The crypto market had a roller coaster ride throughout the month of September so far. The first six days saw most of the best coins in the market recover and right after that the crash of the 7 managed to reverse the bullish narrative.

After consolidating for a couple of days near the local-lows, the market witnessed another uptick phase, and post that, two noteworthy crashes set foot on the 20th and 24th. In fact, at the time of writing, the market has been seen recovering from the same.

Most of the top coins have started becoming increasingly dependent on Ethereum’s price movements of late. That being said, it should be noted that the ETH: Alts correlation has hovered widely in the 0.8-0.9 range lately. In effect, to give larger context, the price movements of Ethereum would only be considered in this article.

The weekend saga

Unlike the past few months, no regular weekly trend was seen on the Ethereum price charts in September. In almost all the cases, the week had started on a particular note and ended on the completely converse note.

Saturdays have been largely monotonous throughout this month for Ethereum. However, the candles have been longer and the ETH market has been more volatile during Sundays. Indeed, the first two days of each new week were also quite dramatic.

As September and the third quarter draw to a close, here is what traders can expect from the Ethereum market over the next few days.

Dramatic-weekend alert

Ethereum’s volatility has been steadily increasing over the last few days. In fact, the same was at its peak of a month [78.30%] at the time of writing. A highly volatile environment usually paves way for a dramatic price action in either direction. Considering how the Ethereum market reacted on Sundays and the start of the new weeks, traders need to stay prepared for an atypical pump / dump.

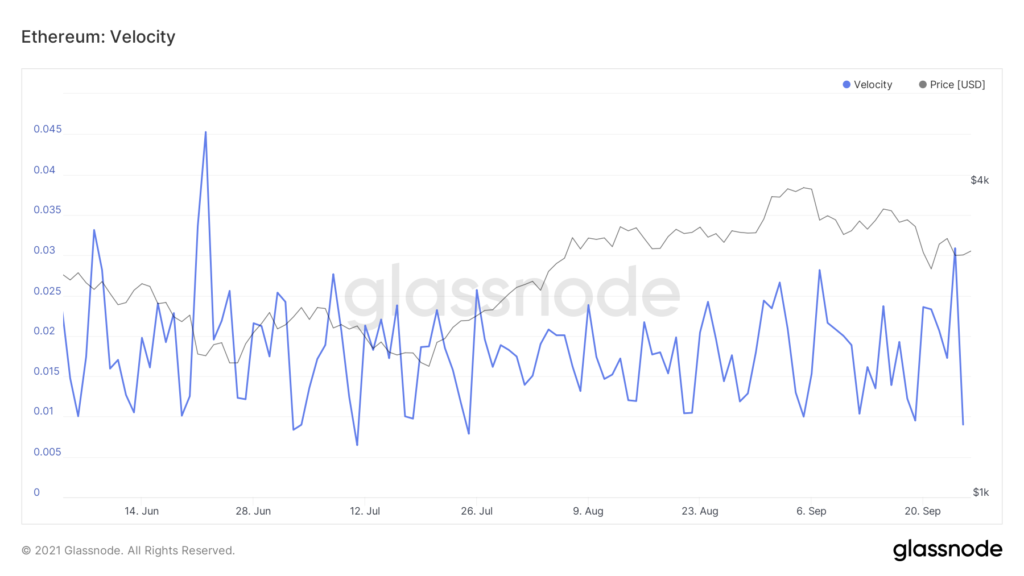

The alt’s velocity has also been massively fluctuating of late. The same value went from 0.03 to 0.008 in the last three days. A rally is usually accompanied by steady velocity, while a turbulent landscape opens up the door for corrections. Considering the current state of this metric, it can be said that the chances of a dump appear to be more likely than a pump at this point.

Further, Ethereum has been trading well-below its moving average of late. Since September 20, the same has kept the price of alt from pumping further. By and large, this is again a bearish sign.

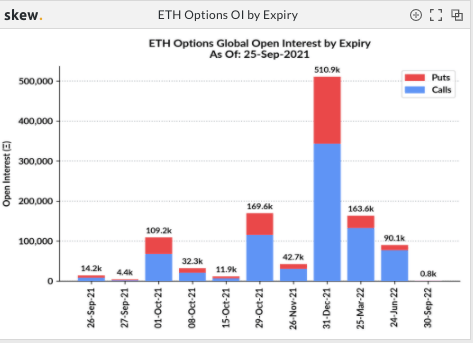

Also, from a derivatives perspective, two upcoming expiration options line up. As per Skew’s data, a total of over 18k Ethereum contracts are set to expire on Sunday and Monday. Even though the aforementioned number is not that huge, maturities have the potential to upset the market equilibrium and initiate a trend change.

Over the course of writing this article, Ethereum’s price witnessed a massive pump from $2.7k to $3.03k. So market participants can expect similar swings and weekend drama until the 28th at least.