Without consensus on its implications, the Evergrande potential default has impacted the traditional market, and Bitcoin. The very first cryptocurrency by market cap began the week with a correction with danger to trend even more down.

At the time of writing, Bitcoin trades at $43,462 with a 9.1% and 6% loss in the daily and weekly chart, respectively.

Bitcoin Holds On To Critical Support

Pseudonym expert IncomeSharks declared that Bitcoin might be at the start of a correction. The analyst looked at BTC’s On Balance Volume (OBV), a metric used to measure momentum.

As seen listed below, Bitcoin has actually been moving sideways on its OBV considering that it moved to the benefit at the end of July. This coincides with BTC breaking out from its former range, and its current price action.

If Bitcoin break to the disadvantage on its OBV, bulls might deal with difficulties on their efforts to recover previous highs.

In the meantime, the $40,500 to $43,000 will operate as critical support, according to analyst Daan Crypto Trades with $50,000 still operating as major resistance. This analyst said:

BTC I’m seeing $40.5-50K roughly as a huge variety we’re in. We initially got rejected by the upper resistance area and now came back down. The whole 40.5-43.5K location must use great assistance and I question we’d fall listed below that without much of a battle.

Bitcoin Indicators Favor The Bulls

Despite the current price action and the macro-economic elements that suggest more downside, Bitcoin seem to show strength on some of its fundamentals. Part of the factor for the crash, according to a Glassnode report, is some BTC holders taking earnings on upper levels.

Since late July, the market has consistently realised net profits on the order of around $1B per day as prices rallied from $31k to over $52k. This recommends a reasonably significant quote has actually supported the marketplace en route up.

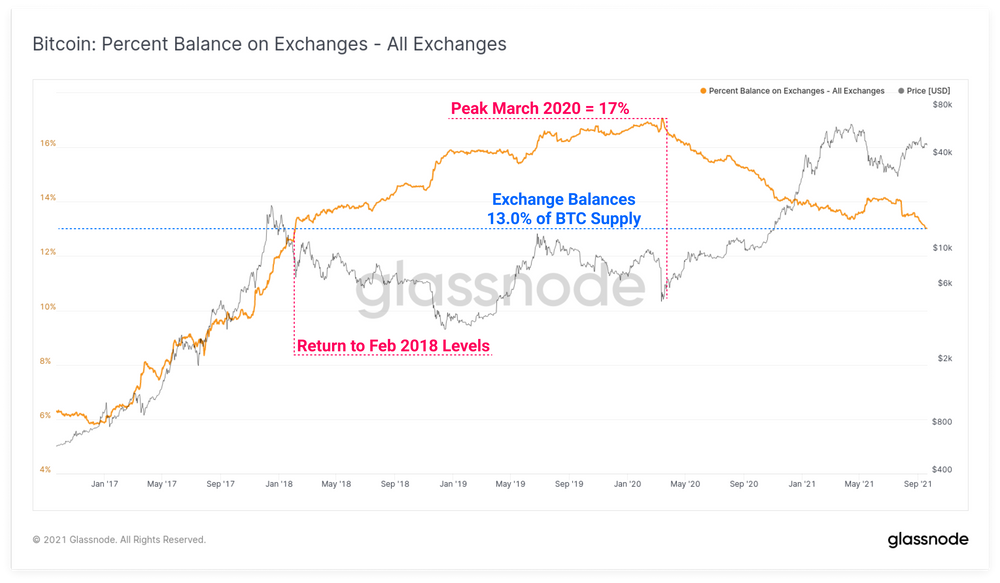

An important metric that has favored the bulls is the amount of Bitcoin sitting on exchange platforms. Standing at a 13% of BTC overall supply, a brand-new multi-year low according to Glassnode, the metric has actually continued to trend downwards.

As seen below, the amount of BTC on exchanges returned to levels last seen in February 2018. This was followed by a duration of debt consolidation prior to Bitcoin collect sufficient strength to score a fresh all-time high.