Bitcoin and Ethereum are currently surviving a bearish scare, with both assets just about holding a position above their immediate supports. For Bitcoin, the $ 41,000 level establishes a strong rebound range while Ethereum has managed to stay above $ 3,000.

On the contrary, some altcoins have recorded strong recoveries, with Solana, Bitcoin Cash, and Uniswap hiking by more than 10% in one 24-hour window.

Now, these altcoins appeared to have the relative advantage at press time. However, there are a couple of key metrics which may allow us to evaluate the actual strength of Bitcoin, Ethereum as the market goes forward.

How much importance should be given to utility?

In recent years, the stability of the market has depended on various aspects. During the bullish rally of 2017, investor sentiment was key and when major traders started to become bearish, the digital assets collapsed.

Then it was a constructive institutional influx in early 2019. At the time, it was suggested that institutions can allow tokens such as BTC, ETH to hold higher price positions. The price fell in 2020, irrespective of rising interest.

However, a key idea missed by most speculators could be the utility side of things, which is currently one of the most important features. Gone are the days when astute marketing allowed assets such as TRON to climb into the top-10.

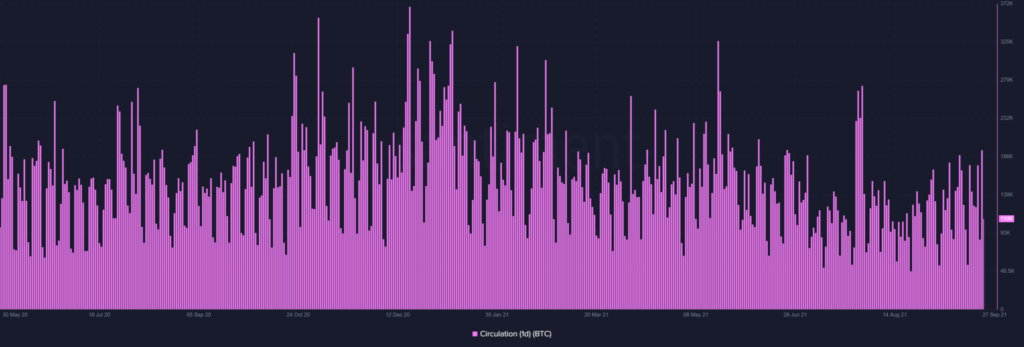

Now according to Feeling, Bitcoin hit a two-month high in terms of circulation. What’s more, if the chart is closely observed, the average BTC transferred has risen consistently over the month of September.

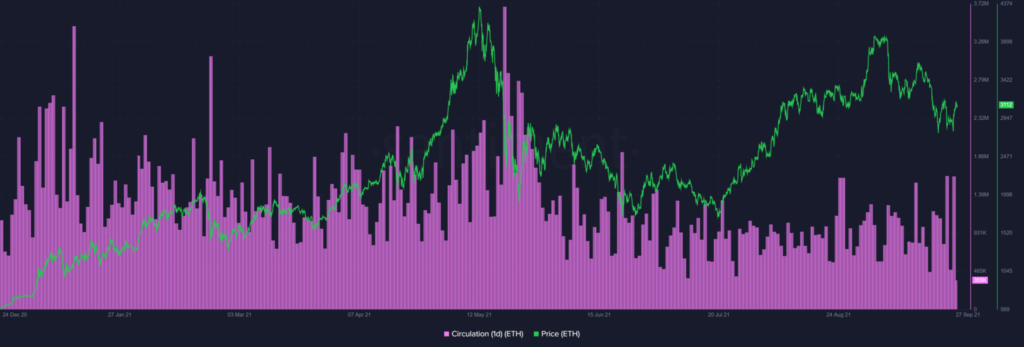

Likewise, Ethereum achieved a similar feat, but its 1-day circulation index was at a 3-month high, indicating high utility and movement in tokens.

Ethereum’s price has dropped sharply over the course of the past few weeks, but circulation has remained high.

Bitcoin, Ethereum spaces have evolved

Now, to be fair, it’s important to consider volatility and the fact that circulation is not as high as it was in May 2021. However, maintaining a development and transaction-intensive ecosystem, one which allows the price to be built on strong foundations, is eventually advantageous.

Now, when it comes to assets that have grown over the past few days, besides BCH, Solana and Uniswap are extremely used tokens. While one is the native token of a major DEX, another asset is currently responsible for bringing better L2 solutions.

Likewise, for Bitcoin and Ethereum, higher utility and circulation are expected to keep the asset relevant and gradually show large recoveries in the fourth quarter of 2021.