Some Bitcoin indicators show similarities between the post-ATH price action and current trend, implying that there will be one last push up before a bigger drop.

Indicators Might Show Today’s Price Action Is Similar To That After $64.5k ATH

As discussed by a CryptoQuant expert, there appear to be numerous resemblances in between the Bitcoin indicators of the post all-time-high (ATH) duration which of present day.

There are three main metrics of relevance here. The initially is the exchange reserve, which reveals the quantity of BTC presently being hung on central exchange wallets.

Here is how this indicator’s value has changed during the past year:

Looking at the above chart, there does appear to be a resemblance in between the 2 durations. Both had declining prices as well as declining exchange reserves.

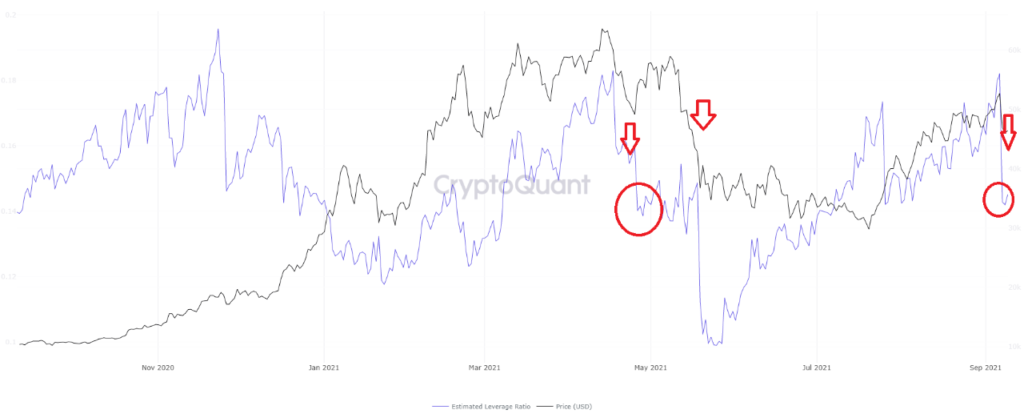

Next is the approximated take advantage of ratio, an indication that demonstrates how much take advantage of is utilized by traders usually. It’s calculated by taking the open interest divided by the exchange reserve.

Here too a resemblance can be viewed as the indication appears to have greatly fell throughout both present day and the post-ATH duration.

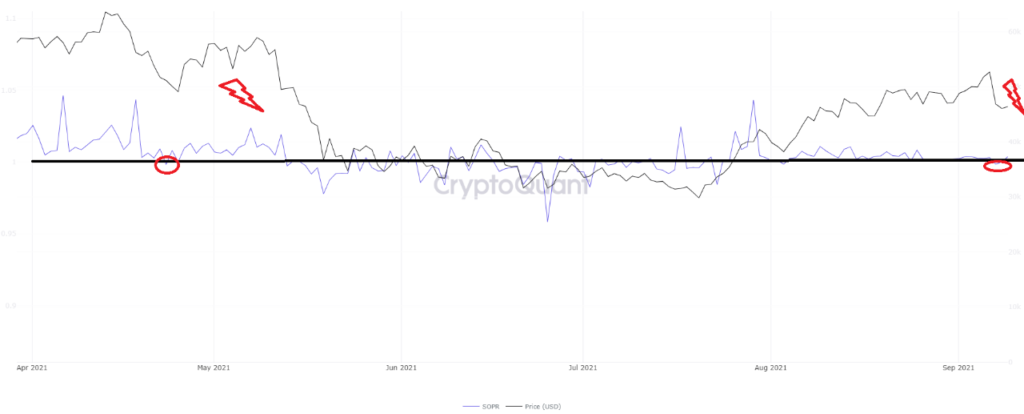

Finally, there is the Spent Output Profit Ratio (SOPR), which is calculated by taking the ratio of realized value (in USD) to the value of creation of a spent output.

In easier terms, the indication reveals whether Bitcoin wallets are offering their coins at a revenue or a loss. The listed below chart reveals the patterns for this metric.

Looks like the value of the SOPR dropped down below 1 during both these periods. Such a worth suggests that financiers have actually been offering BTC at a loss (while worths above 1 would indicate the opposite).

If the current trend really is similar to the post-ATH one as these indicators would seem to imply, then it means BTC’s price might move up soon and make a local peak. And much like last time, a huge drop might occur after that which takes the rate to lower levels. So that this uptrend might end up being the last go up for a while.

BTC Price

At the time of writing, Bitcoin’s price floats around $45.7k, down 10% in the last 7 days. Over the previous month, the cryptocurrency has actually dropped 1% in worth.

Here is a chart showing the trend in the price of the coin over the last three months: