate on OKEx remains at a negative of -0.0005%.

With the futures market cooling off, it’s most likely that rate levels will start to support when again.