Bitcoin transaction fees are usually an indication of how holders are moving their coins around. When the network gets crowded due to a high variety of deals, the transaction fees increase, suggesting a high volume of traffic on the network. Transaction traffic usually is high around bull markets when the price of the digital asset is up. Usually causing a sell-off as financiers attempt to take revenues.

One thing, this recent bull market has been anything but usual. So lots of things that are typical around booming market have actually not occurred with this booming market. An example is the declining reserves on exchanges. Bitcoin increasing would frequently set off a boost in the exchange reserves with the booming market, which takes place since financiers are attempting to sell their coins. This bull market, however, has shown the opposite. Exchange reserves have actually plunged, and in addition to it, bitcoin transaction fees are at one-year lows, suggesting that financiers are performing less deals on the blockchain.

Transaction Fees Plummet

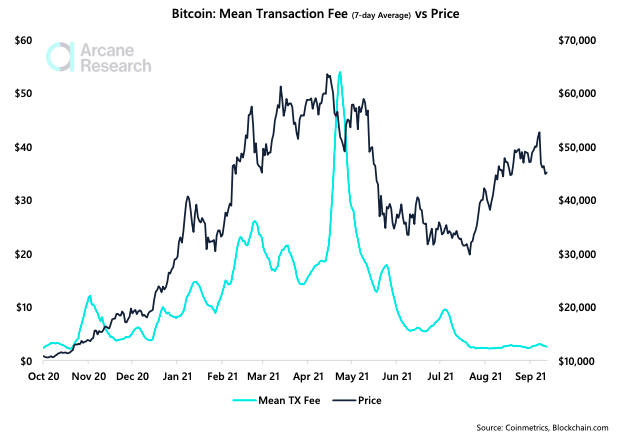

The current climate for bitcoin transaction fees has been at levels not seen since last year. The fees which had spike following the terrific miner migration out of China have actually now hung back to pre-2021 levels. Competition for block space due to the reduced hashrate had seen the transaction fees of bitcoin go up by about 50% in July of 2021. But as miners have actually returned online and the hashrate has actually gotten, fees on the network have actually dropped once again.

Current network activity shows that there is now less demand for block space on the blockchain. This is distinct in the truth that throughout booming market, need for block area is typically at its greatest. The last couple of bull markets have all shown similar trends. Bitcoin transaction volumes have actually increased in previous bulls, causing greater need for block area, causing greater transaction fees.

Presently, the average transaction fee for bitcoin transactions sits at $3. Average transaction fees have actually not been this low because October in 2015 when the typical cost was $3. Comparing this to April, when the bull market was in full force, the average transaction fee had been $61. Competition for block area was high as financiers moved their possessions around.

How This Affects Bitcoin Price

The price of the digital asset, like any other asset, is tied to the demand for the asset. Given the present transaction fees and transaction volumes, this reveals that financiers are stagnating excessive of their digital possessions around. Hence, it points towards more hold sentiment amongst investors. This might spell the extension of the booming market. Maybe one last bull run before the market finally gives in to the bears.

Hold belief has actually constantly been necessary when it pertains to the rate of the digital property. This shows that bitcoin investors are more inclined to buy more coins instead of selling their existing stash. Thus producing shortage in the market, which is evidenced by the reduced exchange reserves, which have actually likewise hit one-year lows. Scarcity inadvertently leads to a higher value for an asset. Playing to the basic laws of economics.

The rate of bitcoin is presently above $48,000. A successful test of the $48,000 resistance point had seen the asset climb $400 above this, before losing hold and falling back below this crucial point. Indicators still reveal a favorable upward pattern in the rate of the property. Possibly a green close by the end of the midweek trading day.