Ethereum follows the basic belief in the market and patterns downwards in the day-to-day and weekly charts. After news about a confirmed FUD on China banning crypto-related operations, a portion of the market reacted negatively and created selling pressure.

This sent out Bitcoin and Ethereum back to their crucial support zones. At the time of writing, ETH trades at $2,842 with an 8.2% and 20.4% loss in the daily and weekly charts, respectively.

Ethereum technical indications reddened as the rate backtracked south of the $3,000 area with momentum in favor of the bears. However, the Relative Strength Index (RSI) remains neutral at a 39.51 value.

This might recommend a turnaround in the existing pattern if integrated with the reality that the FUD originating from China was currently price-in by another part of the marketplace. Trader Rekt Capital commented the following on the price action and those affected by “FUD from China”:

BTC financiers who have actually remained in the marketplace for a while have actually heard various models of FUD from China. But newer investors, unarmed with this experience, are the ones who are affected most. Their panic selling is what is sustaining this current drawback.

What Could Trigger A Rebound On Ethereum?

Ethereum’s recent low stands at $2,652, the price is reached at the beginning of the weak on the back on the potential default of Chinese real state company Evergrande. Thus, why ETH’s rate should hold that level in case of additional drawback.

For the bulls to have a fresh shot at reclaiming the $3,000 area, Ethereum must close the daily above $2,900. The Exponential Moving Average (EMA – 10) might be the next goal from there standing at $3,136.

In the short term, strength in Bitcoin or Ethereum could push the market back to the green. The very first cryptocurrency by market cap has bullish principles that might benefit the whole crypto market.

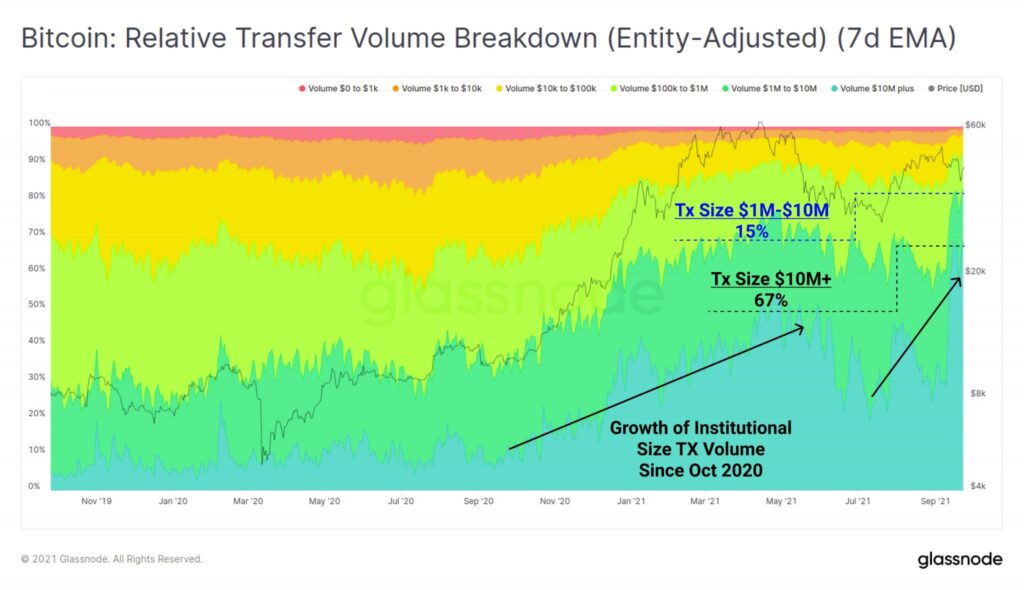

As pointed out by Glassnode founders Jan Happel and Jann Allemann, the Relative Transfer Volume Breakdown, a metric used to measure transaction volume in the market, suggest that institutions are still betting big on Bitcoin (BTC). Alleman and Happel said:

Bitcoin deal volumes continue to show huge cash relocating the area. Institutional sized capital ($1M+ transaction sizes) represent around 82% of settled volume over the past week. Note the development in institutional size capital actually began given that October 2020.

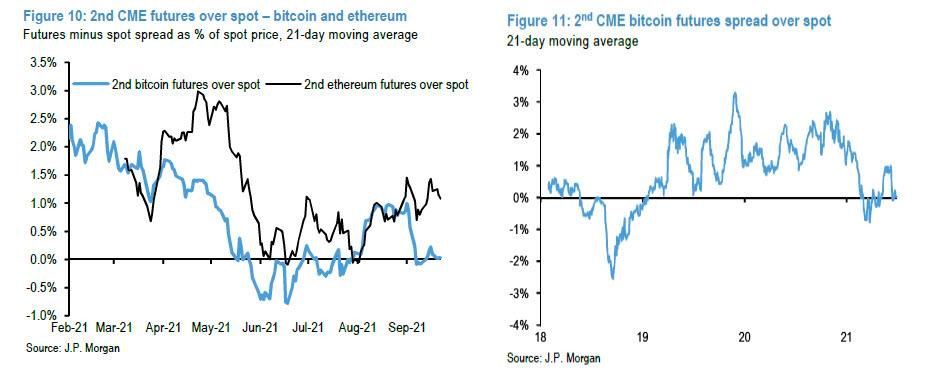

In addition, as pseudonym trader LilMoonLambo said, banking giant JP Morgan seems more bullish on Ethereum than Bitcoin. The bank has actually been dabbing into crypto for a while and their quotes for ETH and BTC mini futures are positive for the bulls.