Two direction signs, one pointing left (Bear Market), and the other one, pointing right (Bull Market).

The crypto community is locked in debate over: Is Bitcoin in a bull or bear market? The controversy will rage on till both a brand new excessive or new low is made.

The current price action is bearish, which gives the impression that sellers are in charge. The information cycle, and sentiment doesn’t assist the image for bulls. But there is one “theory” that suggests a lower low won’t be made.

Mapping Out From The Bear Market Backside To The Bull Cycle Prime

Just lately, Elliott Wave Worldwide held an Open Home on their Crypto Professional Group led by analyst Tony Carrion. Tony nailed the recent 20% crypto market plunge as part of a C-wave and a short-term call.

A long run play appears to be like forward towards a optimistic This fall, the place the analyst expects a wave 5 to develop and “larger value appreciation to happen.” If it fails to do so, then the pattern might not be valid.

The current correct name of a C-wave prompted a deeper evaluation of the long run play. According to Elliott Wave Theory a primary motive wave consists of five waves, with odd-numbered impulse waves following the primary trend. That is Bitcoin we’re speaking about, so the first development has virtually all the time been up.

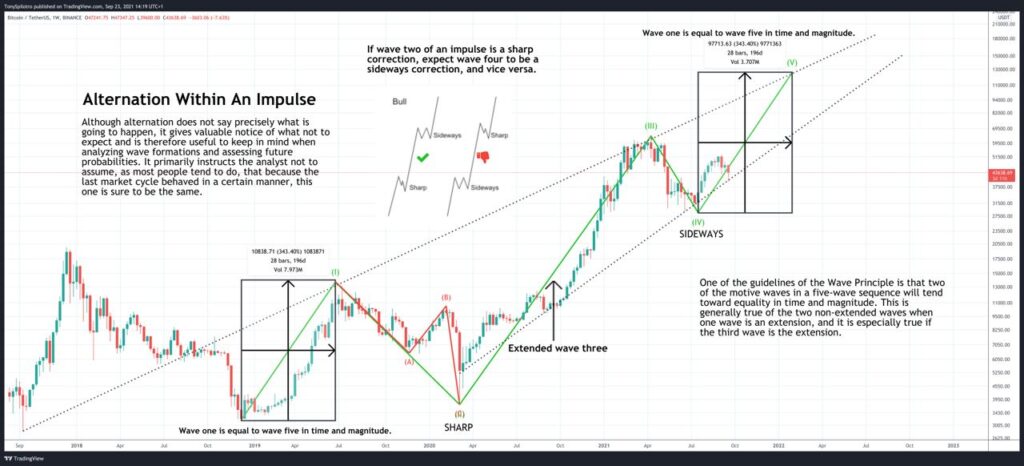

A new motive wave and series of impulse waves began at a bear market bottom. Waves two and 4 are additionally bearish consolidation phases that transfer counter to the development. Tony’s idea is that the run up in early 2019 was wave one, wave two ended with Black Thursday (take note of this), and wave three ended at $65,000 in April.

Why Bitcoin Bears Might Salivate Over New Lows Ceaselessly

What isn’t but clear, is when wave 4 ends, and wave 5 begins. However, when reviewing some facts regarding Elliott Wave rules and guidelines, along with several important factors related to the current market cycle, things begin to fit the mold.

The perfect argument bears have for extra draw back in Bitcoin, is a crash again to $20,000 and a decrease low state of affairs – as a result of that’s what occurred after the 2019 peak to Black Thursday. However, Elliott Wave rules state that wave two and four will alternate in severity.

Out of wave two and wave 4, one correction shall be sharp, the opposite sideways. Looking at the top and bottom of the last correction, sharp is an understatement, especially compared to the most recent “top.”

If wave two was sharp, then wave 4 shall be sideways, in keeping with the alternation in an impulse rule.

“It primarily instructs the analyst not to assume, as most people tend to do, that because the last market cycle behaved in a certain manner, this one is sure to be the same.”

Additionally as a part of the alternation rule, wave one, three, and 5 will alternate to a sure diploma. Elliott Wave theory says that wave one and five will made in both time and magnitude, especially have wave three was an extended wave. When evaluating what can be wave one with wave three, it’s straightforward to see how prolonged wave three would have been.

All of this information suggests that there won’t be a lower low, and wave five should rally around 350% from where wave four ends.

That is all nice information for bulls who have been hoping for $100,000 Bitcoin. The only problem? When it is all over, if the pattern is accurate, the worst bear market ever is coming next.