After what looked to be a month of prosperity following the August bull run, Bitcoin has now entered into an era of increasingly bearish signals. The asset had seen plenty of rallies that pushed it over two-month highs, efficiently breaking above the $52K resistance vary on plenty of events. Throwing the entire market into a stretched-out period of positive sentiment.

September has now include its personal distinctive set of issues for the digital asset. Bitcoin price has been suffering since the beginning of the month, ushered in with a flash crash that rocked the market only a week into September. The market continues to undergo from the aftershock of this flash crash, which has left a path of blood out there, and led to large liquidations.

Bitcoin Price Crash Leads To Sell-Offs

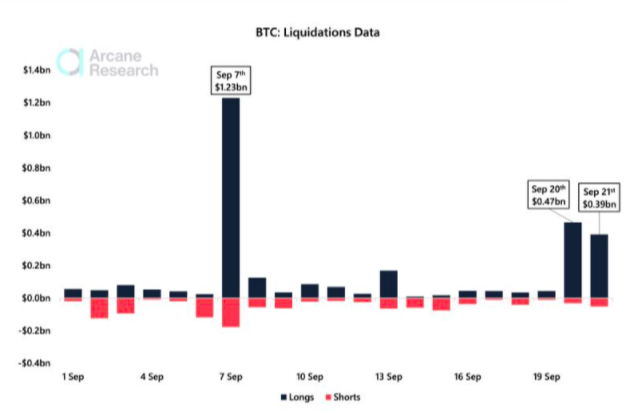

In only a matter of days, the price of bitcoin has fallen from $47,000 to $40,000, which triggered liquidations in the market. The lengthy liquidations totaled as much as the tune of $860 million throughout exchanges. The liquidations took place over two days when the price of the digital asset had inevitably fallen to $40,000 on Tuesday, September 21st. Though important, the liquidations, which have been unfold throughout two days, nonetheless sat under the sell-offs seen following the September seventh crash.

Monday marked the beginning of the liquidations as the market saw $470 million long positions liquidated. And the next Tuesday, a complete of $390 million lengthy positions have been liquidated as nicely. At this point, the price of bitcoin had hit levels not seen since mid-August. And as market sentiment shifted into the unfavorable, the worth continued to plunge.

Current sell-off volumes have remained beneath the $1.2 billion sell-off in early September, suggesting that this current sell-off is more organic than previous ones. Additionally, it exhibits that the present market is extra influenced by spot exercise in comparison with the derivatives market.

September And Its Chokehold On The Market

September has historically come with challenges for the crypto market. So the crash that rocked bitcoin and the whole market originally of the month is on-brand. Crashes with at least a 17% value loss have happened in September for the past four years and it looks like 2021 has fallen in line with this trend.

Nonetheless, the top of September has at all times include higher forecasts for the next month. Chart analysis show crashes in the month precede recoveries that put the market on course to regain its lost value. Setting the market up for another bull run.

The worth of BTC has now recovered above its Tuesday’s lows, which noticed the digital asset plunge under $40K. Bitcoin is currently trading above $42,000 at the time of writing. While the total market cap has fallen below $800 billion.