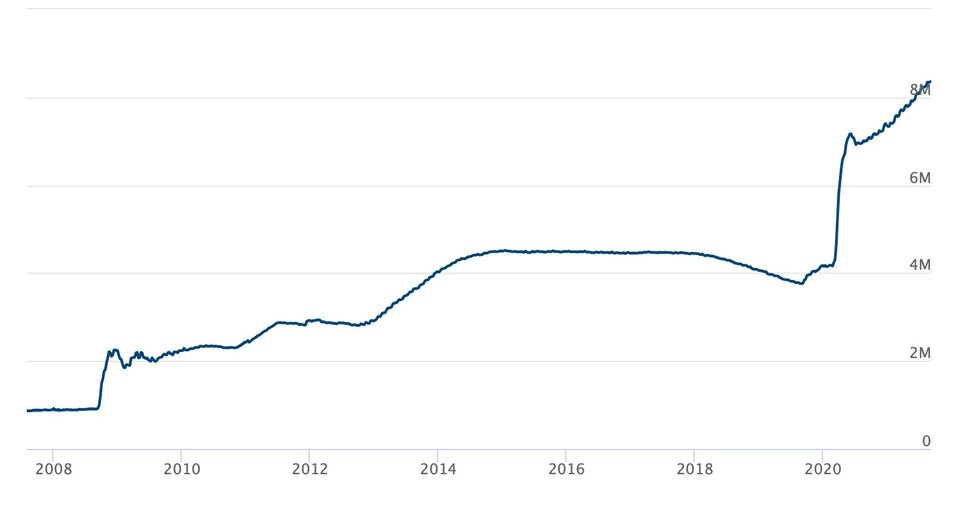

This week the U.S. Federal Reserve’s stability sheet charted one other all-time excessive. At an astounding $8.357 trillion, are the rapidly growing assets of the Fed speeding crypto adoption?

The Federal Reserve publishes updates to its stability sheet numbers each seven days. This week’s report was a doozy, revealing another $8 billion in assets purchased over the period.

The U.S. central financial institution has been busily hoovering up mortgage-backed securities and Treasury bonds, shopping for them with new {dollars} it creates at its personal discretion.

Fed Balance Sheet Hits New Record High

The Fed’s balance sheet now stands at an incredible $8.357 trillion. Are we taking a look at a greenback bubble within the making? “There isn’t any finish in sight,” remarked crypto proponent Anthony Pompliano.

The glut of newly created money pouring into America’s institutional financial infrastructure keeps interest rates glued to near-zero in the U.S. dollar economy.

The aim of this within the Federal Reserve’s parlance is to assist it obtain its twin mandates from Congress to stabilize costs and maximize employment.

The Credit as Money Economy

But really, the purpose is to steadily and easily notch up prices, so dollar users are incentivized to spend their dollars sooner rather than hold them and wait to spend.

The monetarists need to see items and cash trade arms extra usually and use quantitative easing to grease the wheels of the market.

They also fear a deflationary episode, with Jerome Powell warning against a deflation-driven economic depression during and before the coronavirus pandemic.

Borrowing at zero p.c curiosity is a extremely nice deal, truly sort of impossibly nice. No one who couldn’t create more of their own money supply at their own discretion to lend would lend their own money for no interest. It’s a man-made assemble of the financial system that may not make sense in somebody’s private or enterprise funds.

So who’s paying for it? Everyone buys things that cost more because of it. Larger meals and commodity costs subsidize these zero p.c rates of interest. Higher equities and housing prices too, and higher tuition prices with all that low interest student debt to pay back.

Are Central Banks Hastening Crypto Adoption?

Is it hastening crypto adoption? You guess it’s. Investors who see monetary expansion radical even by 2008’s standards are protecting and growing their savings in cryptocurrencies and other digital asset instruments. As Nasdaq recently reported:

“Inflation fears are obvious with financial contraction and authorities stimulus rising the worldwide cash provide. Bitcoin has positioned itself as a perfect hedge against inflation. Unlike fiat currency, bitcoin is not regulated by the central bank.”

The Nasdaq report emphasised how robust this narrative is, how a lot buyers imagine in it, and the way validating Bitcoin’s efficiency in opposition to the greenback has been. Advising readers how to include cryptocurrencies as part of an inflation-proof portfolio on Saturday, Benzinga warned:

“With the U.S. CPI having elevated past 5.4%, inflation is already right here in a really possible way… Investors who are not taking a look at the allocation of their asset portfolios may find themselves with a reduced future long-term spending power.”

Whereas the Federal Reserve is basically skimming different individuals’s cash and lending it out at zero curiosity, buyers on DeFi (decentralized finance) cryptocurrency lending platforms are lending their very own cash for enormous, generally double-digit annual share yields. Meanwhile, others are parking their savings in deflationary digital assets like Bitcoin.

The central banks are pumping liquidity into decentralized banks with each spherical of cash printing.