Global risk-off, uncertainty over Evergrande’s debt crisis, and large liquidations have been pressuring Bitcoin lately. The near-term chart could look bearish, however the elementary and on-chain development stay firmly bullish, making this pullback a possible shopping for alternative.

In just over two weeks, BTC fell from a high of $52.9k to a low of $39.5k, mainly driven by massive liquidations in derivatives and panic selling from younger coins. It’s straightforward to take a look at the chart with a bearish bias contemplating the deep retracement and concern available in the market. Still, the trend in fundamentals and on-chain metrics shows the underlying strength in the holders of Bitcoin.

As we coated in August, September has traditionally been a unstable interval for threat belongings. The recent turmoil can be expected after US stocks became extremely overextended to the upside, with uncertainty regarding monetary policy, the Evergrande debt crisis in China, virus concerns, and a rising dollar. Bear in mind, threat belongings are extremely correlated, making Bitcoin weak to shockwaves in conventional markets, regardless of highly effective fundamentals and on-chain information.

Near-Term Technicals Cautious – Larger Structure Holding

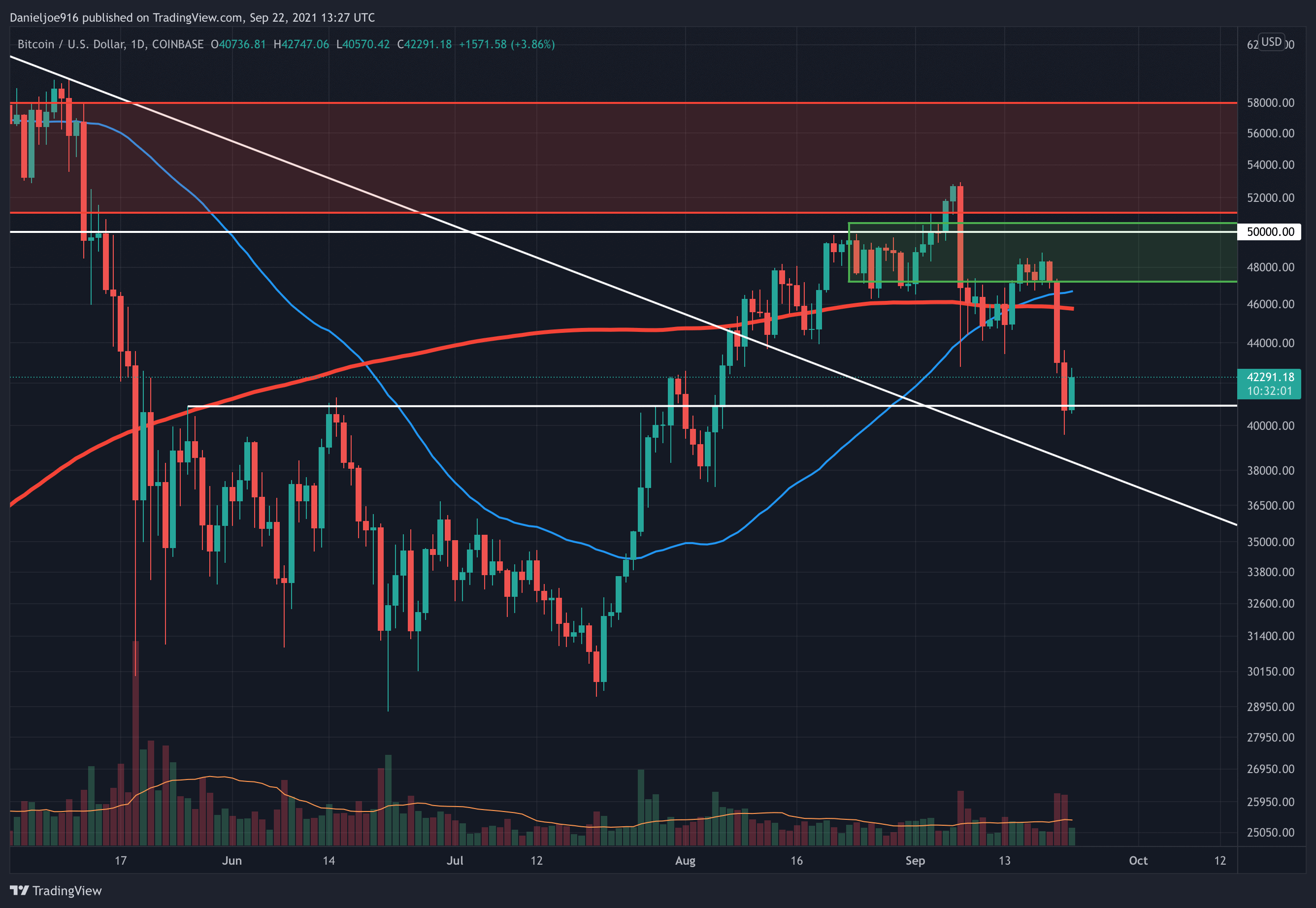

Large liquidations started cascades of forced selling and pushed BTC below a key rising trend line around $43.8k on a closing basis. Additional risk-off in world markets triggered extra liquidations forcing one other $1B wipe out, pushing BTC to wick right down to $39.5k, a key Fibonacci goal, as proven within the chart under.

Price also dipped into the previous $30k to $40k trading range before wicking back up into the close. Although near-term bearish, these levels are being tested on an intraweek basis. Though near-term bearish, these ranges are being examined on an intraweek foundation. A weekly close below $41.3k to $40k could invalidate the technical breakout out of the trading range, significantly increasing the risk of further downside.

Up to now, the Elliott Wave construction is suggesting this pullback might be a Wave 2 corrective transfer after an 80% rally to finish Wave 1. Corrective waves are a 3-wave push to the downside, which BTC has been following so far. It’s going to take a while to substantiate, however the construction strongly suggests it is a Wave 2 pullback. Wave 3 is usually the largest wave to the upside, suggesting potential all-time highs if price action is strong.

It’s essential to notice, derivatives markets can add important volatility to identify BTC costs. Although participants can track metrics such as funding rates, open interest, and leverage ratios, liquidations can happen at any time, which can trigger large cascades of forced selling, catching the market by surprise.

Ranges to Reclaim

With BTC buying and selling within the low 40s, it’s essential to see costs begin pushing increased to get better $45.8k, close to the vital 200-day shifting common. Reclaiming the rising trend line around $43.8k would also be a near-term positive signal.

Ideally, it will assist to have certainty return to the market, particularly relating to Evergrande and Fed financial coverage. Any good news could flip sentiment to bullish, and the risk on trade could resume.

On-chain Trend Remains Firmly Bullish

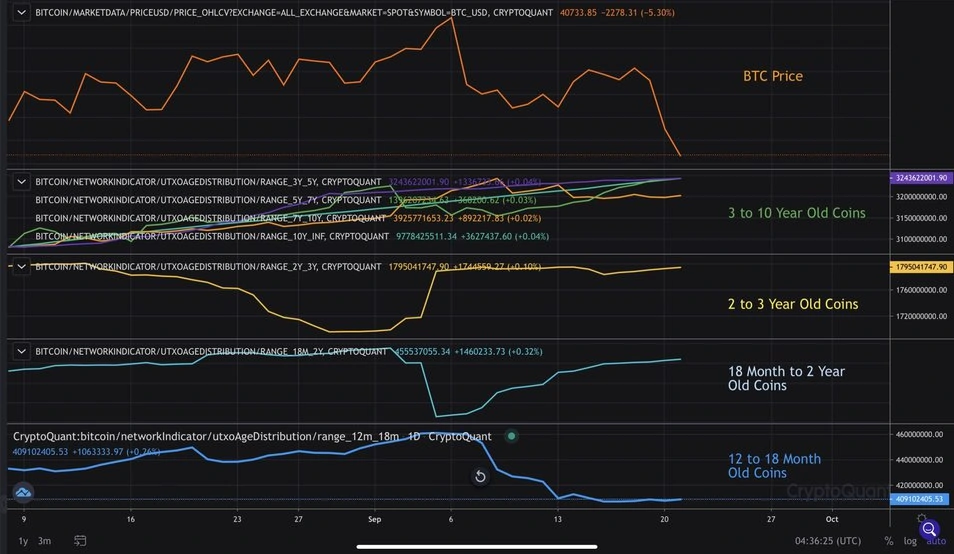

When these liquidations occur, retail and buyers holding youthful cash are likely to panic promote, including additional promoting strain to the market. So far, on-chain data has shown most of the selling has come from liquidations and younger cohorts selling while long-term holders, miners, and entities holding older coins continue to HODL.

Most promoting is coming from 3 to 6-month, 1 to 3-month outdated and youthful cash. These contributors largely gathered above $50k and have been realizing losses as BTC plunged to $39.5k.

BTC miners in aggregate continue to hold with reserves maintaining current levels of around 1.845 million BTC. Every day miner outflows to exchanges to promote stay low, indicating miners haven’t any intention of promoting massive quantities of BTC at present costs.

ASOPR which tracks the profitability of the overall market has dipped back below 1 on a closing basis, meaning the market is currently trading at a loss. Extra importantly, LTH SOPR stays above 1, which means long-term holders are nonetheless in revenue regardless of the drawdown. STH SOPR is under 1, which confirms youthful cash are being offered at a loss.

Historical data using the SOPR metrics have shown bear markets occur when the LTH SOPR is consistently below 1, meaning long-term holders are at a loss. It’s essential to notice the LTH SOPR remained above 1 throughout your entire 55% crash from $64.8k to $30k, a robust sign it is a mid-cycle pullback quite than a bear market.

The Mean Coin Age metric by CryptoQuant continues to trend higher, strongly suggesting long-term holders continue to hold and accumulate. Throughout bull markets, they distribute aggressively as worth appreciates and proceed to distribute as BTC enters a bear market. This occurred during the 2017 bull market peak and the beginning of the 2018 bear market, causing the Mean Coin Age to trend lower as long-term holders continued to distribute.

For greater than 3 months, the Imply Coin Age has been trending increased, strongly suggesting BTC just isn’t in a bear market. If BTC was in a bear market, we would have seen long-term holders and large miners sold massive amounts of BTC, causing the Mean Coin Age to fall, confirming a trend of distribution.

September Shakeout not Impacting Macro Development in On-chain

Regardless of this month’s drawdown, primarily from macro risk-off and enormous liquidations, the general development in fundamentals and on-chain for BTC stays firmly bullish. This is because the long-term holders and miners which own the majority of supply continue to hold and show no interest in selling these drawdowns.

The near-term volatility will seemingly proceed as the worldwide market makes an attempt to navigate the uncertainty with fed financial coverage, financial information, and the Evergrande debt disaster. We can expect the price to catch up to fundamentals and bullish on-chain metrics once certainty comes back to the market.

Given the massive dislocation between fundamentals and worth, this dip might be a major shopping for alternative for buyers trying to enhance publicity to BTC.