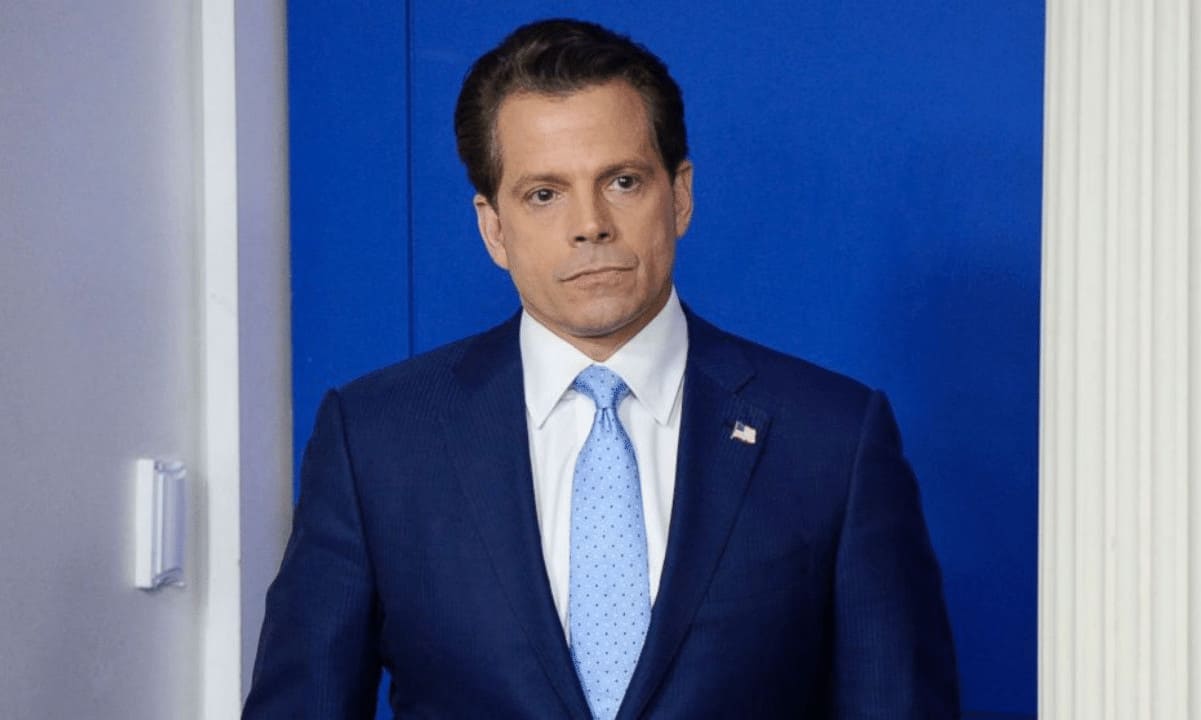

The American financier Anthony Scaramucci believes that bitcoin is a financial commonplace that might someday turn out to be a worldwide reserve foreign money. He explained the volatile nature of the digital asset with the fact that it is still in its early adoption days.

BTC Is Efficient as a Financial Community

Throughout an interview with Natalie Brunell, the Founder and Managing Associate of SkyBridge Capital – Anthony Scaramucci – shared his stance on bitcoin’s deserves and its future improvement.

The top executive scratched the topic of BTC’s volatility, saying that this is something normal for a relatively new asset class and compared it to Amazon. SkyBridge Capital’s CEO reminded that the e-commerce large is now one of many main firms, hinting that the first cryptocurrency can be heading in the direction of that route:

“Bitcoin is volatile because it is in its early adoption stage. Amazon had the same volatile curve 24 years ago. However in case you have put $10,000 on Amazon at its IPO, you’ll have $21 million at the moment.”

Interestingly, this is not the first time when Scaramucci has made such a comparison. In March, he in contrast the asset’s efficiency to Amazon’s inventory and doubled down on his perception that bitcoin is best than gold.

Scaramucci further added that bitcoin is not only a currency. It’s truly an efficient monetary community and a financial commonplace. According to him, the asset’s most significant advantage is its decentralization:

“Bitcoin is decentralized. And financial instruments work better when you put power in peoples’ hands rather than when the government is in charge.”

Do Your Personal Analysis

Regardless of praising the first digital foreign money as a extremely profitable monetary instrument, Scaramucci mentioned his help will not be just for it. He sees merit in other digital assets, including the second-largest – Ethereum.

He additionally urged folks to study extra concerning the cryptocurrency area. Even if they are skeptical about the market, they should know the reason for it:

“Perceive why you don’t need to personal bitcoin, don’t simply robotically say: ‘Oh, that is rat poison.’”

Speaking of initial investments in the field, Scaramucci advised the public to allocate not more than 5% of their total savings in it. Thus, in case of a worth growth, they’d nonetheless get pleasure from stable earnings. On the other hand, if bitcoin’s value starts declining (which he doubts), the loss would be insignificant.

Subsequently, he opined that bitcoin had reached a degree the place the US authorities has no energy to ban it. Instead, the officials could only tax or regulate it, which they have been striving for in the past year or so.