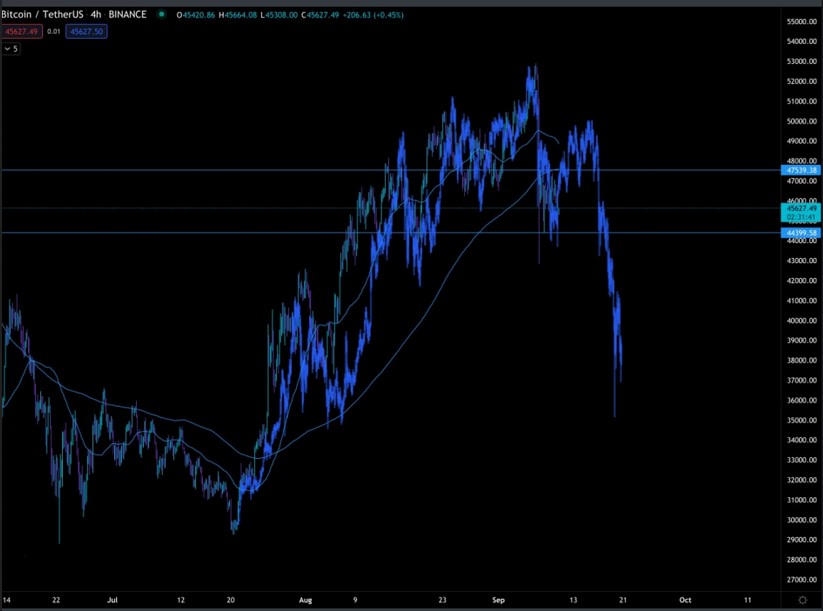

Making its way up to the higher levels of its current range, Bitcoin records a 5.6% profit in 24 hours. BTC’s rate took a heavy loss, as the execution of its legal tender status in El Salvador ended up being a “buy the rumor, sell the news” occasion.

At the time of writing, the first cryptocurrency by market cap trades at $46,529 with an 11.8% loss in the 7-day chart.

Previous to this occasion, Bitcoin made a fast transfer to the $52,000 zone. This moved the Fear & Greed Index back to the green area, as the general sentiment in the market turned bullish.

According to a current Arcane Research report, the Index has actually turned red, back to fear levels as soon as again. Bitcoin has experienced a week of volatility, mostly to the upside, but the violent bearish price action has made investors fearful, as seen below.

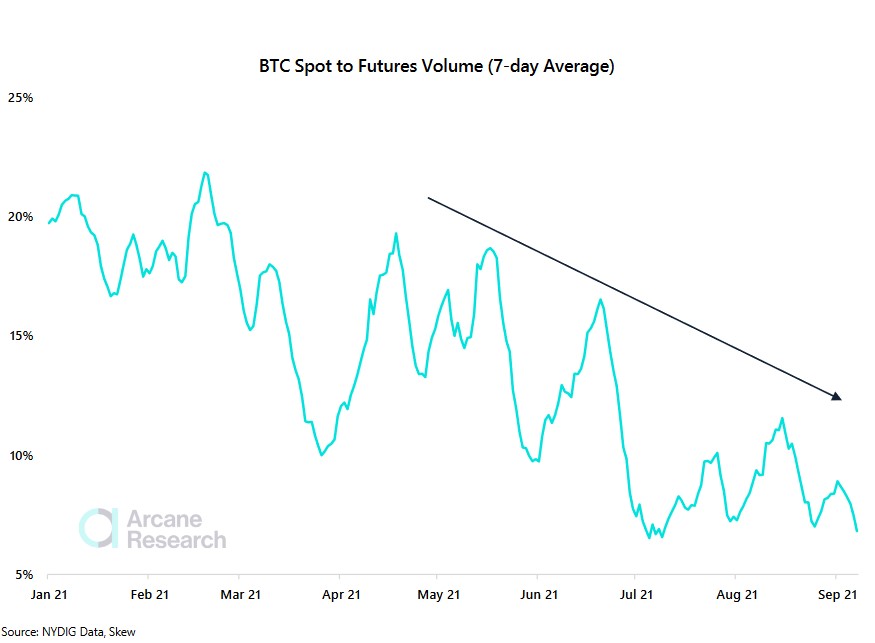

Arcane Research discovered that the majority of the action is occurring in the derivatives sector. The BTC Spot to Futures Volume indicates a decline in the trading volume for the spot market.

This doesn’t always recommend an increase in the trading volume for futures, however a constant dropped in area trading over a duration of 5 months, as derivatives trading volume stays steady.

As NewsBTC reported, much of the recent price action and volatility is related to an increase in over-leverage positions for futures. This associates with durations of bearish momentum, retail futures traders sustain the liquidation waterfall that leaves the crypto market open for disadvantage threat.

Two Possible Scenarios For Bitcoin As Fear Re-Enters The Market

On the other hand, analyst Ben Lilly from Jarvis Labs recently examined Bitcoin’s price action. The cryptocurrency has actually been trading in a crap-like PA showing prior to the other day’s unexpected transfer to the benefit and disadvantage, practically instantly.

This corresponds with an increase in liquidity around those levels. Thus, Ben Lilly argued that market movers or big gamers try to press BTC’s rate into a particular instructions to get the liquidity and ultimately tired.

The market is currently at that stage, as seen below, “bone dry” out of liquidity. In this case, the expert advised trading in the area market, as derivatives might continue moving without a clear instructions.

This is the best-case scenario, a sustain crab-like PA for a few weeks, as Bitcoin prepares for another retest of the $50,000 mark. Before that, the marketplace might see another sweep at the other day’s low:

And this scenario is currently the one we are leaning towards. Meaning we believe a retest of $42kish may be in the cards.

The worst-case scenario could occur by the end of this month with a return to BTC’s previous range in the $30,000 mid-area. Ben Lilly said:

This kind of rate action would be vicious. It will create a lot of liquidity lower very fast. It’s often times known as exit liquidity.