Bitcoin has now seen declining prices following the El Salvador Bitcoin law. The flash crash that had actually cleared a minimum of $400 billion off the crypto overall market cap has actually left sticking around results on the rate of the digital property. The price had plunged from $50,000 to $42,000 in less than an hour, leading to an 18% loss in about 30 minutes. While bitcoin has actually because recuperated from its lows from the crash, the property has actually not had the ability to recuperate to previous levels prior to the crash.

Though the crash had affected most of the market, mid-cap coins have recovered the most from this. The Mid Caps Index had really crashed in addition to the remainder of the market. But subsequent recovery trends show that it had gained back a good percentage of its value since the crash.

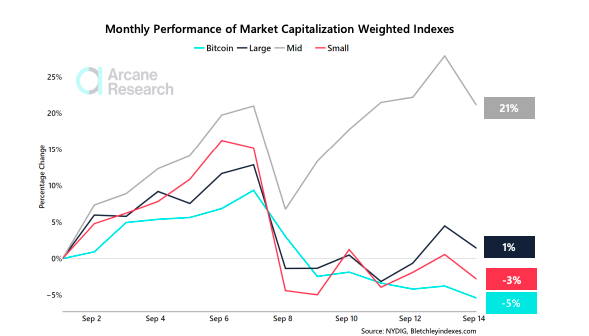

Mid Caps Index Outperforms In September

In the month of September, the Mid Caps Index has actually grown 21% in September alone. This is a complete deviation from the patterns of other indexes, both the Small Caps and the Large Caps, which have both shown declines in the month of September. The Large Caps index is up just 1% in September. Likewise, keeping in line with the low recoveries, the Small Caps index is down 3% for the month.

Bitcoin, which appeared to have actually held up well throughout the crash, has actually made the least considerable healing in the month. The asset shows the lowest performance in the month of September, down 5%, even lower than the Small Caps index.

Altcoins have actually tape-recorded much better efficiencies after the crash, in spite of taking the most strikes with the flash crash. The week following the crash saw the altcoin market recover swiftly. Coins like Algorand which come from the Mid Caps Index carried out so well after the crash that it pulled the whole index up with it. While bitcoin has maintained low momentum and continues to struggle in the market.

Bitcoin Maintains Market Dominance

The efficiencies of the indexes versus bitcoin have actually not had much of an influence on the marketplace dominance of the property. Although bitcoin lost some of its market dominance, the total for the week came out to be about 1% of market dominance lost to altcoins. Currently, the marketplace dominance of the digital property sits at 41.47%. The Mid Caps Index performance has seen the altcoin market creeping up to take more market share from bitcoin.

Bitcoin rate has actually been revealing some considerable healing patterns in the previous couple of days. But there has not been any significant recovery in the price. The digital property is getting ready for what seemed a retest of the $48,000 resistance point, after having actually discovered a comfy position above $47,000 ahead of the opening of the midweek market trading. Currently, the price is trading at $47,473 with a 24-hour price change of 2.11%.